Jordan’s Textile And Apparel Sector:

Small But Significant

The textile and apparel industry in the Hashemite Kingdom Of Jordan — a Middle Eastern country sandwiched between Israel, Saudi Arabia, Iraq and Syria — is relatively small, but it is one of Jordan’s main industrial sectors.

In that country, which has a population of more than 9.5 million and a labor force of nearly 3 million, the textile and apparel industry employs approximately 75,000 people, according to the World Bank, and the apparel sector accounts for approximately 27 percent of export earnings.

In 2019, Jordan’s exports of textile yarn, fabrics, made-up articles, related products and apparel totaled US$2 billion, according to the Central Bank of Jordan’s (CBJ’s) preliminary figures.

Trade Agreements

The garment industry in Jordan has expanded rapidly over the past fifteen years. Jordan’s textile and apparel industry has benefited from numerous free trade agreements (FTAs) the country has signed as part of efforts to strengthen international cooperation and trade and increase its exports. Jordan has signed FTAs with the United States, European Union, European Free Trade Association, the Greater Arab Free Trade Area, Morocco, Turkey, Singapore and Canada.

Both the Jordan-United States FTA and the Qualified Industrial Zone (QIZ) agreement have significantly increased Jordan’s access to the U.S. market. The Jordan-United States FTA went into force in 2001 and allows Jordanian products to enter the United States duty-free.

The QIZ agreement went into force in 1996 and allows Jordanian products made in designated areas and containing Israeli inputs to enter the United States duty-free and quota-free. Together, the agreements have contributed to an increase in Jordan’s apparel and textile exports to the United States from US$50 million annually before 1999 to US$1 billion in 2010, according to a MENA Knowledge and Learning report published by the World Bank in February 2012. In 2010, the United States constituted 93 percent of Jordan’s total apparel exports, the CBJ reports.

Jordan’s exports to the United States go through two main seaports in the Middle East, Aqaba and Haifa, which are among the fastest suppliers to the East Coast and offer shipping lead times of less than three weeks.

The Jordanian textile and apparel industry’s U.S. customers include brands and retailers such as Gap, JCPenney, Levi Strauss & Co., Liz Claiborne, Calvin Klein, Tommy Hilfiger, Walmart, Kmart, Limited, Sears, Columbia, New York Laundry and Victoria’s Secret.

Possible Setbacks

Jordan has been faced with numerous issues impacting its textile and apparel industry. Decreasing natural gas supply to the country and increasing oil prices have necessitated the import of more expensive fuel to generate electricity. This energy crisis, combined with regional tensions and the global economic downturn, has contributed to a slowdown in Jordan’s economic growth.

Another problem with Jordan’s textile and apparel industry is labour unrest. Several of the country’s news agencies have reported strikes by factory workers demanding increased wages, improved health insurance coverage and other benefits. Earlier this year, the Institute for Global Labour and Human Rights reported labour violations at a Jordanian apparel factory, alleging that hundreds of guest workers were forced to work overtime hours without adequate pay or health benefits.

More than two-thirds of jobs in Jordan’s textile and apparel sector are held by guest workers, primarily from Bangladesh, India and Sri Lanka. The Ministry of Labour has urged employers in the sector to reduce their dependence on foreign employees — especially considering Jordan’s high unemployment rate, which was 12.9 percent in 2017, according to Jordan’s Department of Statistics.

Last year, the Jordan Garments, Accessories, & Textiles Exporters’ Association announced there were 5,000 available jobs for Jordanians in apparel factories, but the organization was unable to fill the openings. The Ministry of Labour is offering vocational training programs to Jordanian workers in conjunction with Better Work Jordan’s efforts to boost domestic employment.

The Future

The Jordanian government has set up a comprehensive five-year national program for economic reform, and is receiving financial support from the International Monetary Fund, which has approved a three-year US$2.06 billion Stand-By Arrangement to help implement the program.

Jordan has a good opportunity to attract foreign investment in the textile and apparel sector, as many countries in the region — particularly Iran, Iraq, Syria, Lebanon and Egypt — are experiencing political unrest. The sector holds great potential for the Jordanian economy, especially if it is given adequate support by the government.

Jordan’s textile sector still has a lot to boast of. Mounting labour problems and other setbacks have not discouraged some well-known brands to choose Jordan over other countries for textile and garment manufacturing.

The broad contours of Jordan’s textile sector present an encouraging face, but the country struggles to portray a reasonable picture as far as its textile workers are concerned.

The problems and challenges are many for Jordan’s textile sector, but the industries flourish as exports rise and well-known names in apparel sector continue to support and prefer Jordan over other countries.

Jordan garment sector: exploitation of migrant workers

Jordan’s garment sector is booming, driven by a free trade agreement with the United States and cheap migrant labour from South and Southeast Asia. Historically the situation of these vulnerable workers has been dire and although there have been some real improvements in recent years, systemic problems around migrant workers’ legal status and recruitment means serious abusescontinue to occur. The potential for progress to be undone is heightened by the influx of an estimated 1.3 million Syrian refugees.

