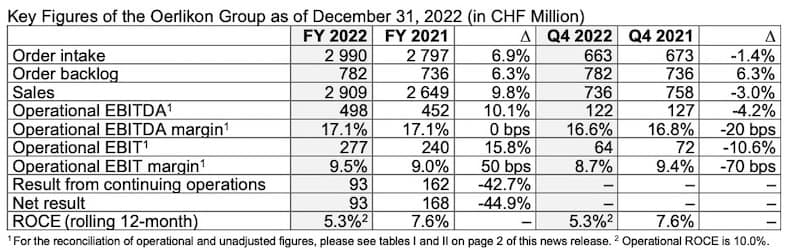

- 2022 with highest Group order intake and sales since Oerlikon focused on two divisions. Order intake increased by 7% (+11% FX-adjusted); sales grew by 10% (+14% FX-adjusted).

- Operational EBITDA increased by 10%; the corresponding margin was 17.1%.

- After a record performance in 2022, preparing for less robust demand in filament in 2024.

- Agreement signed in Q4 to acquire Riri1 to become a market leader in luxury metalware.

- Board to propose an ordinary dividend of CHF 0.35 per share at the AGM.

- 2023 outlook: organic sales of CHF ~2.8 billion at constant FX rates expected; additional CHF 100-150 million sales from Riri acquisition, depending on closing date; operational EBITDA margin of 16.0-16.5%.

- Proposing to strengthen diversity and independence of Board with new Board nominee.

1- Expected closing date in Q1 2023

“We demonstrated strong execution on our strategy, focusing on growth, diversification and sustainability, despite macroeconomic headwinds,” said Michael Suess, Executive Chairman, Oerlikon.

“We accelerated our expansion into luxury with the agreement to acquire Riri, strengthened our regional structure and business, especially in the Americas, and were pleased to see our sustainability ratings upgraded,” added Suess. “Continued lockdowns and weaker textile demand have led to a difficult market environment for our filament business. In Q4, we took the appropriate steps to prepare for lower sales in 2024 and preserve our profitability.”

Strong 2022 Top-Line Driven by Both Divisions

Oerlikon delivered growth in orders and sales, supported by strong execution in both divisions. Group order intake increased by 6.9% to CHF 2 990 million, 10.6% FX-adjusted, and Group sales increased by 9.8% to CHF 2 909 million, 13.9% FX-adjusted, compared to the previous year.

Operational EBITDA up 10% in 2022

Group operational EBITDA increased by 10.1% to CHF 498 million, versus CHF 452 million in 2021. The operational EBITDA margin was sustained at the same level at 17.1% as in the prior year, despite transitory impacts from rising input costs (incl. energy) and adverse mix. The operational EBIT margin was 9.5% (CHF 277 million) compared to 9.0% (CHF 240 million) in the previous year.

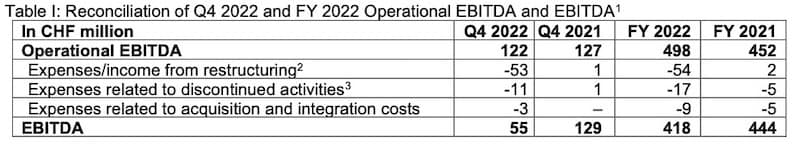

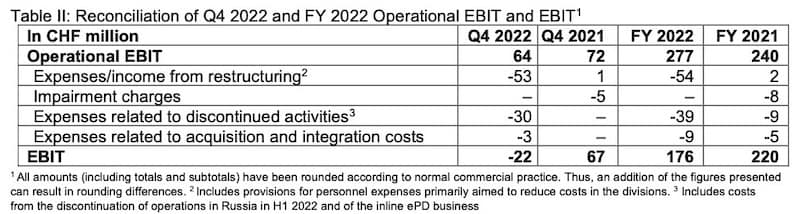

EBITDA and EBIT Impacted by Preemptive Measures to Mitigate Softening Macro Environment

Group unadjusted EBITDA decreased 5.8% year-over-year to CHF 418 million, or 14.4% of sales, while Group unadjusted EBIT was CHF 176 million, or 6.0% of sales. As previously indicated, Oerlikon is optimizing its product portfolio and started to take proactive cost actions in Q4 2022 to mitigate potential macroeconomic impacts.

In Surface Solutions, Oerlikon exited its Russian operations and discontinued its inline embedded PVD (ePD) business to optimize its portfolio, consistent with its strengthened capital allocation framework. The discontinuations resulted in one-off, primarily non-cash expenses. The 2021/22 operational EBIT(DA) is adjusted to reflect the discontinuation of these activities.

Moreover, both divisions have proactively begun streamlining their organization. The one-off provisions for these measures have been booked in Q4 2022, and the majority of the associated positive income statement impacts are expected in the second half of 2023.

