Interview with Mr Ahmed El-shrief;

Marketing & Export Manager of ESW (Egyptian Spinning & Weaving Co.)

By Kohan Textile Journal

Egyptian Spinning & Weaving Company, ESW, was established in 2005, with a land extension of 280,000m2. ESW is a private company belonging to one of the leading group in the textile sector in Egypt.

Please let us know more about your products and export markets.

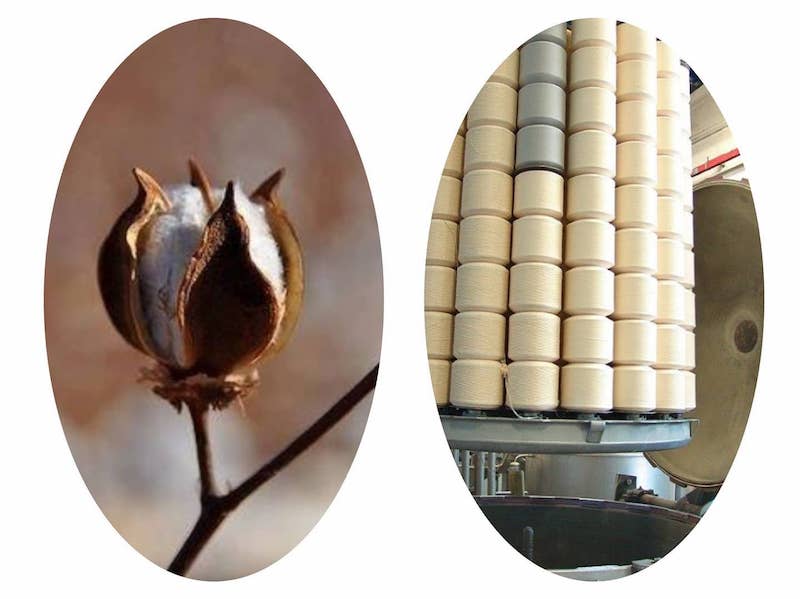

EGYPTIAN SPINNING & WEAVING CO. is one of the leading manufacturers and exporters of 100% Egyptian cotton yarns (CEA certified) as well as 100% US Pima yarns (Supima licensed) – All yarns are manufactured with excellent equipment, continuous new developments to improve our production process.

We are exporting our product range is consists of Ne 16 to 170 ring-spun and compact as single, plied & gassed for weaving, knitting & prestigious embroidery thread & sewing Thread S/Z and Gassing & mercerizing and Bleached are available upon buyer’s request to Turkey & European union countries & Asia countries & America south and Middle East Africa.

ORDER NOW: Ne.80/2 Combed Ring-Spun Singed and Mercerized Knitting Waxed 100% Egyptian Cotton Giza 94 Certificated

How do you evaluate the textile and fashion industry in Egypt in COVID-19 pandemic period? Especially the cotton yarn spinning sector.

“The global demand for the textile products especially Cotton yarns and also the domestic sales have come down to a grinding halt due to the panic situation created by the outbreak of COVID-19. “The spread of the virus in China which later got spread to the EU and USA has majorly impacted us as they are huge markets for Egyptian textile products”

– Egypt’s exports of yarn and textiles to European countries recorded the highest value compared to other international groups, reaching 97 million dollars in the first half of 2020, a decrease of about 32% compared to 116 million dollars in 2019.

– Followed by the Arab countries, where exports of yarn and textiles recorded 88 million dollars in the first half of 2020, a decrease of 24%, compared to 115 million dollars in 2019.

– As for both Africa and the United States of America, they witnessed an increase in the value of yarn and textile exports for this period, and Africa’s exports reached 19 million dollars compared to 17 million dollars in 2019, while the United States of America lost, It reached $ 7 million against $ 1 million in 2019.

– As for the rest of the world, exports of yarn and textiles recorded 154 million dollars in the first half of 2020, a decrease of 15% compared to 181 million dollars in 2019.

Egyptian cotton always is famous for its high quality and being precious, please explain briefly about Egyptian cotton and its characteristics.

The Egyptian extra long-staple cotton, it is well-known for its unique characteristic of a fine touch and silky look, most suitable to produce cotton Fine and Superfine counts as well as modal and micro modal. Such Superfine counts are used to produce high-end apparel with sheer comfort and excellence.

ESW has made its foray into spinning based on the strength of Egyptian cotton to do Fine and Superfine counts for quality-conscious buyers. Our quest for excellence in quality is evident by the fact that our buyers have proved to be loyal to our product in time. We always stand behind our product and assure the finest service to our clients.

As a leader textile Company in Egypt, how do you evaluate the textile and fashion industry in the Middle East and North Africa and its potentials in Future.

Fashion is big business in Africa. The combined apparel and footwear market in sub-Saharan Africa is estimated to be worth US$ 31 billion, according to data from Euro monitor International.

Africa is certainly on its way to becoming the major regional apparel hub with great propensity to provide competitive prices. The African textile and apparel fertile market keep engendering attention among international brands looking for new industrial destinations.

Textile products manufactured in many African countries qualify for both US and European market standards under several trade agreements as duty-free products, with no quota restrictions

COVID 19 shows us we should rely more on sustainability and green products, how do you evaluate the sustainable textile and fashion market and its relation to Pandemic?

The Covid-19 pandemic has caught the world and the apparel, footwear and textile industries unprepared and the resulting societal and economic shutdowns present unprecedented challenges.

While sustainability initiatives were becoming the norm in the industry across varied segments such as luxury, sport, fast fashion and value retail, the crisis now strains the commitment of brands and retailers to sustainability. However, it is more relevant than ever as a recent study finds that the current crisis “simultaneously demands that companies accelerate their progress on sustainable initiatives in order to be competitive in the market that will emerge after the pandemic”.

ORDER NOW: Ne.80/2 Combed Ring-Spun Singed and Mercerized Knitting Waxed 100% Egyptian Cotton Giza 94 Certificated

Recently the Egyptian government Started to fund huge investments in the textile industry like opening world biggest cotton spinning mill. How do you evaluate this project and government support for developing Egypt’s textile sector?

A comprehensive modernization strategy has been executed by the Egyptian Government to develop the textile industry for both, public and private sectors. Based on the strategy, the public sector plans to modernize the state-owned textile segment with an allocated investment of around 24 billion Egyptian Pounds over the course of three years

starting 2019. This budget will be financed by selling unused assets. This will be carried out by merging 24 public factories to only ten state-of-the-art factories, while also merging the current 24 cotton ginning factories to only 14 up and running facilities. As for the private sector, there are plans to establish a training centre for workers to enhance their skills and expand their exposure, open new markets and activate the export support fund.

Lastly, the strategy aims to achieve a significant leap in the production capacity with a target production of 188 thousand tons of yarn yearly compared to 37 thousand tons; 198 million meters of fabric instead of 50 million meters and finally, 50 million pieces of garments instead of 8 million pieces.