Balta Group NV (Balta Group) is pleased to announce that it has entered into a binding agreement to sell its Rugs, Residential polypropylene (Residential PP) and Non-Woven businesses, together with the Balta brand, to Victoria PLC (the Transaction, the Divested Businesses). Completion of the Transaction is subject to certain conditions precedent, most of which are operational in nature and involve the carve out of the Divested Businesses.

The Transaction has an enterprise value on a debt and cash free basis of €225m and is expected to close at the beginning of Q2 2022.

The Transaction will allow the remaining Group to focus on developing its commercial businesses in Europe and the United States under the main brands modulyss and Bentley Mills, as well as its premium European Residential polyamide (Residential PA) business (ITC).

These businesses are yet to fully recover from the effects of pandemic restrictions. The remaining Group has a stronger cash flow and balance sheet, as well as a reduced risk profile.

A higher average EBITDA margin and better cash conversion will enable more investment in sustainability and growth through innovation, manufacturing optimization and more agile digital solutions. Being more focused and less complex is also expected to improve overall efficiency. Furthermore, the impact of currency fluctuations and international transport costs will be significantly reduced in the remaining Group.

The Transaction will significantly reduce Balta Group’s absolute debt and is expected to deleverage the Group’s balance sheet at the time of completion based on expected FY21 full year results.

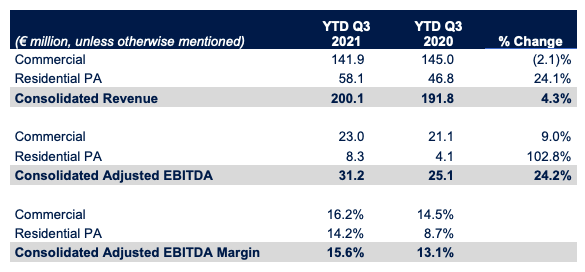

If the Transaction had occurred on 1 January 2021, unaudited pro-forma results for the remaining Balta Group YTD Q3 would have been:

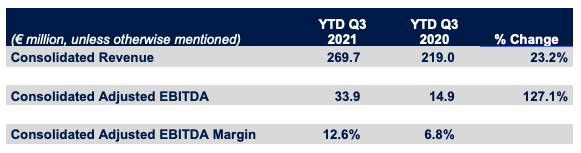

If the Transaction had occurred on 1 January 2021, the unaudited proforma YTD Q3 results of the Divested Businesses would have been:

The Balta Group has secured a commitment to provide a facility after the Transaction completes in the form of new senior secured notes. This facility, together with the cash proceeds from the Transaction, will provide holders of our existing senior secured notes (Notes) the opportunity to retain their Notes or to receive a cash payment for their Notes.

As part of our drive to simplify the organisation and move in pace with our markets, we created a new Business Unit on 22nd November 2021, Commercial and Residential Europe, to align our business model with customer needs and move towards a more agile and flexible approach. Emmanuel Rigaux, previously Chief Transformation Officer, has been appointed as the Business Unit’s Managing Director.

Cyrille Ragoucy, CEO and Chairman of the Board of Balta said,

“I am pleased that we have achieved this mutually beneficial agreement with Victoria PLC. While our Rugs, Residential PP and Non-Woven businesses have found a new owner with a great operational fit, the Transaction will allow the remaining Group to focus on its Commercial businesses in Europe and the United States and their expected recovery after the lifting of pandemic restrictions, and on its premium European Residential PA business. The remaining Group has a stronger cash flow and balance sheet, as well as a reduced risk profile, allowing us to invest in growth and strengthen our position across markets.

Until the Transaction closes, we will continue to run our businesses “as usual” and our employees and customers remain a top priority. Customers will receive a call from their sales representative to explain the next steps in this transforming transaction.”

Philippe Hamers, CEO of Victoria said,

“This selective acquisition of two highly complementary businesses will be significantly value creating for Victoria’s shareholders. The rugs division has been hugely successful over many years and there are very material operating synergies between the carpet division and Victoria’s existing business. These are both businesses that Victoria already knows extremely well.”