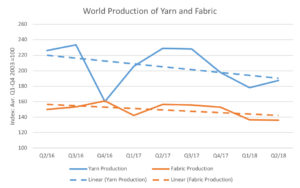

Global yarn production increased by +5% between Q1/18 and Q2/18. Higher output where observed in Egypt (+1.4%), the U.S.A. (+3.2%), South Africa (+3.3%), and globally in Asia where the overall +5.7% increase was led by Chinese Taipei and Korea, Rep. (respective growth rates of +8.1% and +8.8). An opposite trend has been observed in all surveyed European countries, Brazil and Japan. Forecasts for Q3/18 are only optimistic in Africa but the Q4/18 previsions turn positive in all regions except Brazil where stability is expected. Global yarn stocks decreased globally by -4.75%. This is the effect of small contractions in Asia and Europe (between -3% and -4%), an +18% increase in Brazil, and a -20% average decrease in the African countries surveyed. Altogether, yarn stocks reached 85% of their previous year’s level for the same quarter. Global yarn orders decreased by -6% led by a strong reduction in the Brazilian market (-28%). Yarn orders however increased in Africa and Europe by +5.7% and +7.5%, respectively.

Global fabric production slightly decreased from Q1/18 to Q2/18. The +0.25% contraction reflects a -6% output reduction in Africa, a decrease of -0.5% in Asia, a +1.6% increase in Europe, and a +3.7% jump in Brazil. The world output level now reaches 87% of its Q2/17 level. Fabric production in all regions is expected to decrease in Q3/18 except in Brazil where stability is foreseen. Q4/18 should see improvements in all regions. In Q2/18, the global fabric stock level grew by almost +2%. It was driven by Brazil’s stock increase of +7%, which brought global fabrics stocks 11% above their Q2/17 level. Stocks remain stable in Asia, Europe, and the U.S.A. They continue to steadily drop in Egypt. Global fabric orders have risen by +43% at world level in Q2/18, led by a +65% increase in Brazil that followed an unusually low first quarter. Orders in Asia and Europe have stagnated and contracted in Egypt, respectively. Global fabric orders are now 16% above their level observed in Q2/17.