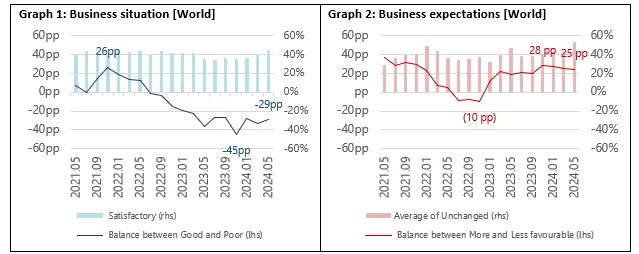

The business situation continues to stagnate, casting a shadow on year-end expectations

The May 2024 ITMF Global Textile Industry Survey (GTIS) indicates a continued stagnation in the textile business climate, with a marginal improvement of the economic situation due to more companies deeming business “satisfactory”. On the other hand, business expectations have stagnated in positive territory for a year, reflecting optimism rather than actual improvement, as the entire supply chain suffers from a lack of orders and high costs that affect profit margins.

The balance between “good” and “poor” order intake has improved slightly, and expectations for order intake in six months are trending upwards. Since summer 2023, order backlog has fluctuated around two months on average, rising slightly from 1.9 months in March 2024 to 2.1 months in May, though it is too early to interpret this as a positive trend. The reported average capacity utilization rate increased marginally to 71% in May 2024, after declining from a peak of 80% at the end of 2021. Survey participants expect better capacity utilization in six months.

Weak demand remains the main concern since September 2022, though its importance has decreased in the last six months. Other concerns include high raw material prices, geopolitics, high energy prices, and a lack of workers and talents. Globally, 58% of respondents did not experience any order cancellations in May 2024, slightly down from 59% in March. Africa and Europe had relatively low order cancellations, while the Americas experienced more, with spinners and finishers/dyers/printers reporting the highest levels.

In May 2024, 59% of companies reported average inventory levels. North America registered the highest levels among regions, and spinners among segments. Inventories at brands and retailers remain high but are slowly decreasing. The prolonged negative business cycle often forces companies to produce at a loss or lower capacity utilization, with no significant change expected in 2024.