The reconciliation of the operational and unadjusted figures can be seen in the tables below.

The Group’s net result was CHF 93 million in 2022, compared with CHF 168 million in 2021. The improvement in operational EBITDA did not completely offset the one-off costs and impairments. Earnings per share in 2022 were CHF 0.27 (CHF 0.50 in 2021).

As of December 31, 2022, Oerlikon had net debt of CHF 471 million. This corresponds to a net debt/operational EBITDA ratio of 0.9. Net debt was impacted by an increase in net working capital related to higher raw material prices and lower customer advances due to weakening end markets. Oerlikon’s total equity ratio was 33% at the end of 2022.

Continued Strong Commitment to Sustainable R&D

In 2022, Oerlikon filed 69 patents and continued to invest in innovation, spending 3.9% (CHF 113 million) of 2022 Group sales on R&D to develop new, improved and sustainable technologies to meet customers’ needs and demands.

Q4 2022 Performance

Order intake for the fourth quarter decreased slightly by 1.4% due to adverse currency impacts. At constant exchange rates, Q4 orders increased by 4.0% year-over-year. Group sales decreased in the fourth quarter by 3.0% to CHF 736 million. FX-adjusted, sales increased 1.8%, supported by Surface Solutions growth in aviation.

Group operational EBITDA in Q4 decreased by 4.2% to CHF 122 million, or 16.6% of sales (Q4 2021: CHF 127 million, or 16.8% of sales). Operational EBITDA and margin comparison were impacted by Polymer Processing Solution’s record performance in the same period last year, which included record sales and a favorable project mix. Q4 2022 Group operational EBIT was CHF 64 million, or 8.7% of sales (Q4 2021: CHF 72 million, or 9.4% of sales).

Group Q4 unadjusted EBITDA was CHF 55 million, or 7.5% of sales (2021: CHF 129 million; 17.0%), and unadjusted EBIT was CHF -22 million, or -3.0% of sales (2021: CHF 67 million; 8.9%). The decrease is attributed to the one-off costs and impairments booked in the fourth quarter.

Stable Dividends per Share

Oerlikon is committed to providing attractive returns to shareholders while maintaining financial flexibility to invest in growth. In line with its strategy, the Board will recommend to shareholders an ordinary dividend payout of CHF 0.35 per share at the 2023 Annual General Meeting of Shareholders (AGM) on March 21, 2023, taking place in KKL Lucerne, Switzerland.

2023 Outlook Envisages Transitory Macro Headwinds

For 2023, Oerlikon expects a mid-single digit percentage organic sales decrease at constant currencies to CHF ~2.8 billion, reflecting primarily the postponement of customer investment decisions in Polymer Processing Solutions. Depending on the closing date of the announced Riri acquisition, an additional CHF 100-150 million of sales is expected. The operational EBITDA margin is expected to be between 16.0% and 16.5%. Oerlikon’s cost actions are designed to counteract inflation and mix.

Amendment of Oerlikon’s Articles of Association

Pursuant to the revised Swiss corporate law that entered into force on January 1, 2023, Swiss corporations are obliged to revise their articles of association to comply with the new provisions. Correspondingly, Oerlikon’s Board of Directors will propose to the AGM 2023 various amendments to the Articles of Association to ensure that they will be aligned with the revised law. Further, the Articles of Association shall be updated in line with prevailing market standards in Switzerland and the company’s needs.

Nomination of a new Independent Board Member

Subject to the approval by the AGM 2023 to amend the Articles of Association with respect to increasing the potential maximum number of Board members, the Board of Directors proposes to nominate Mrs. Inka Koljonen for election as a member of the Board at the AGM on March 21, 2023. All current Board members will be standing for re-election. Mrs. Inka Koljonen is Chief Financial Officer at MAN Truck & Bus SE. Her significant experience in strategy and finance in the automotive and aerospace industry – both key sectors for Oerlikon – will further strengthen the diversity of the Board’s expertise.

Composition of the Board of Directors and its Committees, subject to (re)-election at the AGM

Oerlikon strives to have an independent, well-diversified Board of Directors in terms of skills, experiences, geographic reach, tenure, independence and gender, aligned with its strategic goals and business needs. Subject to all members of the Board of Directors and all members of the Human Resources Committee (HRC) being (re-)elected at the AGM on March 21, 2023, the Board of Directors will comprise of Prof. Dr. Michael Suess as Executive Chairman, Gerhard Pegam as Vice-Chairman, Paul Adams as Lead Director and Jürg Fedier, Inka Koljonen, Irina Matveeva, Alexey V. Moskov and Zhenguo Yao as members of the Board of Directors.

