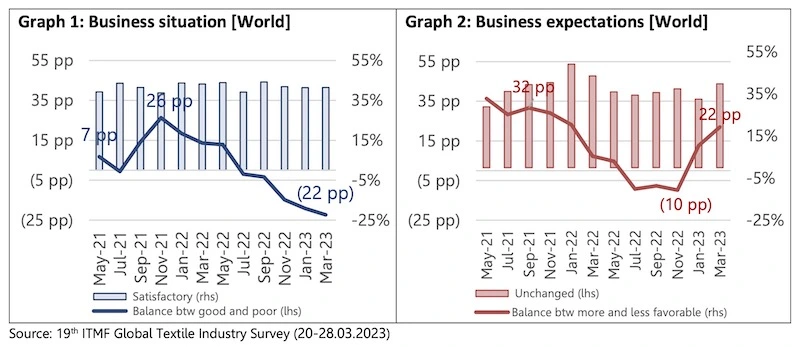

The business situation is still gloomy while expectations are booming

The global business situation in the textile industry has been negative since June 2022 and is still deteriorating (see Graph 1). Companies around the world and across all segments face a “perfect storm”-a scenario with high production costs and relatively low demand. At the same time, companies’ expectations for the business climate in 6 months-time have been improving since November 2022. It is unclear if this growing optimism about the mid-term future is due to a believe that the situation cannot get much worse or anticipation for a well-founded economic normalisation.

Order intake has also steadily decreased since November 2021, mostly in line with the trend in the business situation. The rate of decline has nevertheless slowed down in March 2023, likely due to weak demand. “Weakening demand” has indeed been rated the major concern in the global textile value chain since July 2022 and its importance has even grown in the last survey. Inflation remains the second major concern worldwide.

The expected improvements for the second half of 2023 are supported by a relatively low level of order cancellations and stabilizing inventory levels. 53% of respondents to the 19th GTIS recorded no order cancelations during the last 4 months (down from 58% last January). The phenomenon is stronger in South America and touches spinners and weavers relatively more. 58% of respondents also rated inventory levels as average. The number of companies reporting high inventory levels is greater in Asia and Europe. Among segments, it is the highest for home textile producers.