Why Garment Made in Jordan ?

Textiles play a big part in the Jordanian culture and that of the area around it. Throughout history, Jordanians have used textiles in practical, day-to-day uses; in architecture, as we see in Bedouin tents, furniture, products, and clothing and fashion. More than that, textiles have been an important part of the culture and identity of a place, reflecting its history, lifestyles, economy, and values.

- Jordan -US Free Trade Agreement

- Zero Custom Duties NO Tariff Duties

- Support Migrants And Syrian Refugees

- High Labour Standards

- International Compliance

- Collective Bargaining and Freedom Of Association

- Enhanced Gender Equality

- Workers Center and Welfare Facilities

- Occupational Safety and Health Management System

$1.1 million to boost leather, textile industries in Jordan

Leather and textile industries sector is a vital engine to the national economy, as it contributed to about 27 percent of the total exports in 2019, Minister of Industry and Trade state.

In remarks during the launching ceremony of a project to enhance the competitiveness of the leather and textile industries sector in Jordan (MENATEX), implemented by the International Trade Center (ITC) in cooperation with the Industry Ministry and the Jordan Chamber of Industry, and funded by the Swedish government, the minister pointed out that the sector faces great challenges of which efforts must band together to turn them into opportunities.

Project’s Manager in Jordan, Iman Bseisu, said that ITC has evaluated the needs of the small and medium-sized enterprises (SMEs), the sector’s mechanism of work and its priorities.

‘The $1.1 million project aims at improving the environment for companies in the textile sector, by training workers on international best practices that qualify them to enter the global markets’, ITC’s advisor of the Textiles and Clothing, Abdul Latif Obaid, said.

‘About 20 companies were chosen to benefit from the project’s technical support to enhance production, export and sustainability standards,’ he said, adding that the project is part of the MENATEX regional program, which covers 4 countries: Jordan, Egypt, Tunisia and Morocco.

About Jordan

The Hashemite Kingdom of Jordan is a small country with few natural resources, but it has played a pivotal role in the struggle for power in the Middle East.

Jordan’s significance results partly from its strategic location at the crossroads of what Christians, Jews and Muslims call the Holy Land.

The Kingdom of Jordan

Capital: Amman

Population: 9.5 million

Area: 89,342 sq km (34,492 sq miles)

