Introduction

The Tanzanian textile and garment industry stand as a beacon of untapped potential, offering investors a lucrative opportunity to capitalize on its abundant resources and growing market demands. With a combination of favorable factors including extensive cotton production, strategic trade connections, and competitive labor costs, Tanzania emerges as a promising destination for textile and garment production.

Abundant Cotton Supply

Tanzania’s cotton production is concentrated in two main zones: the Western Cotton Growing Area (WCGA) and the Eastern Cotton Growing Area (ECGA). These regions collectively produce the majority of Tanzania’s cotton output, laying the foundation for a robust textile value chain. However, a significant portion of this cotton is exported unprocessed, presenting an opportunity for value addition and vertical integration within the domestic industry.

- Tanzania produces approximately 350,000 tonnes of seed cotton annually.

- About 80% of Tanzania’s cotton production is exported unprocessed.

- The WCGA comprises seven regions: Shinyanga, Mwanza, Tabora, Mara, Singida, Geita, and Simiyu, and accounts for 97% of Tanzania’s cotton production.

- The ECGA comprises three regions: Coast, Morogoro, and Tanga.

Textile Mills and Garment Factories

Textile mills and garment factories are scattered across Tanzania, with key clusters located in cotton-growing regions and major port cities like Tanga and Dar es Salaam. Despite existing infrastructure, there remains a gap in the production of fabrics to meet the demands of downstream garment producers. Yet, with investments in modern machinery and capacity enhancements, the industry is poised for growth and self-sufficiency.

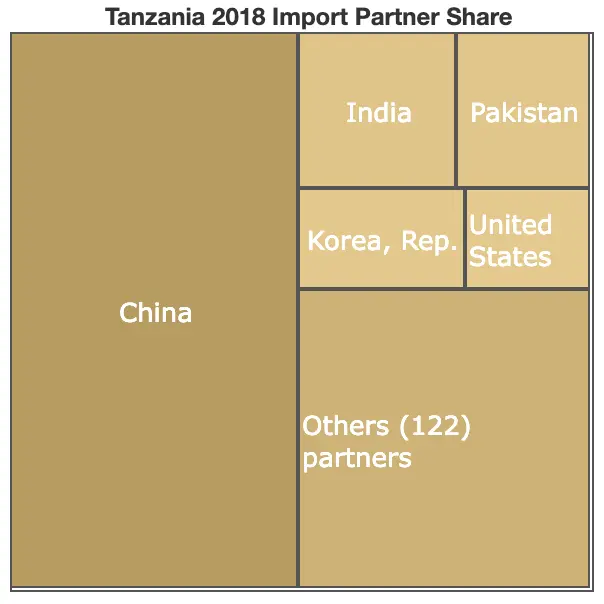

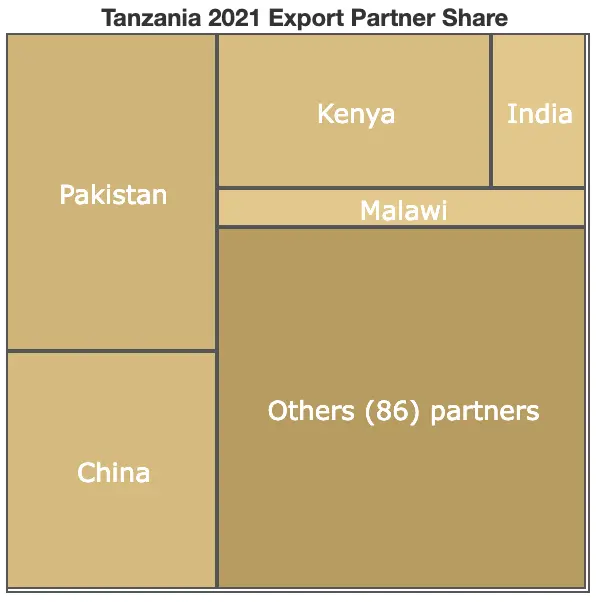

Market Demand and Export Opportunities

The domestic market in Tanzania exhibits a strong demand for textiles and garments, offering a lucrative avenue for local producers to replace imports and cater to the burgeoning middle class. Moreover, Tanzania’s membership in regional trading blocs such as the East African Community (EAC) and Southern African Development Community (SADC) opens doors to a broader regional market for apparel. Additionally, preferential trade agreements like the African Growth and Opportunity Act (AGOA) and Economic Partnership Agreements (EPAs) provide duty-free access to lucrative markets like the United States and European Union.

Why Invest in Tanzania?

Vertically Integrated Operations: With abundant cotton resources, Tanzania offers the potential for vertically integrated textile and garment operations, from spinning to manufacturing. Major firms are already leveraging this model successfully, supported by the expertise and infrastructure within the country.

Export Market Access: Tanzania’s membership in regional trading blocs and preferential trade agreements grants access to diverse export markets, reducing trade barriers and enhancing competitiveness on the global stage.

