Third-Quarter 2021 Results

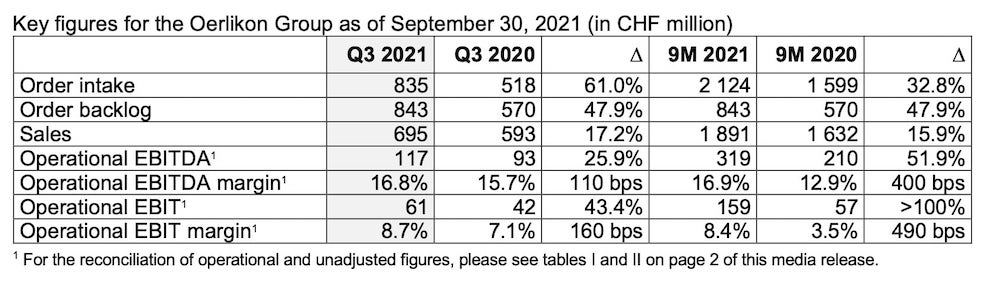

- Oerlikon posts strong quarterly results: +61% in order intake, +17% in sales and +26% in operational EBITDA vs. prior year. Group operational EBITDA margin of 16.8%.

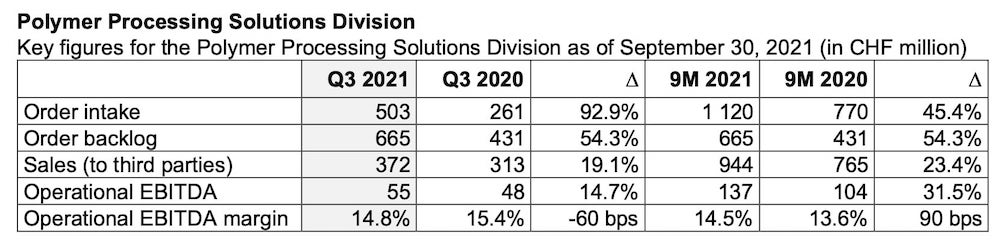

- Polymer Processing Solutions achieved record Q3 order intake (+93%) and sales (+19%), and robust growth in operational EBITDA (+15%), driven by continued strong demand in filament and successful execution of diversification strategy into non-filament.

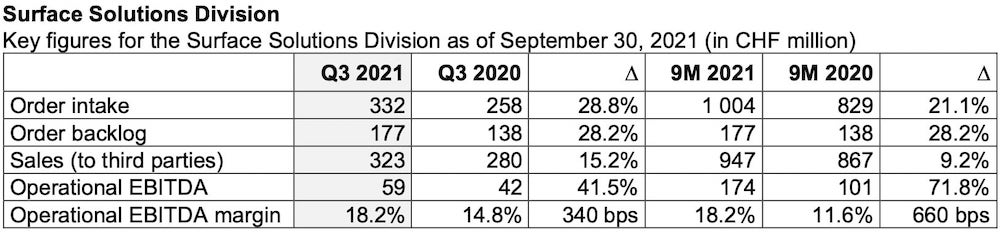

- Surface Solutions increased Q3 order intake (+29%), sales (+15%) and operational EBITDA

(+41%), supported by recovery across end markets and implemented - 2021 Group Guidance confirmed.

“Our robust Q3 results confirm our strategy of focusing on sustainable innovation, profitable growth and disciplined capital allocation,” said Dr. Roland Fischer, CEO Oerlikon Group.

“Polymer Processing Solutions achieved record order intake and sales and is on-track with the integration of INglass. In Surface Solutions, we continue to drive margin expansion, underscoring our commitment to maintain the low fixed cost base we have achieved. Following our strong Q3 results, we reiterate our Group guidance for the full year of 2021. On that basis, we expect that our broad portfolio of solutions and technologies will allow us to generate higher sales and margins in 2021 than in 2019 before the pandemic,” added Dr. Fischer. “Supply chain disruptions are expected to extend into the first half of 2022. We will continue to actively manage and mitigate the impact of these challenges.”