Major language: Arabic

Major religion: Islam

Life expectancy: 72 years (men), 75 years

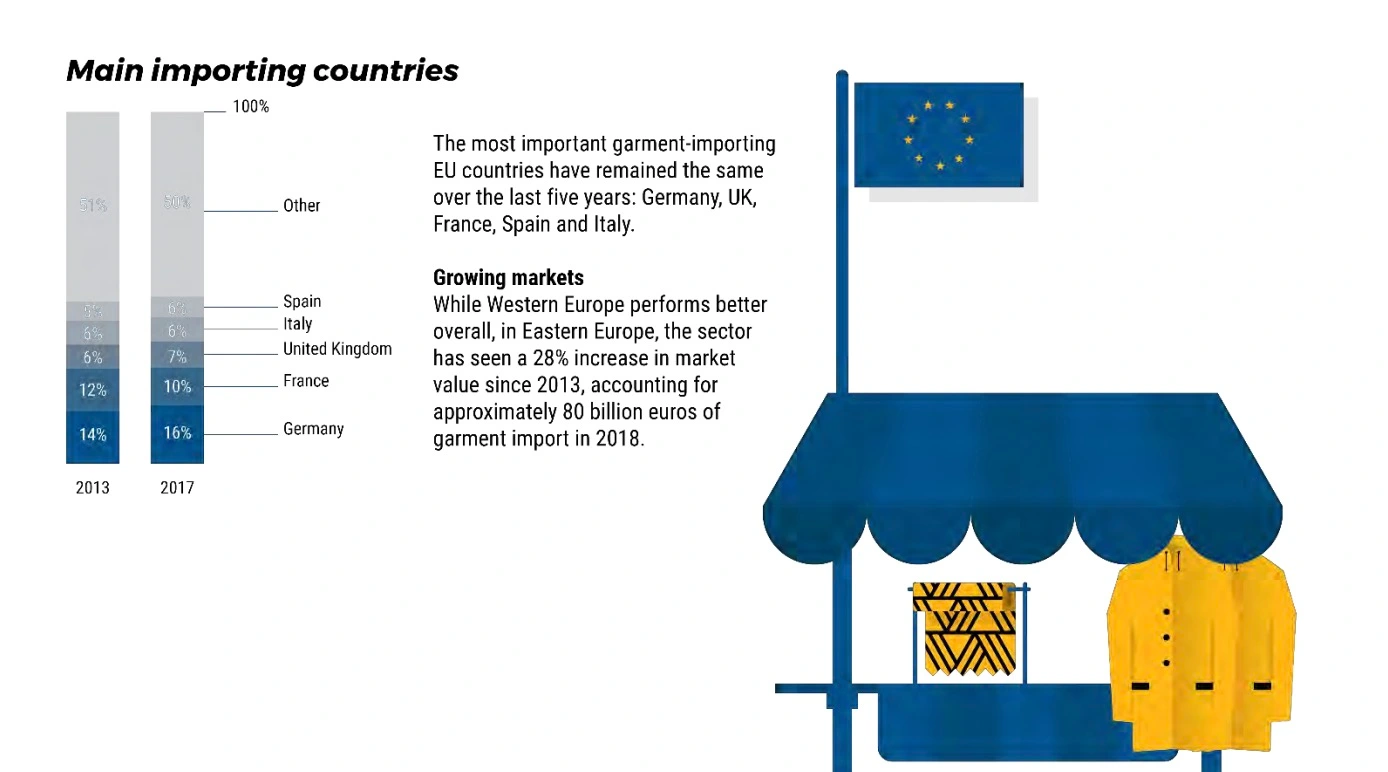

Jordan’s textiles, garments and accessories segment pushes into new markets

The textiles, garments and accessories segment has been a success story of Jordan’s industry. The ready-wear, footwear and fabric manufacturers have grown despite difficult business environments. The segment is likely to benefit from a relaxation of the rules of origin (ROO) agreement with the EU, as more companies raise standards to meet materials-sourcing and employment criteria. Companies are set to create agreements with larger suppliers in Europe, replicating the other successful examples. “What we need to do is use the experience we have gained in the US market to establish the EU as a more major export partner,” Fares Hammoudeh, chairperson of the Zarqa Chamber of Industry, told OBG.

The industry faces challenges of cost management and competition, and there is a need to innovate and produce more value-added products. This will require a shift in output from staples to designer items, and from bulk supplying to cultivating branded chains. These may be some way off, but signs point to Jordan’s garment manufacturers moving the market in this direction.

Facts & Figures

According to the Department of Statistics, Jordanian clothing manufacturers exported JD1.11bn ($1.6bn) worth of products in 2017, equivalent to 24.9% of export earnings. When JD537,700 ($759,000) in footwear exports and JD28.7m ($40.5m) in yarn, fabrics, made-up articles and related products are added, the percentage rises to 25.5%. Only chemicals exported more, at JD1.5bn ($2.1bn).

Clothing producers have reported consistent export growth in recent years, of 2.7% and a value of JD1.02bn ($1.4bn) in 2016, 7.8% in 2015 (JD979.1m, $1.38bn), 12.1% in 2014 (JD908.2m, $1.28bn) and 9.7% (JD810.1m, $1.1bn) in 2013, bucking the more mixed trend overall. The total export value declined in 2015 and 2016 from a high of JD5.2bn ($7.3bn) in 2014, as a regional conflicts and economic softening took their toll.

Segment History

The garment sector began to take off in 1996 with the signing of the qualifying industrial zones (QIZs) agreement with the US. Under this, Jordanian manufacturers were given tariff- and quota-free access to the US market if they used a certain portion of inputs from Israel, the US, Jordan and the Palestinian Territories (see overview). Manufacturers were given designated production areas, the first of which was the Al Hassan Industrial Estate at Irbid, which began operations in 1998.

Additional QIZs have been created since then, with 14 in existence at the end of 2016. The removal of tariffs and quotas was a boon for the garment segment, as import tariffs on these goods were particularly high in the US at the time.

In the years of the QIZs, Jordanian garment manufacturers made agreements directly with large stores and outlets in the US, along with bulk textile and clothing manufacturers there. The US outfits established reliable supply chains, good relationships and long-term contracts, while Jordanian products became more well known and in demand.

However, in 2001 a free trade agreement was signed between Jordan and the US, removing some competitive advantages of the QIZs. Nonetheless, the majority of garment firms remain there, with the three largest at Dual, Sahab and Irbid. QIZs mainly produce men’s and women’s apparel.

Boosting Trade

The garment segment was thought to be the main beneficiary of this. Yet, as of early 2018 just 11 Jordanian companies met the ROO conditions, and only three of these were engaged in trading, according to the Ministry of Planning and International Cooperation. While few businesses have taken advantage of the relaxation of the ROO, many can export qualified goods to the EU. Indeed, the kingdom already does substantial trade with the bloc, recording JD124m ($174.9m) in exports and JD3.17bn ($4.5bn) in imports in 2017.

“We need to get out of the formalities of the agreement and into the practice,” Hammoudeh told OBG. Making business-to-business connections is the next step towards this transition. The government is ready to assist with agencies such as the Jordan Enterprise Development Corporation and the Industrial Development Directorate. Individual chambers of the industry have a major role to play in solidifying partnerships as well, attempting to directly match members with major EU industrial and commercial players.

The next advantageous development target of garment firms may be domestic designer brands and becoming a sourcing place for international brands to produce in Jordan, with a booming local fashion designer scene emerging. The domestic high-end fashion industry may be in its infancy compared to more established markets, but branded products represent the most value-added line of the industry and are an area that manufacturers could more aggressively pursue.