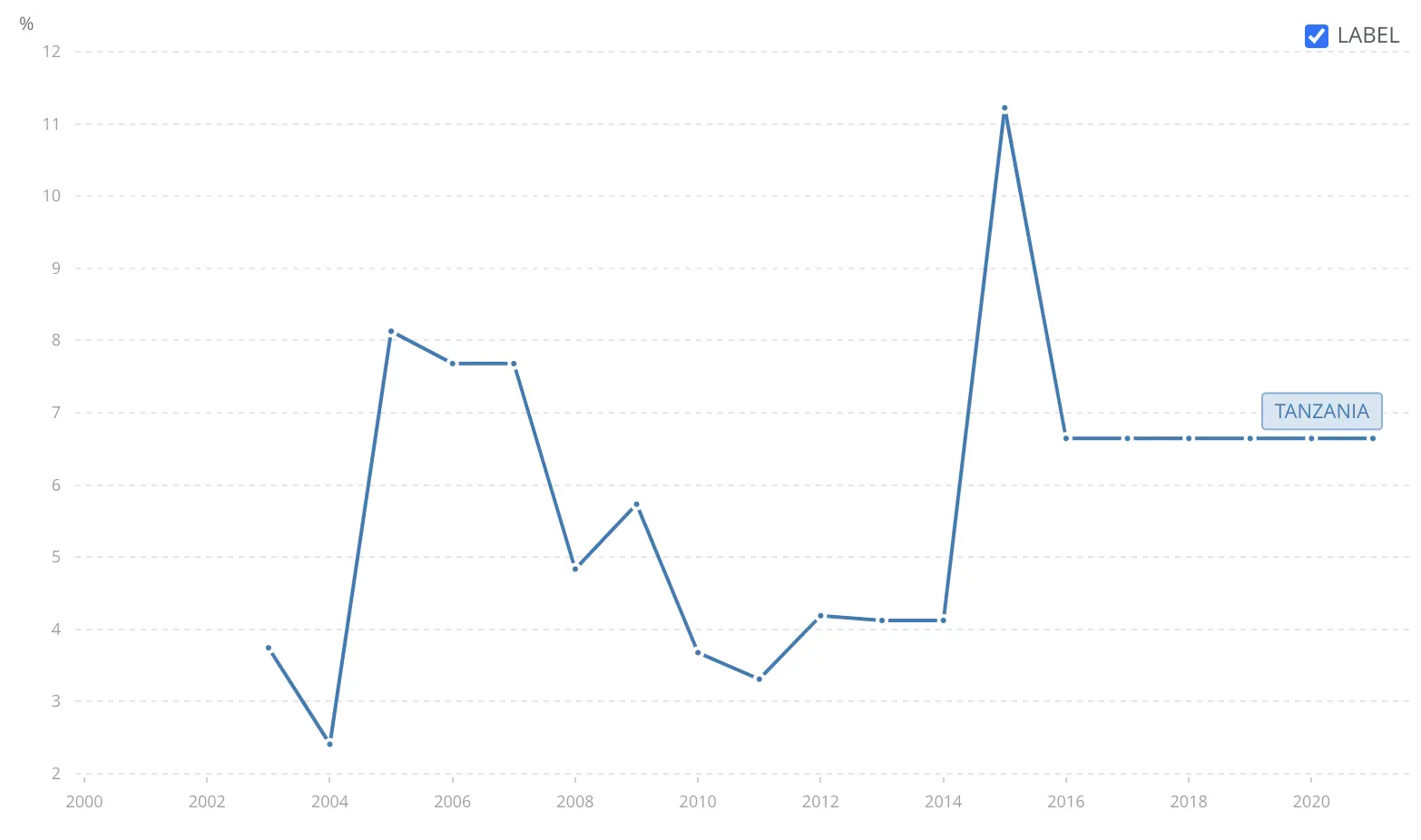

Competitive Labor and Power Costs: Tanzania boasts competitive labor costs compared to other garment-producing nations in Sub-Saharan Africa. Combined with relatively low electricity charges, this translates into significant cost advantages for investors.

Government Support and Investment Incentives: The Tanzanian government has demonstrated a strong commitment to supporting the textile and garment sub-sector through initiatives like the Textile Development Unit (TDU) and regulatory reforms. Collaboration between government agencies and industry associations further facilitates investment and industry development.

Regional Investment Opportunities: Investment support extends beyond the national level, with regional investment committees and the TDU actively promoting investment opportunities and joint ventures across different regions of the country.

Challenges and Opportunities

While Tanzania’s textile and garment industry holds immense promise, it also faces several challenges that must be addressed to fully unlock its potential. Key challenges include:

Infrastructure Deficiencies: Despite efforts to improve infrastructure, Tanzania still faces challenges in transportation, energy supply, and access to finance. Improvements in these areas are critical to supporting the growth of the textile and garment industry.

Skills Development: The industry requires skilled labor to operate modern machinery and meet international quality standards. Investing in vocational training and technical education programs will be essential to develop a skilled workforce.

Value Addition and Upgrading: Tanzania’s cotton is primarily exported as raw material, limiting the potential for value addition and higher returns. Encouraging investment in spinning, weaving, and fabric production will enable Tanzania to capture more value within the domestic industry.

Market Access and Competition: While Tanzania enjoys preferential trade agreements, it faces stiff competition from other garment-producing countries in Asia and Africa. Enhancing product quality, branding, and marketing efforts will be crucial to compete effectively in global markets.

Policy and Regulatory Environment: Streamlining regulations, reducing bureaucratic hurdles, and providing clear investment incentives will create a more conducive environment for domestic and foreign investors in the textile and garment sector.

Despite these challenges, Tanzania’s textile and garment industry offers immense opportunities for growth and development. By leveraging its abundant resources, strategic trade connections, and favorable investment climate, Tanzania can position itself as a leading textile and garment producer in the region and beyond.

Conclusion

In conclusion, the Tanzanian textile and garment sub-sector presents a compelling investment proposition, characterized by abundant resources, favorable market dynamics, and supportive government policies. As Tanzania strives towards economic transformation and middle-income status, the textile and garment industry emerges as a key driver of growth, poised to unlock its vast potential and contribute to sustainable development. With strategic investments, policy reforms, and industry collaborations, Tanzania can harness the power of its textile and garment industry to create jobs, generate export revenues, and foster inclusive economic growth for the benefit of its people.