“Dr. Helmut Rudigier, our Group CTO, will retire at the end of 2021. Helmut joined Oerlikon in 1986 and has been the company’s technology expert, particularly for innovative surface solutions, for many years. He has contributed greatly to R&D, innovative technologies and the management team. On behalf of the Board and my colleagues, I would like to thank Helmut for his valuable contributions and technological leadership at Oerlikon and wish him all the best in his retirement,” said Dr. Fischer. “To enable closer alignment of R&D with market and customer needs, the Division CTOs will lead and manage the R&D and technology innovation of their respective Divisions from January 1, 2022 onwards.”

Robust Q3 2021 Performance

Group order intake increased significantly by 61.0% year over year to CHF 835 million, driven by the record level of order intake in the Polymer Processing Solutions Division and market recovery in Surface Solutions. Sales improved across all regions, rising 17.2% to CHF 695 million. At constant exchange rates, Group sales increased by 15.7% to CHF 686 million.

Operational EBITDA for the third quarter improved by 25.9% to CHF 117 million, and the EBITDA margin improved by 110 basis points to 16.8%. Q3 operational EBIT was CHF 61 million, or 8.7% of sales (Q3 2020: CHF 42 million; 7.1%). The margin improvements are attributed to higher sales and the benefits of cost actions executed by the Group.

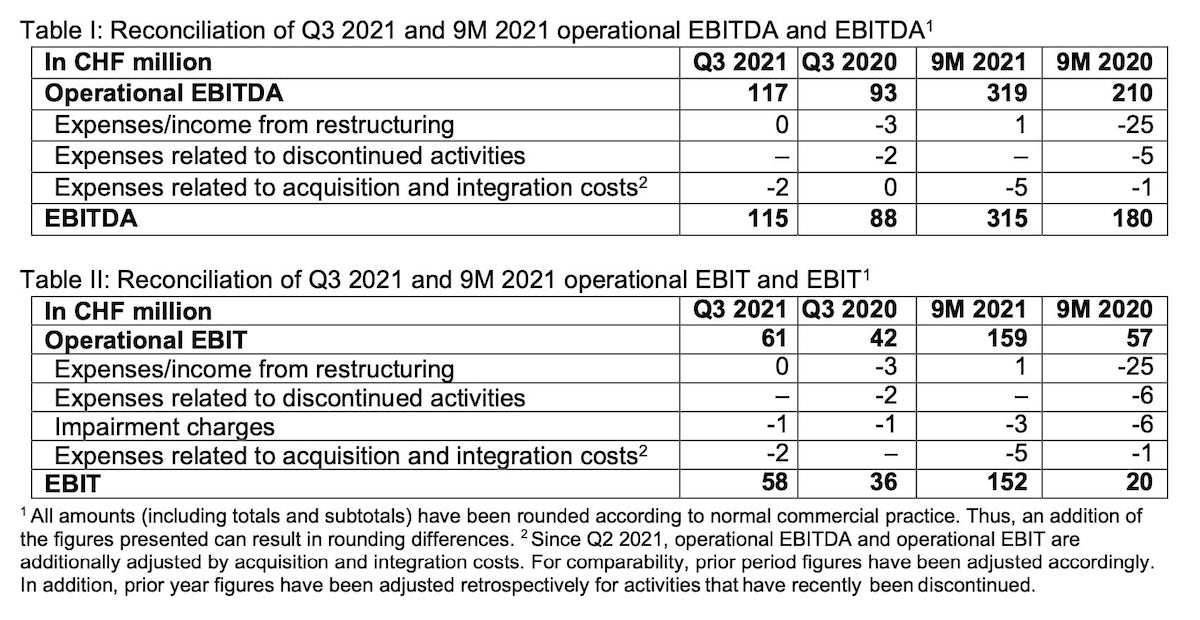

Group Q3 EBITDA was CHF 115 million, or 16.6% of sales (Q3 2020: CHF 88 million, 14.8%), and EBIT was CHF 58 million, or 8.3% (Q3 2020: CHF 36 million, 6.0%). The reconciliation of the operational and unadjusted figures can be seen in the tables below.