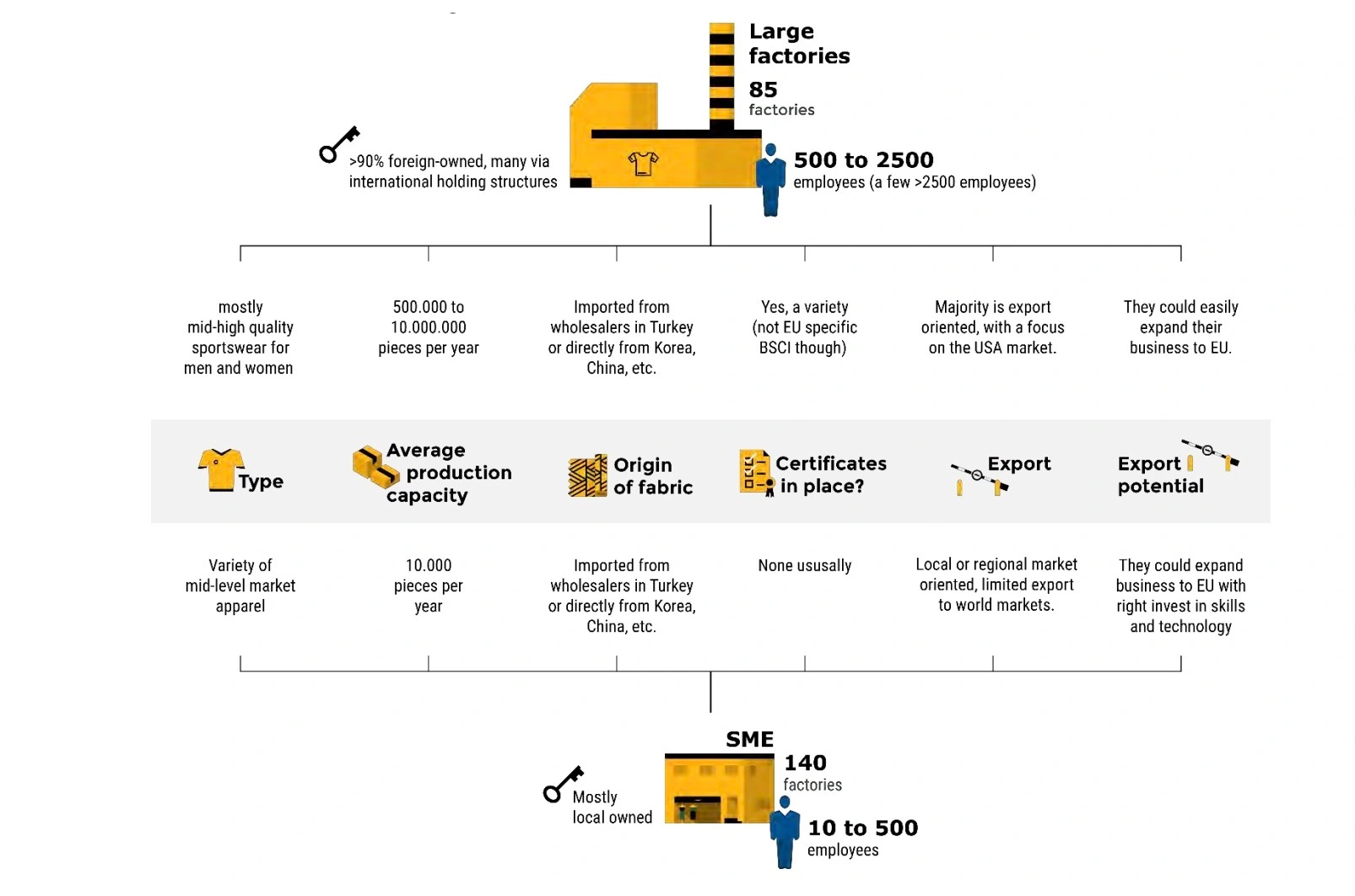

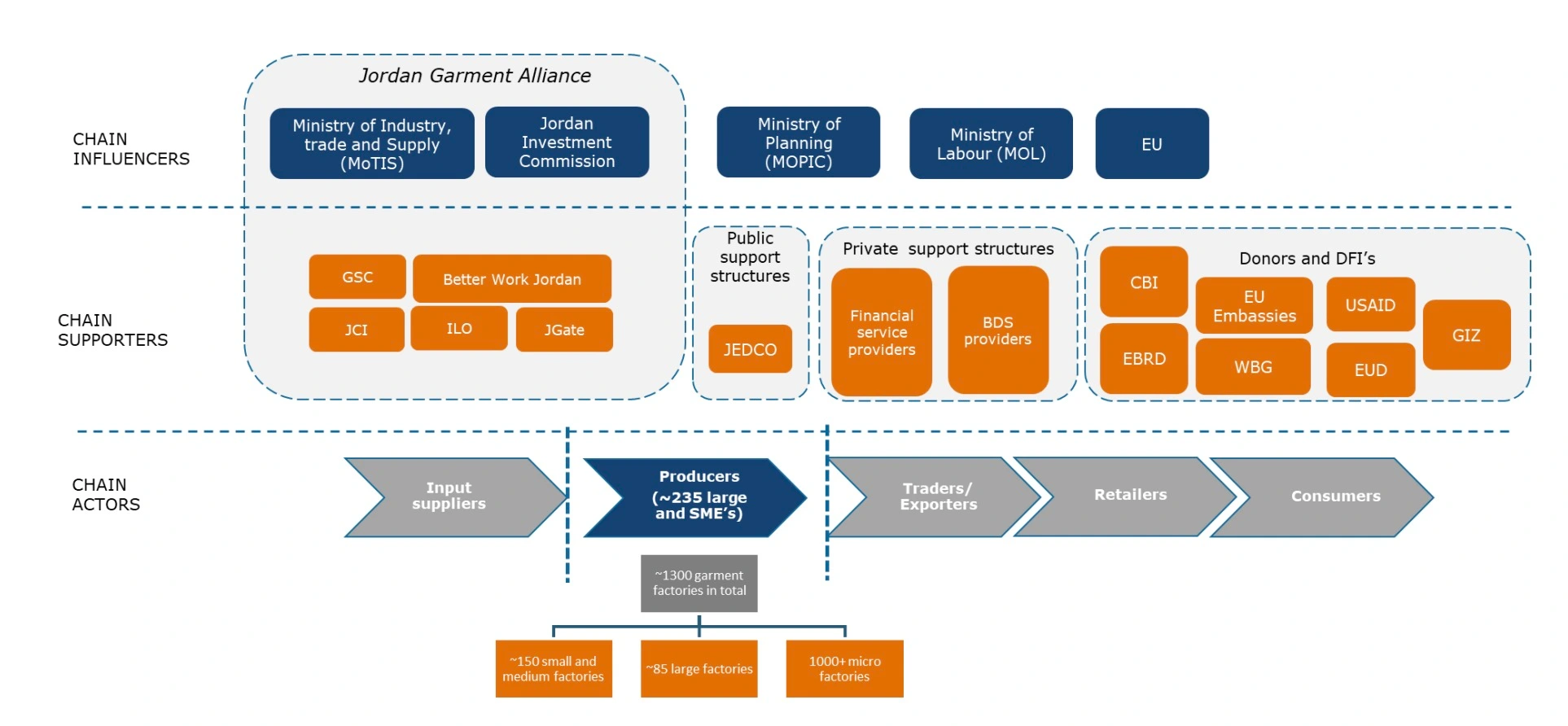

Structure and Governance

This section will introduce the key players in Jordan’s garment export value chain. Garment factories do not only

work with a range of suppliers and clients, but are also affected by the support and activities of various public and

private sector actors. We will introduce these relevant players on the sidelines of the garment production, and

discuss how they could play a role in the export sector development.

Key value chain stakeholders

Governmental organisations:

• Ministry of Trade and Industry

• Jordan Investment Commission

• JEDCO

Private sector organisations:

• GSC: The Garment Design & Training Services Center (GSC)

• JGate: Jordan Garment Accessories and Textile Exporters Association

• JCI: Jordan Chamber of Industry

• ACI: Amman Chamber of Industry

• The Garment Alliance

Trade unions and labour unions:

• The General trade Union of Workers in Textile, Garment & Clothing

Industries (JTGCU)

• Textile and Readymade Clothes Syndicate

International organisations:

• ILO: The International Labour Organisation & the Better Work Programme

• The World Bank

• USAID

• Netherlands Enterprise Agency

• PUM

• GiZ

• EBRD

• The Confederation of Danish Industry (DI)

• ITC

Certification

The interviewed SMEs generally do not see the need for investing in certifications, as they are not required by their

buyers. This covers both local buyers as well as regional buyers from the Middle East.

Only companies exporting to Westerns countries including the EU and the US tend to have certain international

certification standards in place. This is a firm requirement on the buyers’ side. The list below introduces the key

national and international certification requirements for export.

National standards:

• CTPAT — anti-terrorism;

• Golden List — Ministry of Labour;

• Better Work Jordan ILO — labour standards;

15 http://carnegieendowment.org/sada/66598

16 Better Work Jordan: Garment Industry 7th Compliance Synthesis Report

International standards:

• ISO 14001 — environmental management system;

• HIGG index — a self-assessment tool to measure the environmental impact of textile companies;

• SEDEX — social auditing certification system, mostly for UK markets;

• Amfori — previously BSCI, a social auditing system that is used by most EU buyers.

• Fairwear — based on eight labour standards derived from ILO Conventions and the UN’s Declaration on

Human Rights;

• WRAP — platinum, gold or silver, mostly for US markets;

• ISO 9001 — quality management system.

Top Textile Manufacturers in Jordan

Classic Fashion Apparel Industry Ltd. Co.

