Sales and Margins Impacted by Weak End Markets; Focusing on Cost Containment and Strong Technology Pipeline; Long-Term Demand Drivers Intact

- Surface Solutions Q3 sales +6% year-over-year (+1% adjusted for FX and Riri) impacted by weak end markets; operational EBITDA margin at 17.1%, improved 100 bps sequentially supported by pricing and cost actions.

- Polymer Processing Solutions Q3 sales -35% (-31% FX adjusted), driven by customers postponing orders; continue to focus on executing cost actions, with first positive impacts expected during Q4.

- Continue to expect organic mid-single-digit percentage sales decline vs. 2022 at constant currencies. Further CHF strengthening in H2. Operational EBITDA margin guidance unchanged at ~15.5%.

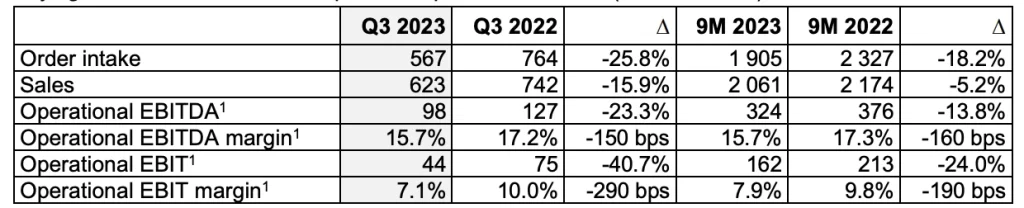

Key figures for the Oerlikon Group as of September 30, 2023 (in CHF million)

“Our quarterly results reflect the weakness in key end markets and the continued currency headwinds. In the near term, we are performing a review of operational and strategic actions to strengthen the resilience of the company,” said Michael Suess, Executive Chairman, Oerlikon.

“Our innovation pipeline for the coming quarters is filled with solutions that will increase customer value. Notwithstanding the cyclical weakness of Polymer Processing Solutions, its underlying fundamentals remain strong, and the long-term demand drivers for both our businesses are intact. This makes us confident about the future growth potential of our company,” added Michael Suess.

Q3 Performance

Group order intake decreased by 25.8% to CHF 567 million, attributed to weak demand in Polymer Processing Solutions. Sales decreased by 15.9% to CHF 623 million. At constant exchange rates, Group sales decreased by 10.9%.

Operational EBITDA for the third quarter decreased by 23.3% to CHF 98 million, and the operational EBITDA margin was 15.7%. The margins are attributed to the lower demand in Polymer Processing Solutions, higher input costs and currency impacts. Q3 operational EBIT was CHF 44 million, or 7.1% of sales (Q3 2022: CHF 75 million; 10.0%).

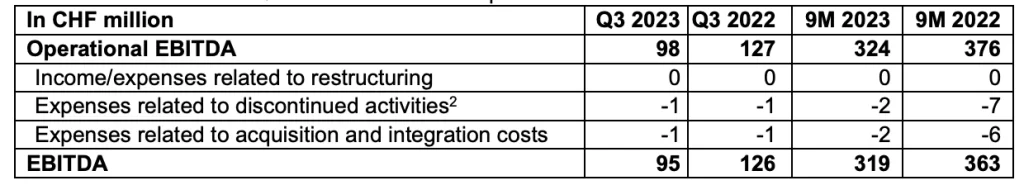

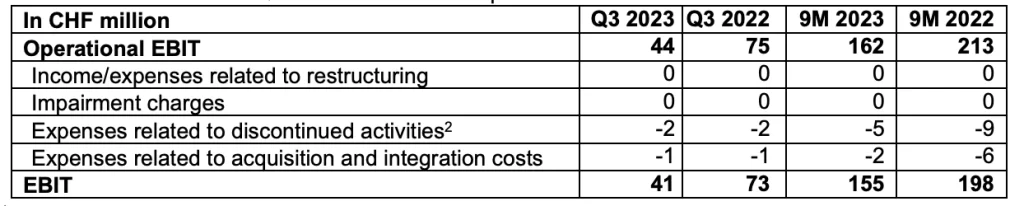

Group Q3 unadjusted EBITDA was CHF 95 million, or 15.3% of sales (Q3 2022: CHF 126 million, 16.9%), and EBIT was CHF 41 million, or 6.6% (Q3 2022: CHF 73 million, 9.8%). The reconciliation of the operational and unadjusted figures can be seen in the tables below.

