The textile market in the United Arab Emirates (UAE) is a dynamic and significant sector of the country’s economy. Encompassing a wide range of products, including apparel, home textiles, technical textiles, and fabrics, this market is a crucial component of the UAE’s retail and fashion industries, catering to diverse consumer and business needs.

The UAE Textile Market’s Growth and Dubai’s Role in GCC Expansion

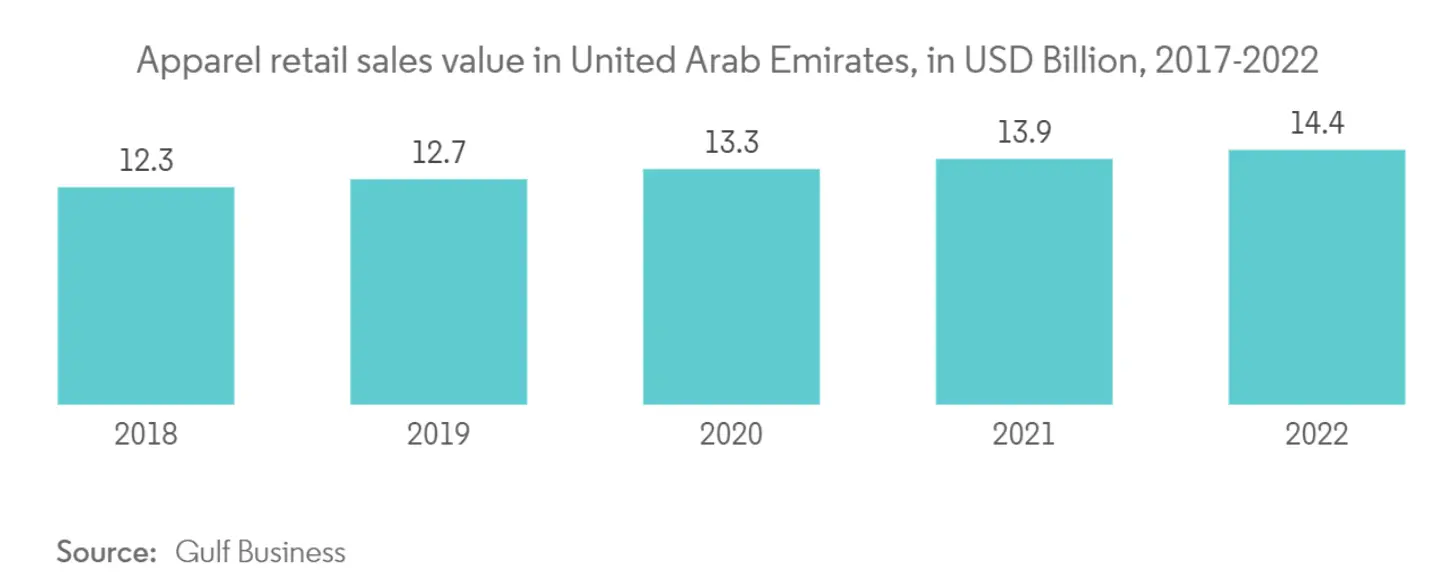

The UAE textile market, a significant component of the GCC’s projected growth from USD 15.08 billion in 2024 to USD 20.93 billion by 2029, thrives on a diverse array of products from knitwear to high-end fashion. With its textile industry’s income and employment contributions just behind oil and gas, the UAE’s sector serves over 50 countries while enjoying strong domestic demand.

Dubai, a key player, leverages its 16 million annual tourists to boost retail and textile sectors, with the city contributing over 10% to the national GDP through its thriving retail and tourism industries.

The textile trade, apparel fabric manufacturing, yarn production, and textile processing in the UAE are set for growth due to favorable government policies and supportive legal frameworks. The Office of Textiles and Apparel (OTEXA) and the Gulf Cooperation Council (GCC) offer special investment and trade benefits within Gulf countries, including the UAE, Kuwait, Qatar, Bahrain, Oman, and Saudi Arabia. The UAE ranks second in clothing retail industries based on retail development, production capacity, government policies, market infrastructure, and labor.

The UAE’s Fujairah free zone has lured significant business relocations with tax exemptions and repatriation benefits. Established in 2012, a major textile mill there stands as the largest in the Middle East, with operational efficiency boosted by employees using roller skates for swift productivity.