Contact Information:

Website: www.classicfashionapparel.com/

Address: Al Hassan Industrial Estate, P.O Box 54, Ramtha, Irbid, Jordan

Tel: +962 273 91369

Email: [email protected]

Classic Fashion in a nutshell

Classic Fashion, based in Jordan, is a truly global enterprise with worldwide sourcing of inputs and global marketing of products. It is the largest apparel manufacturer in the MENA region, with a turnover of $ 610 million. It produces 450, 000 to 500, 000 garments per day, with an average run of 200 styles per month, and contributes over 30% of all the garment exports of Jordan.

A well-satisfied workforce of 30,000 from various countries operates 16,000 machines, in 12 factories and 7 satellite units. The Company produces about 100 million garments annually according to the figures for 2019. Using Industry 4.0 factories and machines, the estimated output for 2020 is 120 million.

Products: Active and Sportswear Knit Tops, Bottoms and Jackets, Life Styles Knit Tops, Bottoms and Jackets, Outerwear Jackets, Swimwear, Denims Bottoms, Woven Tops and Bottoms, Golf Wear, Casual Wear

Needle Craft for Clothing Industry

Contact Information:

Website: www.ncljo.com/

Address: 684 Ad-Dulayl Industrial Park (QIZ) P.O Box 213 Ad-Dulayl 13136 Jordan

Phone: +962 5 3825680 -1

Email: [email protected]

Needle Craft Established in 2000, We are committed to deliver the best in the global market by producing high quality apparel, delivering at the right time, with competitive pricing & ensuring continues improvement in customer’s satisfaction.

Our Vision is to build Market-Driven, diversified organization, providing value to its customers through continuous innovation & outstanding quality products.

Needle Craft provides an exceptional work environment for its employees to achieve their potential and ensure their growth.

Hi-Tech Textile L.L.C.

Contact Information:

Website: www.hitech-textile.com/jordan/

Address: Plot # 674, Ad-Dulayl industrial. Park, Zarqa, Jordan

Phone: +962 – 5 3825 169 / 320 / 530

Email: [email protected]

COMPANY OVERVIEW: Hi-Tech Textile LLC is a team of professionals who are committed to serve its customers in an efficient way with Quality and Competitiveness. Hi-Tech has a history of Textile Expertise being the part of Famous Textile Group, Fair Deal Textiles, established in 1960.

Hi-Tech Textile was established in May 2000 in Jordan QIZ, Ad- Dulayl to focus exclusively on Casual bottoms manufacturing, Designing, Embroidery, Dry & Wet process and applications. Through the dynamic experience of almost four decades and a dedicated team of professionals from South Asia Our production now reaching to 35,000 DZNs/ month.

JORDAN APPAREL INDUSTRY

The apparel industry is considered one of the main industrial sector in Jordan contributing more than 40% of Jordan’s total exports and employing more than 75,000 employees. Jordan’s success story with the apparel industry was initiated by the Qualified Industrial Zones agreement which was signed in 1999 between Jordan, Israel and the United States. The agreement grants any product manufactured within the QIZ preferential duty-free and quota-free access to the United States.

QIZs have attracted huge investments into Jordan from various parts of the world and in the year 2016, Jordan’s apparel exports to the U.S. topped 1.6 billion dollars. In addition to the QIZs, the Jordan-U.S. Free Trade Agreement which was singed in 2001 offers preferential duty-free treatment for all of the apparel products.

Currently, Jordanian manufacturers are serving leading U.S. companies such as Polo Ralph Lauren, One Jeanswear Group, Wal-Mart, Sara Lee, Perry Ellis, Sears, Liz Claiborne, JC Penny, Gap, Chaps, Victoria’s Secret, Target, Under Armor, Talbots, Macy’s, Nike, Adidas, Puma to mention a few.

Gai Fashion

Contact Information:

President & CEO: Mohammad Nur Alam

Phone: Jordan +962796742457

Email: [email protected] / [email protected]

Office Address: Al-Hassan Industrial Estate (QIZ), P.O. Box-94, AR-Ramtha, Irbid, Jordan

We have more than 1000 employees in Galaxy Apparel Industry, Most of the employees from Bangladesh, Sri Lanka, Nepal, India, and Jordan. Our workforce is satisfied with compensation and benefits, the accommodation and the food and other facilities that they are getting, including health care, entertainment facilities, social security measures, etc.

Compensation and Benefits: The minimum compensation required by local law, including mandated wages, overtime, additional all allowances, and benefits instructed by law is paid to our valued workers without any delay.

Hours of Work: Galaxy Apparel Industry ensures the working hour of each day and the days worked each week do not exceed the legal maximum limit. One day off is allowed in every seven days, except if there in any top most emergency shipment pressure. In Such case Galaxy is providing alternative holiday or additional holiday compensation to the worker.