Following these elections, the majority of Oerlikon’s Board of Directors will be independent and its committees will be composed as follows:

Paul Adams, Inka Koljonen, Alexey V. Moskov, Gerhard Pegam and Zhenguo Yao will serve as members of the Human Resources Committee. Paul Adams, Jürg Fedier, Inka Koljonen and Irina Matveeva will be members of the Audit & Finance Committee, and the Governance Committee will comprise of Paul Adams, Gerhard Pegam and Zhenguo Yao.

“With the role of Lead Director and with the support of the Governance Committee, the Board is able to ensure the necessary control mechanisms to ensure good corporate governance,” said Paul Adams, Lead Director and Chair of the Governance Committee.

Division Overview

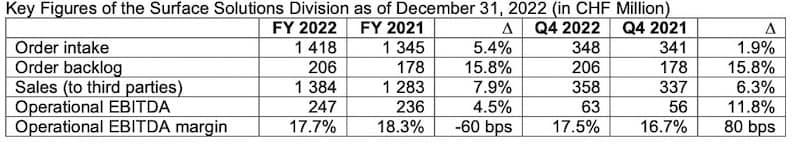

Surface Solutions Division

Surface Solutions saw market recovery in some end markets in the first half of the year, although this was dampened by customers’ supply chain shortages. While shortages started to ease in the second half of the year, difficult macro conditions led to weakening industrial activity.

The division’s 2022 order intake increased by 5.4% (8.7% FX-adjusted) to CHF 1 418 million. In Q4 2022, order intake increased by 1.9% (6.0% FX-adjusted) year-over-year. Division sales of CHF 1 384 million in 2022 were 7.9% (11.4% FX-adjusted) higher. In Q4 2022, sales increased 6.3% (10.5% FX-adjusted), driven by aviation and tooling, but were partly offset by weakening industrial activity.

2022 operational EBITDA improved by 4.5% to CHF 247 million, or 17.7% of sales. The margin was impacted by higher input costs and mix. The Q4 operational EBITDA improved 11.8% year-over-year. Q4 operational EBITDA margin was supported by operating leverage and further passing on of input costs, partly offset by mix. Operational EBIT was CHF 96 million in 2022, or 6.9% of sales (2021: CHF 81 million, or 6.3% of sales).

Unadjusted EBITDA was CHF 226 million, or 16.2% of sales, compared to CHF 232 million, or 18.0% of sales in 2021. Unadjusted EBIT was CHF 54 million, or 3.9% of sales (2021: CHF 66 million, or 5.1% of sales), attributed to one-off costs and impairments.

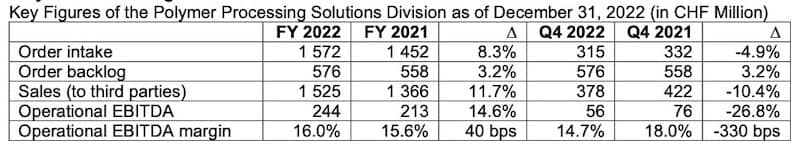

Polymer Processing Solutions Division

The division experienced strong market demand in the first half of 2022. In the second half, the macro environment impacted discretionary textile spending, leading to some customers starting to postpone orders. As a result, the division began in Q4 2022 to proactively implement measures to protect its cost base. It is expected that the division will be downsized by more than 800 employees.

Overall, the division achieved one of its highest annual order intakes and sales levels in 2022 and improved its operational EBITDA. Order intake increased by 8.3% (12.4% FX-adjusted) to CHF 1 572 million year-over-year and sales increased by 11.7% (16.2% FX-adjusted) to CHF 1 525 million, driven by filament and non-filament and in part by the Oerlikon HRSflow business, which recorded all-time high sales and notably increased its market share.

In the fourth quarter, orders decreased due to adverse currency impacts. At constant exchange rates, orders increased by 1.9% year-over-year. Sales decreased year-over-year due to the division’s record quarterly sales in the same period last year.

Operational EBITDA in 2022 improved 14.6% year-over-year to CHF 244 million, or 16.0% of sales, attributed to positive impacts from operating leverage, cost control and acquisition. In Q4 2022, the margin decreased year-over-year due to the positive mix effect in Q4 2021, costs related to elevated COVID cases in China and a provision for inflation compensation in Q4 2022. Operational EBIT for 2022 was CHF 187 million (2021: CHF 163 million), or 12.2% of sales (2021: 12.0%).

Unadjusted EBITDA was CHF 193 million, or 12.6% of sales (2021: CHF 208 million, 15.2%). Unadjusted EBIT was CHF 135 million (2021: CHF 158 million), or 8.9% of sales (2021: 11.6%). Both were impacted by one-off provisions related to the division’s proactive cost actions.