- Polymer Processing Solutions improved sequential order intake by 38% vs Q4 2023. Surface Solutions delivered stable organic sales in ongoing challenging end markets.

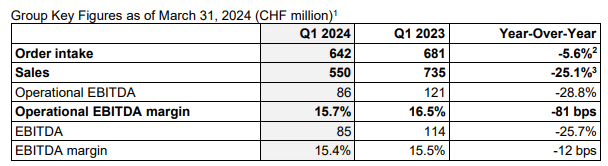

- Strong execution resulting in robust Group operational EBITDA margin of 15.7%. Surface Solutions saw an improvement of +122 basis points year-over-year. Polymer Processing Solutions achieved double-digit EBITDA margin despite cyclically low Q1 sales volume.

- 2024 guidance confirmed.

Michael Suess, Executive Chairman, Oerlikon, stated:

“We executed well and delivered robust results against soft industrial activity, particularly in Germany and China. Our strong focus on innovation, proactive cost management and rigorous pricing resulted in significantly improved margins in Surface Solutions and double-digit EBITDA margin in Polymer Processing Solutions. Our plans to separate Polymer Processing Solutions are on track.”

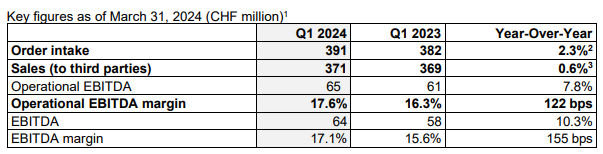

Surface Solutions Division

Surface Solutions achieved stable organic orders and sales, at constant exchange rates, supported by automotive and aerospace. The division saw cautious customer purchasing as reflected in the soft Purchase Management Index (PMI). While the Euro Area manufacturing PMI remained in contraction, the PMIs for China and the US were at neutral levels.

Operational EBITDA margin improved 122 basis points to 17.6%, supported by innovation, efficiency and pricing.

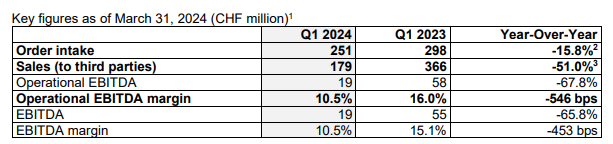

Polymer Processing Solutions Division

Polymer Processing Solutions’ filament end market continued to be impacted by customers postponing investments. Organic order intake at constant exchange rates decreased by 9% year-over-year. Sequentially, the division improved order intake (Q3 2023: CHF 199 million; Q4 2023: CHF 182 million; Q1 2024: CHF 251 million). Q1 2024 sales of CHF 179 million reflect the transitorily lower order intake of the previous quarters. Furthermore, sales were impacted by delayed shipments due to tensions in the Red Sea, shifting sales into the remainder of 2024.

The division achieved a robust operational EBITDA margin of 10.5%, despite lower sales volume, FX and limited pass-through of higher input costs to maintain volume. The double-digit margin was supported by the previously announced proactive costs actions.