Table I: Reconciliation of Q3 2023 and 9M 2023 operational EBITDA and EBITDA1

Table II: Reconciliation of Q3 2023 and 9M 2023 operational EBIT and EBIT1

Division Overview

Surface Solutions division

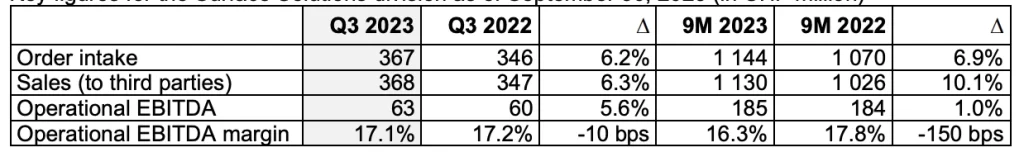

Key figures for the Surface Solutions division as of September 30, 2023 (in CHF million)

Surface Solutions increased order intake by 6.2% to CHF 367 million and sales by 6.3% to CHF 368 million. Adjusted for FX, sales increased 11.9%, thereof 11.1% is related to the Riri acquisition. The organic FX adjusted sales growth of 0.8% was impacted by weakening manufacturing activity as reflected in the manufacturing PMIs.

The Q3 operational EBITDA margin was stable at around 17%, representing an improvement in sequential margin (Q2 2023: 16.1%) that is attributable to the positive impact from cost and pricing actions. The margin continues to be impacted by higher input costs and the strengthening Swiss franc. Operational EBIT was CHF 27 million, or 7.3% of sales (Q3 2022: CHF 24 million, 7.0%). The division’s unadjusted Q3 EBITDA was CHF 63 million or 16.9% of sales (Q3 2022: CHF 59 million, 16.9%). EBIT was CHF 26 million, or 7.1% of sales (Q3 2022: CHF 23 million, or 6.5%).

Polymer Processing Solutions division

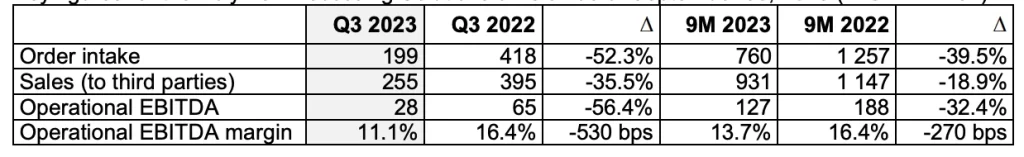

Key figures for the Polymer Processing Solutions division as of September 30, 2023 (in CHF million)

Polymer Processing Solutions saw a decrease in orders and sales in the quarter. This was attributed to the persistent weakness in the filament market and lower demand for staple fiber and nonwovens, driven by customers prioritizing cash preservation as inflation and prevailing economic uncertainties. Furthermore, flow control solutions were transitorily impacted by automotive customers delaying the launches of new car models. The division’s order intake decreased by 52.3% to CHF 199 million, and sales declined by 35.5% (FX adjusted: -30.8%) to CHF 255 million.

Q3 operational EBITDA declined by 56.4% to CHF 28 million, or 11.1% of sales. The margin was impacted by a lower sales volume, unfavorable currency developments and input costs. During the quarter, the division continued to execute its announced cost actions with initial positive impacts expected to phase in during Q4. Operational EBIT was CHF 16 million or 6.2% of sales (Q3 2022: CHF 51 million, 12.9%). The division’s unadjusted Q3 EBITDA was CHF 28 million, or 11.1% of sales (Q3 2022: CHF 65 million, 16.4%), and EBIT was CHF 16 million or 6.1% of sales (Q3 2022: CHF 51 million, 12.8%).