European countries import 96 per cent of Tunisia‘s total textile and apparel exports; France, Germany and Italy alone receive 75 percent. … Expertise is spread over spinning and thread-making, fabric weaving, finishing, hosiery, knitting, the manufacture of woven and knitted clothing as well as other textile products. The textile industry in Tunisia needs more attention.

Tunisia is among the top 15 garment suppliers in the world and has the advantage of being close to the European market. It is the fifth-largest supplier to the European Union, as well as the leading trouser supplier to the EU.

Other important products are workwear and lingerie. The main foreign investors in the apparel sector in Tunisia are France, Germany, Belgium and Italy.

This article is a part of a project initiated by the chamber of commerce and Industry of the centre and funded by the FAMEX (foreign markets access fund) in order to offer to Scandinavian companies the opportunity to meet selected Tunisian companies and to explore further partnership and production opportunities.

Textile industry in Tunisia

The Scandinavian apparel and fashion industry is characterized by the emergence of many new brands and designers; Tunisian apparel industry offers many opportunities to Scandinavian countries. Thanks to its assets in terms of flexibility, reactivity, adaptable production volumes, just-in-time delivery, communication skills and fundamental respect for social and environmental standards.

Tunisia enjoys several comparative advantages, such as low labor cost and proximity to the EU market. According to the 2007 textile labor cost comparison by Werner International, the average cost per operator hour in the Tunisian industry is significantly lower than in Morocco and Turkey.

Due to the reactivity of the Tunisian apparel sector delivery times ( 2 to 3 weeks ) are lower than Turkey and Poland ( 3 to 4 weeks ) and definitely lower than India and China (12 à 20 weeks).

Thanks to its proximity to Europe, Tunisian Workers are familiar with the European mentality and work culture. Italy is only 1 hour away from Tunis by airplane, France and Germany 2 hours away, Copenhagen and Stockholm are 2h 30 and 3h away respectively. Most of the Tunisian factories employ multi-linguistic skilled workers: French, English, Italian and German are widely used.

FUNDAMENTAL RESPECT FOR SOCIAL AND ENVIRONMENTAL STANDARDS AND NORMS

Tunisia is a signatory to the Geneva Convention on the conditions of the employment of child labor. All companies must comply with social rules and regulations; systematic control procedures ensure that these social standards are respected.

MAIN CLIENTS AND REFERENCES

More than 200 brands are currently working in Tunisia. here is a non-exhaustive list of known brands: Armand Thierry, Benetton, Cacharel, Diesel, Balmain, 4 You, G.Laroche, Hugo Boss, Kookai, Lacoste, Adidas, Catimini, Lee.

Certification for products, systems and environment have become widespread among sector enterprises as has the development of labelling such as OEKO-TEX, ECOLABEL…(see the website menu and read more under the headline social and environmental standards and norms).

MAJOR REASONS FOR CHOOSING TUNISIA

• Competitive production costs

• Flexible and adaptable production system

• Qualified and available human resources.

• Respect of delivery time frames.

• Reliable and high-performance sourcing.

• Respect of social and environmental standards.

• Full line of services available from sub-contracting to co-contracting and finished products.

Sector Overview

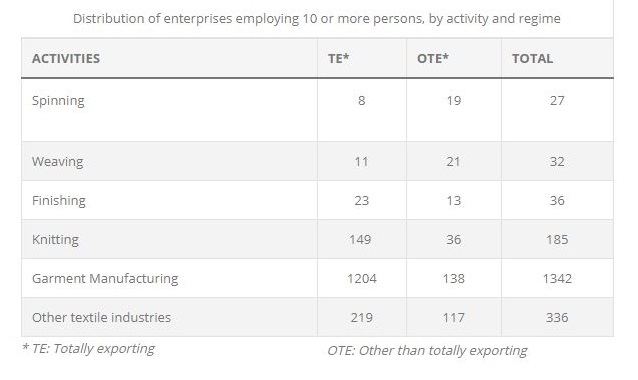

The textile and clothing industries sector holds strategic significance for the national economy, serving as a cornerstone of the manufacturing industry with regards to exports, employment, and added value. Presently, the sector comprises 2100 companies with a workforce of 10 employees or more, collectively employing over 179,000 individuals. This accounts for approximately 34% of all employment within the manufacturing sector.

PARTNERSHIP

The Textile and clothing industries (TCI) sector is comprised of some 2,094 industrial enterprises employing 10 or more persons, of which 1,656 produce exclusively for the export market.

The Sector counts 971 enterprises with foreign participation, of which 635 are wholly (100%) foreign-owned.

The leading foreign investors in the textile/clothing sector are Italy, Belgium, Holland, France, Algeria and the USA.

EMPLOYMENT AND HUMAN RESOURCES

• Textile/clothing industries provide the largest number of jobs in the manufacturing sector, employing 205,911 people, 46% of all manufacturing jobs.

• Accessible quality education for all citizens has endowed Tunisia with a young human resource pool (supervisors, technicians, designers, engineers).

• The country has over thirty centres for specialised education covering the textiles industries: 8 sectorial centres for training supervisors and technicians; a higher institute of textiles for senior technicians; a textile engineer university; a higher institute for fashion professionals; a textile design department within the fine arts university.

Tunisia ranks as the fifth most significant supplier to European countries, with one out of three bras and one out of six workwear garments originating from the country. The production value of Tunisia’s textile sector reached 5,362 million Tunisian dinars in 2008, showcasing the financial weight of this industry.

The ready-to-wear clothing segment dominates the sector with 1,567 firms recorded in 2008, highlighting its competitiveness. In contrast, the spinning segment is less saturated, with just 30 firms at the last count.

Tunisia also serves as a main supplier for global brands of jeans and sportswear, with renowned companies such as Benetton, Diesel, Esprit, Gap, Hugo Boss, Lacoste, and Tommy Hilfiger involved in its textile industry.

Innovative hubs like the Technopole in Monastir, equipped with a fashion institute and business incubator, and the industrial activity area in El Fejja, which includes textile finishing facilities, provide infrastructure support. These assets further reinforce Tunisia’s appeal as an investment destination.