In recent years, Egypt has emerged as one of the most attractive destinations for Turkish textile and apparel producers looking to reduce operational costs and expand market reach. Amid Türkiye’s economic challenges—rising inflation, energy prices, labor costs, and currency volatility—a growing number of companies have begun relocating production to Egypt. But is this migration a sustainable, strategic decision or a short-term response that risks long-term competitiveness?

The debate is intensifying within Türkiye’s textile community. While some praise Egypt’s incentives and market access, others warn of operational risks, regulatory hurdles, and industrial erosion at home. This article offers a comprehensive look at the pros and cons of moving production to Egypt and explores whether this shift is the right path for Turkish textile stakeholders.

Why Egypt?

Cost Advantages and Government Incentives

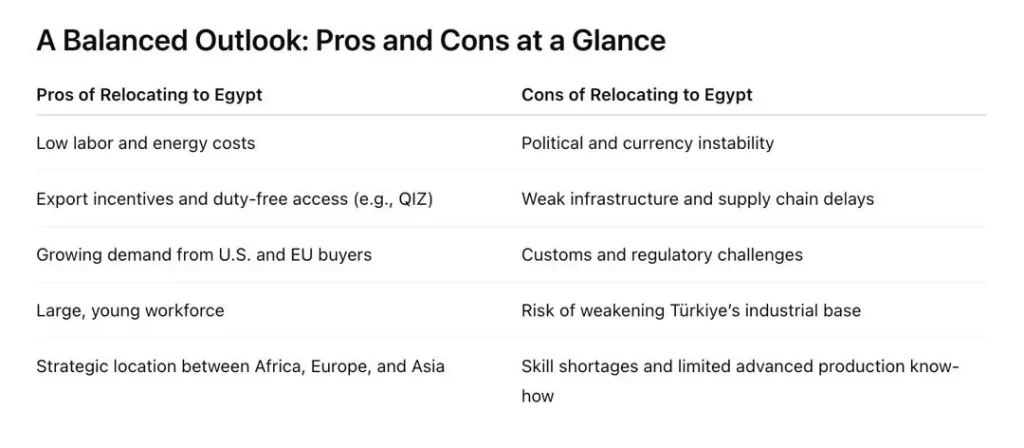

Egypt’s appeal lies primarily in lower labor and energy costs, a favorable customs and trade regime, and strategic geographic proximity to key export markets such as Europe and the United States. With minimum wages under $150/month, Egypt offers one of the lowest labor cost structures in the region. Moreover, Egypt benefits from a range of free trade agreements, including with the EU and the U.S. (under the QIZ agreement), giving manufacturers duty-free access to major markets.

In recent years, the Suez Canal Economic Zone and investment regions like Minya and Upper Egypt have attracted significant interest due to tax incentives, streamlined export procedures, and logistical connectivity. Sherin Hosni, Executive Director of the Apparel Export Council of Egypt, recently noted that “Egypt provides a one-stop shop for investors—less bureaucracy, tax advantages, and direct export subsidies,” positioning itself as a competitive textile hub for international investors.

The Push Factors from Türkiye

Inflation, Energy, and Export Challenges

Back home, Turkish textile manufacturers face mounting pressures. According to multiple reports from Turkish trade associations and industry media, the sector is experiencing its deepest crisis in recent decades. Apparel exports dropped by over 10% in early 2025, and for the first time, ready-to-wear clothing fell to fourth place in Türkiye’s export rankings.

Several factors are contributing to this downturn:

- High labor costs and minimum wage increases

- Unstable energy pricing

- Logistical inefficiencies

- Currency fluctuations and inflation

- Shrinking export competitiveness

As noted by Haluk Akın, President of KOMİD (Turkish Apparel Machinery Manufacturers’ Association), “We cannot remain indifferent to the migration of our customers. If our clients are moving to Egypt, we must follow them with service and machinery supply.” However, he also cautioned that regulatory and logistics challenges in Egypt may not be easily navigated and that Egypt’s customs and import structures differ significantly from Türkiye’s more established industrial framework.

Risks and Uncertainties in Egypt

Political Volatility and Operational Challenges

Despite its current attractiveness, Egypt is not without risk. While initial cost savings may seem appealing, the country faces periodic political unrest, currency devaluation, and infrastructural weaknesses that can pose serious disruptions to manufacturers.

In 2024, Egypt’s currency depreciated by 45%—a sharp reminder of the macroeconomic instability that investors must factor in. Delays in port clearance, customs complications, and shortages of skilled labor have also been cited as frequent issues by Turkish stakeholders operating in Egypt.

Additionally, relying too heavily on Egypt for production may weaken Türkiye’s domestic capabilities and innovation base. Industry leaders warn that continued relocation could lead to the hollowing out of Türkiye’s textile ecosystem, including R&D, design centers, and sustainable fashion initiatives.

Strategic Response: Branding, Value-Addition, and Technology

Several Turkish experts and associations suggest that the solution lies not in cost-cutting relocation, but in strategic transformation. Mustafa Paşahan, Vice President of İHKİB (Istanbul Ready-Wear Exporters’ Association), emphasized that Turkish companies must adopt the “Italian model”: shifting from low-cost production to branding, innovation, and flexible, high-quality production for global retailers.

Türkiye already has the industrial know-how, skilled labor force, and proximity to Europe to offer full-package solutions, from design to delivery. Maintaining this strength requires investment in sustainability, digitalisation, and smart production, rather than fleeing to cheaper destinations.

Conclusion: A Tactical Move, But Not a Strategic Future

While moving production to Egypt may offer short-term relief from Türkiye’s economic constraints, it is not a long-term strategic solution. Türkiye’s textile sector, historically one of the most innovative and value-driven in the world, must focus on upgrading its capabilities, investing in human capital, and offering integrated services that go beyond price competitiveness.

As the sector navigates turbulent times, Egypt may play a complementary role—but not a replacement. Policymakers in Türkiye also need to address internal challenges, such as labor costs, export support, and currency stability, to retain and attract manufacturers.

Ultimately, the goal should be to create an ecosystem so competitive and innovative that companies see no reason to leave. Only then can Türkiye sustain its position as a global leader in textile and apparel manufacturing.