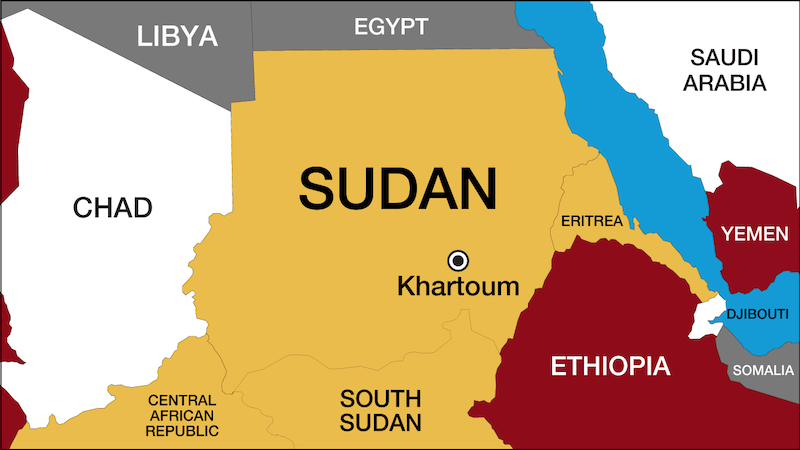

Getting to know Sudan :

The Republic of Sudan is a country in Northeast Africa and its capital is Khartoum. Sudan has a population of 30,894,000 and is the currency of Sudan.

More than 97% of the people of this country are Muslims. Prior to 2005, Arabic was the only official language of Sudan.

Sudanese industry

Sudan industry depends mainly on its agricultural sector, getting most of its raw materials from agricultural products, including textiles, leather tanning, sugar, edible oils, and other food products, along with some other related operations, such as soap making. Sudanese industry accounted for about 20% of the gross domestic product (GDP) in 2014.

Textiles

The first modern textile factory goes back to 1945 when the private sector established the Anzara (Equatoria State) textile factory. It was designed to produce 4 to 5 million yards of cloth per year from locally grown cotton. However, textile industries’ construction on a large scale began under the first national government, immediately after independence in 1956, and later under the Numeri regime (1969-1985).

In 1962 the first plant, the Sudan Textile Factory, which was financed completely by the Sudanese private sector, began production; many factories followed. The textile industry in Sudan has depended solely upon cotton that is grown in the country.

The Sudan government owns fifteen spinning factories. Only five are working, and seventeen textile factories, only four workings, are mostly in privatization.

There are also nine large spinning and weaving plants operated by national and joint venture companies in Sudan.

About 75 small textile factories of varying capacity are scattered mainly in Gezira, the main cotton-producing region of Sudan and Khartoum. The textile industry’s total design capacity is estimated at 54,000 tons of spun yarn and 380,000,000 yards of cloth per year, but these plants are working at a fraction of their capacity.

The textile industry is going through many financial, mechanical, and technical difficulties. Mainly because of the decline of cotton production in Sudan because of the government’s political decision to produce more wheat in the Gaziras scheme instead of cotton in the 1990s, which proved to be disastrous a few years later.

That is to add to the frequent electrical power shortages, dumping local market with cheap imported textiles. Some plants have even halted production for long periods. At least 80,000 Sudanese workers have lost their jobs during the last ten years because of the decline in the textile industry in Sudan until 2013.

Three textile factories were affiliated with Giad. A government-owned leading industrial group in 2015. Another important spinning factory in Al Haji Abdullah in Algazira is undergoing a rehabilitation process. These measures are expected to revive the textile industry and increase manufacturing growth.

The revival of the textile sector in Sudan

The revival of textile factories in Wad Medani, the capital of the Al Jazirah state in east-central Sudan, is currently in progress and is likely to be completed by June 2013, Eng. Abdul Wahab Osman, the Minister of Industry has said.

Al Hada, Gametixt and Wad-Medani textile factories are among the ones that at being revived, the Minister said, according to a Sudan Vision report.

said his Ministry will help the revival of the textile industry in Sudan by seeking a cut in various federal and state taxes as well as electricity and other utility tariffs.

He urged the factory owners to adapt latest technologies and make products according to the market demands.

