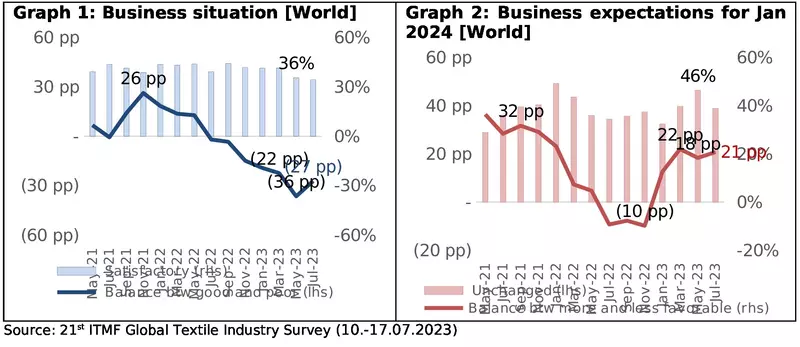

Business situation remains negative but improves for the first time since November 2021

According to the ITMF’s Global Textile Industry Survey (GTIS) conducted in the first half of July 2023, the business situation improved on average worldwide in July 2023 despite remaining negative. An increasing number of companies have adapted to the harsh business environment and are now reporting improvements.

A regional analysis shows that Asia is struggling the most and South America is back in positive territory. The global business expectations did not change since March 2023. All regions remain optimistic about the situation in 6 months-time, except for East Asia. Weavers / knitters and dyers / finishers / printers are two segments where the expectations have turned negative.

Order intake remains negative in all regions and all segments despite a slight increase recorded in July 2023. Garment, home textile and technical textile producers have registered significant improvements, though the balance stays negative. Order backlog fell to the lowest level recorded in the GTIS.

An increase could be observed only in South America and for technical textiles. Globally, companies are not expecting order intake to improve in such a manner that order backlog goes up significantly. The capacity utilization rate hit the lowest level since the start of this survey as well. It has steadily decreased in Asia and Europe since 2021 and dropped for home textile and technical textile producers lately. The major concern worldwide remains by far “Weakening demand” in July 2023. A second distant concern is “Inflation” closely followed by “Higher raw material prices”, “Geopolitics”, and “Higher energy prices”. Some positive signs are that costs for logistics, energy and raw material have fallen in the past few months and “Geopolitics” has not risen in the ranking.

The major concern worldwide remains by far “Weakening demand” in July 2023. A second distant concern is “Inflation” closely followed by “Higher raw material prices”, “Geopolitics”, and “Higher energy prices”. Some positive signs are that costs for logistics, energy and raw material have fallen in the past few months and “Geopolitics” has not risen in the ranking.

The number of cancelled orders remained relatively low globally. Most companies in the textile supply chain report average or low inventories levels which makes cancellations obsolete. Interestingly, 96% of garment manufacturers report average or low inventory levels. Spinners, weavers / knitters, and fiber producers report the highest inventories.