The Reporter (Addis Ababa)

Today, we face a major economic upheaval particularly more severe than we have ever witnessed before. The coronavirus pandemic is a different kind of shock than previous economic shocks. Never before have economies shut down at this magnitude.

From one week to the next, many workers are losing their jobs or payments or businesses get bankrupted. Government’s ability to subsidize will be stretched to the limit.

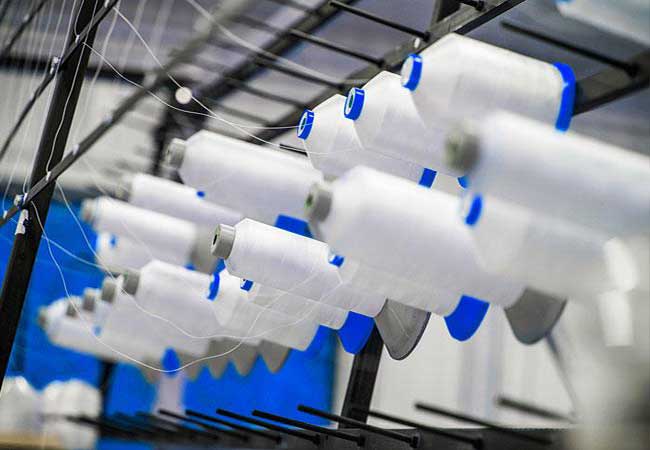

Restaurants, hotels, bars, taxis, mass transit services, etc. will stop services or slow down and face steep losses in incomes and potentially widespread problems attached to it. Exporters (flowers/textiles, coffee, oil seeds), certain manufacturers like textile, the national carrier Ethiopian Airlines and cargo service, and banks will be heavily affected.

The key question for Ethiopia’s policymakers is how to prepare for this and react to it? Our policymakers have to come together, and coordinate their work in the financial as well as the productive and service sectors. National authorities must continue taking a host of measures to provide support to ensure continuity and minimize damage in the economy.

They have to respond to the fast-moving and extraordinary situation and mobilize the public. Policymakers must combine the tools from their playbooks for dealing with crisis, disaster, operational risks, stoppage of decline of import-export, and overall stress on the economy. The fundamental core point is not to panic, to be cold-blooded and calculating as well as practical.

More than 50 people have been infected by the virus in our country. The government is taking commendable measures under the circumstances. Measures are progressively getting tighter and tighter. Schools and universities are closed. Very aggressive awareness campaign is taking place.

Civil servants are asked to stay home with just skeletal staff in operation.

People are guided and advised to keep their proximity at a reasonable distance, consistently wash their hands and wear masks.

The government is also supporting hospitals and emergency rooms, establishing make-shift field clinics at schools and other compounds, buying protective gear and essential medical equipment or getting them through aid, and carrying out public awareness campaigns about simple measures like hand washing. Companies are operating with strategic essential staff. Borders are officially closed.

Roads in Addis are being disinfected. Ethiopian Airlines has stopped passenger flights and is focusing on cargos. Flowers, coffee and other commodity exports are either at a standstill because of Global logistical problems or totally stopped. Significant slowdown and progressive lockdowns are taking place. There more than 100 million Ethiopians and the national testing capacity is very limited.

Therefore, the number of infected could possibly be more. We have to wait and see if a substantial number of people are going to be infected or the infection stays at a minimum. If it comes to the American, Italian, Chinese, Spanish and French and Iranian level, it will be enormously devastating. However, we have to be ready and work for all possibilities with dedication and extraordinary efforts.

The marketing and consumption patterns of most Ethiopians, the distribution of good and services, the local marketing styles and storage facilities, lack of universal and easy availability of clean water, people’s religious rituals and the way we worship etc. are all challenging with many difficulties to overcome. Generally, the majority of the people trade and exchange in an open market, crowded and with close proximity few wearing protective masks.

It is a challenge to change these patters but the effort has to continue and some visible result are observed. If the open markets (gebeyas) are closed, it can only be for a short period of time or there will be supply constraints and practical solutions must be devised. The length of time people could stop work in Ethiopia can only be short. Closing boarders is also difficult where the majority of pastoralists cross open borders at will with no checkpoints and designated entry points. The disruption of people’s daily lives means less paid works, less income and less spending and fewer jobs in the sea of unemployment.

However, with the creativity of the private sector, government and creative individuals it is possible to design other ways, including reorganizing the nation’s logistics and supply chains to reach to communities and localities.