The revival of textile sector in Sudan is important as it would create new job opportunities, while reducing dependence on clothing imports, thus decreasing the need for foreign currency.

Introduction:

Sudan has been one of the large land area owing countries in Africa, with a diverse climate enabling cultivation of so many crops. The River Nile, passing through the country, became a continuous source of irrigation. Thus, cotton was one of the economical products in the country, and was being exported to Great Britain to feed the textile industry. During that time, ginning mills were available for this purpose.

A step by step, one centralized governmental spinning mill was established to prepare yarns for six weaving mills, which were established around the country in different regions targeting social development. There was a lack of textile finishing factories for dyeing and printing the produced grey fabrics, whence these grey fabrics have market demand in the local and neighbouring countries. Some private-sector integrated textile factories were then established since this industry is of high market demand, mostly in the central region where cotton is mainly cultivated.

These factories made a big difference in the social life of the workers and played an important role in the economical development in the society. Thus, the textile industry in Sudan can be considered as one of the deep-rooted industries relying mostly on the huge production of Sudanese cotton, which is characterized by its different varieties and grades.

The raw material, in fact, represents a high percentage of the final product cost.

Nevertheless, this available diversified raw material leads to diversified final products of sheeting, shirting, and others; together with the grey fabric which has got plenty of end usage. Some dyed and printed fabrics were also exported to the neighbouring countries.

Nowadays, the textile industry is suffering from many problems, facing acute challenges, and becoming less attractive. However, some investments are still running and continuing their efforts to develop this

sector since the potentials for such development are still available.

The strategic advantages of this industry:

1- Endless of the human needs of the final products.

2- Other sectors needs like medical, agricultural, technical etc.

3- Stage by stage industry leading to capability of stage development .i.e. economic development can emerge from this factor (i.e. social groups or regions can specialize in one or more stages)

4- Labour-intensive industry

5- Eco-friendly industry

1- Spinning:

In the spinning mills, ring and rotor spinning frames are being used. The produced yarns are of low to moderate quality and the production is not sufficient for the processes needed in the different textile industries requiring yarns. This is mainly due to the lack of new technology in the field of spinning.

2- Yarn preparations:

The machines used in this section are not up to date, using old technology leading to the production of faulty yarns not

suitable for the coming textiles processes.

3- Weaving:

Air jet and rapier looms of high efficiency are available for the production of high-quality fabrics. These looms require high-quality yarns, which are not available because of the spinning drawbacks.

4- Finishing:

This section is suffering from the lack of high-quality dyestuff, pigments, and chemical auxiliaries. The machines available in this section are mainly old technology machines, but they can still work efficiently. Thus, the spinning stage seems to be the most important stage for maintaining continuous textile production whether mass production or good quality products in weaving and finishing.

The high quality produced yarn will also affect positively the production of knitted fabrics. Highly finished fabrics mean excellent marketing and thus continuity of the textile industry is maintained. This section suffers from skilled and well-trained man who is capable of dealing with computerized designs. The expenses of chemical materials are too high and not attainable in this section and this is one of the problems limiting the development in finishing.

Other related textile production mills are as follows:

a- Knitting industry:

This industry is a mass-production industry that is getting developed continuously fast. This is because of the new technology being emerged and the diverse end-uses for the product. Some small factories are available in Sudan, some with new machines and others with traditional machines. The main challenges are:

1- Lack of good quality yarns with specific counts and properties

2- Lack of dimensional stability machines

3- Lack of further factories (ready-made garment factories for knitted fabrics)

b- Clothing industry:

In this industry, good quality fabrics are available from export. However, mass production is facing the followings:

1- Skilled manpower

2- Body size data for the population

3- Competition with exported goods

c- Sanitary products industry:

This industry which is not very much known in Sudan has got a high

consumption rate. It includes:

1- Lady napkins (cotton is available)

2- Absorbent cotton gauze

3- Baby diapers

Conclusion:

Sudan has the potential to be one of the most promising countries in the textile industry in Africa. Most of the problems facing this industry can easily be overcome. A real investment is required to establish a good base for this industry with a new vision, new approach. The availability of the land and the raw material are encouraging factors in addition to the widely open market locally

and regionally.