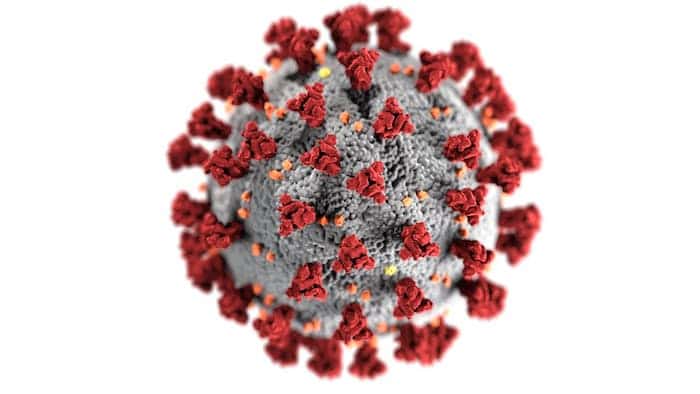

Africa’s booming textile business seems to have nosedived as a result of the Coronavirus (COVID-19) crisis and government importation policies. Before the pandemic, the textile and clothing industry was seen as an avenue to boost value-added benefits and job creation.

It is estimated that up to 600 percent of this value can be created in the cotton value chain, ranging from cotton production, spinning and twisting into yarn, to weaving and knitting into fabric, followed by dying, printing and designing. This value chain forms the majority of micro, small and medium enterprises (MSMEs), which then generates value-added benefits and job creation.

In addition, the textile and garment industry presents an opportunity for African countries to focus on industrialization, a diversification that is geared towards exports, thereby creating a source of foreign exchange.

However, there seems to be a clause as Africa imports about 85 percent of textiles and garments from Asia, given that African countries produce cotton. This importation has created a setback by reducing revenue generated from the industry, thus, increasing unemployment and shortage of foreign exchange.

In Nigeria for instance, experts have identified several factors that have affected the industry. Some of which include insufficient cotton seeds for production, high cost of operations, smuggling, and most importantly, insufficient power supply.

As a result of this, the Nigerian government is taking drastic measures to end textile imports, in partnership with the Central Bank of Nigeria (CBN). Adding all forms of textile materials to the list of items ineligible for foreign exchange from official windows, is seen as a watershed move in efforts to resuscitate the collapsed textile industry.

Gradually, the textile industry in Africa began to focus on producing locally and reducing importation of textiles. However, the industry seems to have taken a step back since the pandemic began, as leaders imposed lockdowns, travel bans and strict restrictions all in a bid to curb the spread of the virus.

Given the globalized nature of the industry, companies and retailers must transport their goods and raw materials across many countries as restrictions set by the government to curb the spread of the virus has limited the sales and production of textile industry. With the social distancing rule and fewer gatherings, the industry has witnessed a decline in demand as the purchasing power of consumers are limited.

Also affected are the workers in the textile and garment industries in Africa, who are left without jobs to do due to the stay home orders and decline in orders.Textile merchants are crying loaf because business is down and there are no parties or celebrations like before to keep them in business constantly with high demands for fabrics.

The pandemic has greatly affected the industry with a decline in sales, and high level of foreign exchange, CEO of Lavive fabrics Vivian Ozabor said in an interview. “I have to deal with little or no sales, inflation, high exchange rate and travel restrictions.”

When asked how she managed her business during this crisis, Vivian says that effective customer relations, the use of social media and reduced prices was the key in keeping her business running. Although sales were not in surplus but the business was moving.

This seems to be the new norm for most businesses as textile merchants have resulted in captivating pictures of attractive models wearing their fabrics to entice customers to make purchases, not necessarily for parties but for their own personal feel good consumption. They seem to be succeeding because social media is filled with likes of these captivating textile postings.

Despite the challenges caused by the pandemic, Vivian believes that the African textile industry is a productive one that could generate a lot of revenue and become a major source of foreign exchange if properly regulated.