Results of the 16th ITMF Global Textile Industry Survey

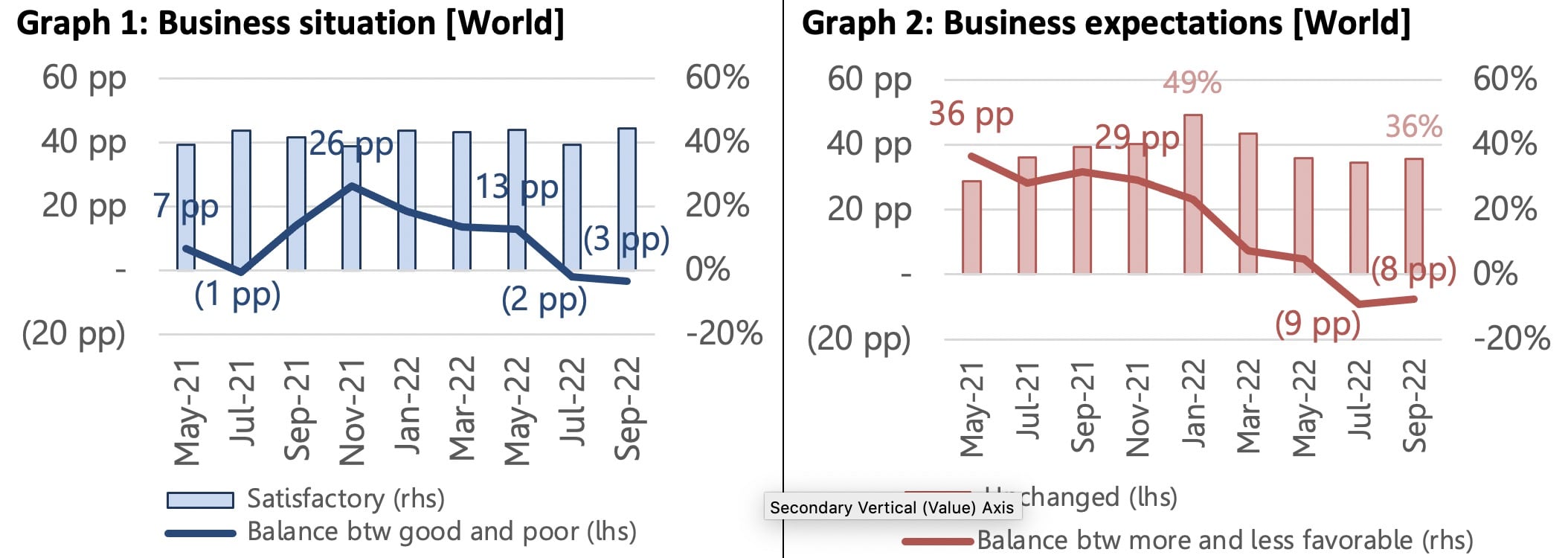

The 16th ITMF Global Textile Industry Survey (GTIS, formerly known as ITMF Corona-Survey) shows deteriorating business situation and expectations in the global textile industry in September 2022. The indicators for order intake, order backlog, and capacity utilisation rate also fell, globally.

According to the survey, the business situation was relatively worst in Asia, although improving. While all segments found themselves in negative situations, spinners’ situation have plunged to an unprecedented level. A positive sign for the future is that global expectations have stopped falling in September 2022, albeit staying in negative territory and therefore indicating difficult times ahead. Expectations have improved in South Asia, North & Central America, and Africa. Spinners have also better prospects for March 2023, globally, indicating potential relief.

Order intake fell further, in line with the weaker business situation. Companies in North & Central and especially in South America saw order intake increase while the Asian regions continued struggling with an unsatisfactory order situation. Order backlog fell on average across all regions.

South America is an exception; both order intake and backlog increased. Only dyers/finishers and knitters/weavers experienced a small increase in order backlog. In all other segments, order backlog fell. While the capacity utilization rate dropped globally in Septembers 2022, it increased in South America’s. Fibre producers registered a steady decrease in capacity utilization rate and home textile producers seem to have reversed their downward trend.

Weakening demand, high raw material prices, high energy prices, and inflation are the four major concerns of the global textile industry for the next 6 months. The concern about transportation costs have fallen significantly. Concerns about geopolitics on the other hand have increased significantly in the past two months.