GTA Plastics – Hangers

Contact Information:

Website: www.gtame.com

Address: P.O. Box: 18142, Jebel Ali Free Zone, Dubai – United Arab Emirates

Phone: +971 4 88 17 166 / 8817159

Hanger Division: [email protected]

Driven by a visionary at its helm and powered by a growth story that is inspirational, GTA is a force to reckon with in the regional plastics industry. Innovative thinking, managerial foresight, dedicated professionals, state-of-the-art technology, exacting quality standards and unparalleled customer service are all pivotal in creating the synergy that is GTA.

The year 2000 was a defining year for Mr Rajan Lall. As the head of A&E Products- India & CMD of ITL Industries Limited, he has been offered an opportunity to cover the Middle East region as a licensee of A&E Products (then a part TYCO Group a Fortune-500 company). Garment Trims and Accessories (GTA) was thus established as a branch of the ITL Industries Limited, one of the industry icons in its segment in India with Mr Rajan Lall at its helm as Chairman and Managing Director.

Exclusive Licensees for Mainetti Hangers in the Middle East & Africa

GTA is the exclusive licensee for Middle East & Africa for the Mainetti Group, the world’s largest garment hanger manufacturer with more than 40 manufacturing locations worldwide. The group’s brands; A&E, Mainetti & Randy enjoy the largest share in the global garment hanger market as the most preferred by the leading garment retailers in the USA and Europe.

Mainetti’s dedication to exploring new territories, developing new products, reduce costs, seek answers to environmental issues and continuously improve customer service has kept the group ahead of the competition in serving the customers.

Leveraging the group’s experience and success in offering innovative products and services, GTA manufactures garment hangers in several types of plastic resins such as K-Resin, Poly Propylene, and Polystyrene. The hangers are also personalized with optional colors, printing and labelling. We also manufacture special hangers for specific needs like overcoats, suits, undergarments etc. as required by the retailers.

Rainbow Jordan

Contact Information:

Website: www.rainbowjordan.com/

Mail: [email protected]

Address: Plot 25, AD Dulayl Industrial Park (QIZ), p.o. box 170, AD Dulayl 13136, Kingdom of Jordan

PHONE :+962-5-3825-801 / 802

Rainbow Textiles LLC (RTL) is led by a distinguished textile group from Pakistan with the expertise of more than three decades in the field.

Located in one of the QIZ zones of Jordan, Rainbow Textiles LLC (RTL) is one of the largest state-of-the-art facilities producing quality activewear and knitwear for men and women. What sets RTL apart is it’s ability to handle a diverse range of fabrics as per the demand.

RTL takes pride in efficient and robust quality controls that enables the company for mass production and use of vast range of fabrics with zero compromises on the quality of the finished products.

Our business philosophy is underpinned by the value of Quality. Our expert teams work tirelessly to deliver excellence every step of the way

EAM Maliban Textiles (Jordan) Pvt Ltd

Contact information:

Website: www.maliban.com

Azeem Ismail – Managing Director

Address: Ad-Dulayl Industrial Park, PO Box 204, Ad-Dulayl, Jordan

Tel: +962 53824765

Email: [email protected]

“Thirty-Eight Years Ago”…it certainly seems a lifetime since EAM Maliban Textiles was first woven in to Sri Lanka’s garment fraternity, by a bold, inspired individual. This was an era when the country was not entirely in a premier technological and high-end manufacturing zone, so operations in a company of this stature was certainly a challenge.

EAM Maliban and Melbourne, icons in this area specialize in manufacturing and wet processing respectively and it is with the harnessing and harmonizing of our expertise that we can promise our woven garments.

Naturally, by our error-free track record we have gained a premium reputation in the business and our global customer is always assured of the very best, Consistent Quality, Reliable & On time Delivery and comprehensive capability in all related areas.

Akkad Carpet

Contact Information:

Website: www.akkadcarpet.com/

Address: Amman –Jordan-Almuwaqqar industrial development

Phone +962 7 7000 0112

Email: [email protected]

[email protected]

The Akkad family established a factory for the manufacture of ground carpets, polyester yarns and yarn dyeing in Al-Muwaqqar Industrial Development City in the Hashemite Kingdom of Jordan. The Kingdom is considered the first nucleus for establishing commercial exchange relations, assisted by its important geographic position as the heart of the Middle East.

The Akkad family was one of the founders of this industry, where their factory was established. It is the newest of its kind, which works in the manufacture of carpets by means of automatic weaving by Belgian and German machines. It was named after the factory (Akkad Company for Carpets, The company is one of the largest Jordanian companies, the most important and the most prestigious and the leading Jordanian textile companies in its various industries such as carpet, muffin, polyester yarn and yarn dyeing.

The factory was founded with the latest machinery in the world, namely Belgian, British, German, Italian The Akkad family continued to practice all the developments on their machines to offer the best and best in the world and local markets.

JORDANIAN MODERN TEXTILE

Website: www.jordanianmoderntextile.com/

ADDRESS: Al Tajamouat Industrial City Building A, Unit B, P.O BOX:950673 Amman 11195 , Jordan

PHONE: +962 6 4020112

Jordanian Modern Textile (JMT) Company is a family-owned business established in June, 2002 as a producer of casual knitwear for men, ladies and children such as T-shirts, trousers, tops, training suits…etc.