The government initially allocated billions of birr upfront to start tackling the problem. There is a mobilization to encourage contributions. A taskforce under the leadership of the Deputy PM is set. The public, churches, mosques and the media are all collaborating.

As already stated, the economic consequences will be quite tough. Foreign exchange is already in short supply to bring in medicines, protective masks, testing equipment, ventilators, general supplies etc. There are already steady supply constraints to earn foreign exchange in the Ethiopian economy with visible macroeconomic impact.

The entire globe is going to go into recession and developing countries like Ethiopia will be facing more of the burden. The promising thing is that if the spread of the virus is under control, the Ethiopian economy is mostly agrarian and with two good harvesting seasons partial recovery out of the danger zone is possible even if macro and industrial policy will sustain quite a stress.

A wider and more adverse domestic virus spread scenario cannot be ruled out at this stage and if it happens it will be more disasters and economically devastating. I estimate that growth will be falling to 3.5 percent and net balance payments impacts close to USD three billion. The current containment policies of the Ethiopian government will definitely have a positive and damage limitation impact.

Closely looking at the reality on the ground and lessons learnt from the experience of other countries, it will be naive to assume Ethiopia is capable of containing the spread to the extent we wish we could. When we look at the general rank and file, pattern of daily routine and behavior, the way the young and the public at large huddle together, walk together, eat together and work together, reaching a critical number say thousands of cases is a reasonable expectation in the next six months.

Ethiopia has a high informal economic sector with many small and micro businesses that create employment for the majority of the public. Therefore, there needs to be strong policy and strategy to support these micro, small and medium enterprises for sustainability and recovery. Most of these small and informal sectors are missing from the assumptions of economic analysts who rely on figures and statistical estimations that does not include the informal sector or micro businesses which are quite substantive in number.

Ethiopia also has a very young population with high unemployment rate. Many have migrated and are still actively migrating and gathering in the urban areas looking for any kind of work. The crisis has huge implication on them and must creatively be addressed.

Generally, in economic terms: Ethiopia will be on the negative end of recipients of the global economy; disruption of global supply chains etc.

The global recession will affect Ethiopia’s current and capital account; will have fiscal and monetary challenges, slow down on economic activities and overall impact on the GDP. There will be growing import demand both from the public and private entities.

Lower demands in the global markets for Ethiopia’s exports. There will continued decline in export receipt threatening the stability of the country’s macroeconomy. Flower export has already stopped, coffee export is affected due to logistics and supply chain disruption, and Ethiopian Airlines is losing hundreds of millions of dollars.

Above target level of inflation as well as rear and near challenges are facing the economy.

Accessible economic indicators point general negative results as it is and the crisis can aggravate it. The internal sector has witnessed slowdown, especially in merchandise trade.

Domestic credit and deposit of the banking system will negatively be affected. Liquidity problems is already being observed.

The tighter fiscal and monetary policy agreed with the Bretton Woods Institutions to control inflation cannot be fully implemented due to the crisis and supply side constraints.

The likelihood of government being forced to import additional food and medical supplies as well as equipment will result in inflationary and budgetary deficit.

Growth rate will decline under the circumstances; travel bans and lockdowns limiting movements of people and disrupting ways of working, limiting access to resources.

The disproportionate impact will be on poor households and informal businesses and the pace of disruption is likely to accelerate in the weeks ahead.

The government, the private sector, development institutions and International Agencies capable of providing tangible (not rhetorical) assistance need to double efforts along with the government resolve.

Ethiopia must take bolder, more creative steps to secure supply chains of essential products, continuously trying to contain the health crisis; maintaining the stability of the financial system; helping businesses (especially small businesses) to survive the crisis; and supporting household economic welfare. Well considered and tangible stimulus packages to reverse the economic damage is in order.

We need to stabilize the Country’s supply chains through active supplier engagements, making demand assessment and adjustment of production and operation.

We need to make continuous stress and financial assessments, economic impact cost containment etc..

The country needs to come out with a dynamic and right policy prescription to combat the economic fallout with an Ethiopian specific solution addressing the specific circumstances. The channels through which the country is most exposed need to be identified, and the depth of the connections needs to be closely examined.

Fiscal policy will have to play a leading role in integrating the shock, with fiscal positioning reverting to medium-term path consistent with debt sustainability.

Easing monitory policy can complement fiscal efforts, with the challenges of inflation taken into account. Financial measures can help minimize disruption to the much-needed credit and liquidity provisions.

Ed.’s Note: The views expressed in this article do not necessarily reflect the views of The Reporter. The writer refrained from making figurative estimates since it can easily be misleading.

Contributed by Tegenework Gettu