Confirm FY2021 Group Guidance

The current environment is facing challenges arising from supply chain disruptions, the energy crisis in China, the Covid-19 pandemic and political tensions. Oerlikon is actively managing and mitigating the impact from these challenges, supported by the strength of its broad customer and supplier base worldwide. Based on the strong Q3 2021 results, Oerlikon confirms its Group guidance for the full year 2021. The Group expects sales to be around CHF 2.65 billion and the operational EBITDA margin to be around 16.5%.

Aligning Technology Innovation Closer to Business

Oerlikon CTO Dr. Helmut Rudigier is retiring at the end of 2021. Effective January 1, 2022, the Executive Committee will consist of five members – CEO Dr. Roland Fischer, CFO Philipp Müller, CHRO Anna Ryzhova, CSO and CEO Polymer Processing Division Georg Stausberg and CEO Surface Solutions Division Dr. Markus Tacke. To align R&D closer with market and customer needs, the Division CTOs will lead and manage the R&D and technology innovation of their respective Divisions from January 1, 2022 onwards.

In the third quarter, Surface Solutions saw an increase in year-over-year demand across end markets. As anticipated, supply chain bottlenecks impacted some markets, particularly automotive. Despite that, the Division noted continued recovery in automotive, tooling and general industries, as well as an initial soft recovery in aerospace, compared to the previous year. Supply chain disruptions are expected to extend into the first half of 2022 and result in some delays and postponements of projects in the short term. The Division is actively taking actions to mitigate the impacts of these challenges. Over the medium to long term, the growth prospects for the businesses remain intact.

Q3 order intake increased by 29% to CHF 332 million and sales increased by 15% to CHF 323 million, driven by the Division’s ability to further capture business alongside year-over-year market recovery.

Q3 operational EBITDA improved notably by 41.5% and the EBITDA margin by 340 basis points, driven by positive operating leverage and continued cost control. Operational EBIT was CHF 19 million, or 6.0% of sales. The Division’s unadjusted Q3 EBITDA was CHF 58 million or 18.0% of sales (Q3 2020: CHF 37 million, 13.1%). EBIT was CHF 18 million or 5.5% of sales (Q3 2020: CHF -6 million, or -2.0%).

The Polymer Processing Solutions Division delivered another quarter of excellent results. Quarterly order intake of CHF 503 million and sales of CHF 372 million both set new record levels since the Division was formed in 2013. The high level of orders and sales were supported by ongoing strong demand for filament and texturing equipment in China and recovery of the carpet yarn (bulked continuous filament, BCF) business in the U.S.

Q3 operational EBITDA improved by 14.7% to CHF 55 million. Q3 operational EBITDA margin of 14.8% was 60 basis points lower year over year, due to the transitory impact from higher freight and material cost and costs related to a project delay as communicated with the second quarter results. Operational EBIT was CHF 40 million or 10.9% of sales (Q3 2020: CHF 41 million, 13.0%). The Division’s unadjusted Q3 EBITDA was CHF 52 million, or 13.9% of sales (Q3 2020: CHF 48 million, 15.4%), and EBIT was CHF 37 million or 9.9% of sales (Q3 2020: CHF 41 million, 13.0%).

About Oerlikon

Oerlikon (SIX: OERL) is a global innovation powerhouse for surface engineering, polymer processing and additive manufacturing. The Group’s solutions and comprehensive services, together with its advanced materials, improve and maximize the performance, function, design and sustainability of its customers’ products and manufacturing processes in key industries. Pioneering technology for decades, everything Oerlikon invents and does is guided by its passion to support customers’ goals and foster a sustainable world. Headquartered in Pfäffikon, Switzerland, the Group operates its business in two Divisions – Surface Solutions and Polymer Processing Solutions. It has a global footprint of more than 10 600 employees at 179 locations in 37 countries and generated sales of CHF 2.3 billion in 2020.