As a privately held company, JMT freely strives to implement its core philosophy of achieving success by being of service to its clients, an asset to its employees and a partner to its vendors. A heritage of hard work, integrity, and gratitude has clearly demonstrated that these character traits are JMT path to long-term success.

We believe that the best way to ensure profitability is by putting people and principals first and foremost. We look forward to serving our current and potential clients with warmth and service that is unparalleled in the textile industry.

ATLANTA JORDAN

Website: www.atlanta.com.jo/

Address: AL TAJAMOUAT INDUSTRIAL CITY, AMMAN – 11636, JORDAN

Tel: +962-6-4021836

ATLANTA JORDAN is a member of QVE apparel group.

We have built a leaner structure with increased productivity to face the new challenges. The constant pursuit of excellent quality and improvement in our system and process lies at the heart of QVE Group corporate philosophy. We are also now in a stronger position to respond to new challenges

GARMENT DESIGN & TRAINING SERVICES CENTER

Contact Information:

Website: www.gsc.com.jo/Default/En

Address: Garment Design & Training Services Center- Building #6- Ekremah Qurashi street- Abdali- Amman- Jordan

Tel: +962 (6) 5620056

Email: [email protected]

The Garment Design & Training Services Center (GSC) is an establishment created through the direct support of Jordan Enterprise Development Corporation, Dedicated to provide specialized technical assistance and fashion training courses through local and International expertise.

Jerash Garment

Contact Information:

Website: www.jerashholdings.com/

Address: Jerash Holdings (US), Inc. 277 Fairfield Road, Suite 338 Fairfield, New Jersey 07004, USA

Tel: 201-285-7973

Email: [email protected]

Jerash Holdings manufactures and exports custom, ready-made sport and outerwear from Jordan. We make products for leading global brands that include The North Face, Timberland, New Balance, American Eagle, Calvin Klein, and Adidas. With 6 factories and 4 warehouses employing approximately 5,700 people, our annual capacity is more than 14 million pieces.

PRODUCTION FACILITIES

6 factories, 4 warehouses, 5,700 people and unlimited possibilities. We conduct production operations in Jordan, allowing sales within the U.S. and EU without tariff or quota restrictions.

Even though we produce over 14 million pieces annually, quality is our first priority because we manufacture clothing for the finest global brands with exacting standards.

Rich Pine International Group Jordan Textile Co.

Contact Information:

Address: Al Ramtha, Qiz Area, P.O.Box 630007, Irbid, Jordan

Email: [email protected]

Established in 2001, Rich Pine International Group Jordan Garments Manufacturing Ltd is a Private Limited Company based in Irbid City, Jordan. The organisation operates in the Clothing & Accessories, and Specialty REITs sectors.

Sources:

we want to export textile & Garments products

Garments sewing mechanic 13 year experience

I used to work as a senior mechanic in Ethiopia and now I am working in Bangladesh

I want to go for work in textile mill such as dyeing spinning etc. 10 years experience in dyeing from me.

Respected kohan textile journal readers,

Pleased to introduce our Company as Dawood Javed Textiles Export, situated in Nishatabad , Faisalabad working in the Textiles Sector for many years.

We would also like to inform you that we deal in all kind of Fabrics and all Textile Items, however in the Dyed Fabrics such as

Fire Prove Fabrics, Water Prove Fabrics, Florescent Fabrics, Silk Fabrics, Satin Fabrics, Camouflage Fabrics, Uniform Fabrics, Karate Belt Fabrics, Cotton and Pc Twill Fabrics, Rib Stop Fabrics, Canvas Fabrics, Latah Black and White Fabrics and like 82×52/14×14 PC Twill Fabrics.

It is pleasure for us to let you know about our Products in Dyed as well as in Printed Fabrics such as in Home Textiles, Kitchen Accessories, Hospital Items, Hosiery Items, Martial Art Items and Garments Items.

Bed Sheets, Bath Towel, Kitchen Towel, Kitchen Gloves, Working Gloves, Working Suits, Scrub Suits, Bathrobe, Dungaree, Hajj Ahraam, Under Garments and all Garments Articles.

It would be so kind of you if you please give us the inquiry for the same, assuring you to provide the best quality as well as the better services in this regard.

Thanks,

Mirza Nazir Ahmad,

Marketing Manager,

Dawood Javed Textiles Export,

Address: Main Sheikhupura Road Malik Pur Stop, Nishatabad, Faisalabad, Pakistan

I have 15 years exp. in textile lab mainly for report review & report making to various buyer according to their standard. I am looking job in jordan textile industry.

I want to job in Jordan & anyone please help me in this regard. So I have lot of experience I quality assurance department as a final auditor. I am from Pakistan.

Hi,

I am with Style textile from last 5 years as a Senior internal Auditor.Now I’m looking for a job in jorden appearl textile .

Thanks and Regards,

Mudasir Ali