Textile Manufacturing and Trade in the UAE

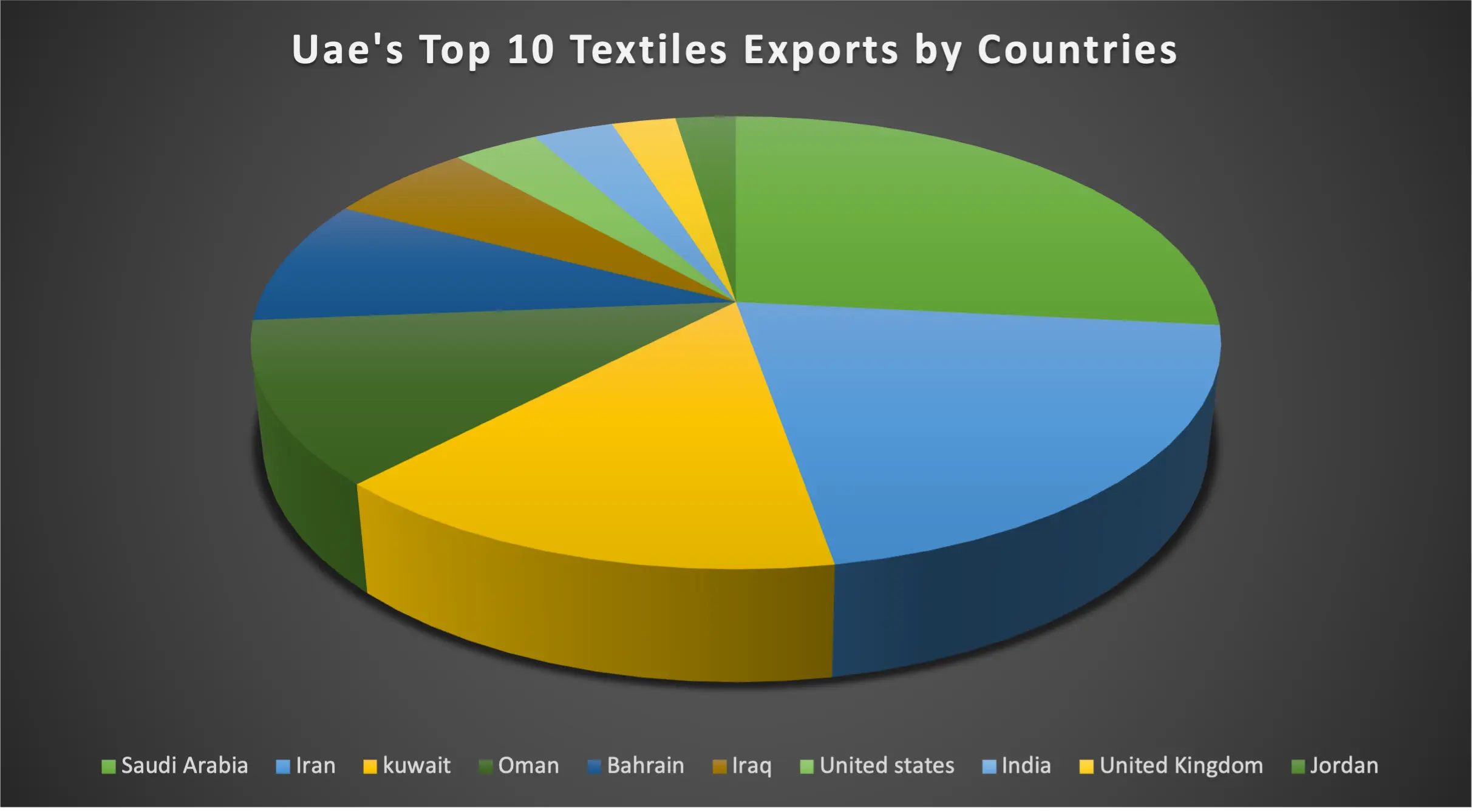

The UAE’s textile industry includes various segments such as woven and knitted garments, fabrics, home textiles, and technical textiles. The country hosts around 170 garment and cloth manufacturers, mainly in Abu Dhabi, Dubai, and Sharjah. UAE exports textile products to over 52 countries in Asia, the Middle East, Europe, and Africa. The textile trade, including apparel fabrics manufacturing and textile processing, is poised for growth due to supportive government policies and strategic advantages provided by the Gulf Cooperation Council (GCC).

Key Players in the UAE Textile

The UAE textile market includes both local and international players. Key local players include Al Ghurair Group, Al Ain Alkhadra, and Naseej. Additionally, international fashion brands and luxury retailers have a significant presence in the UAE, contributing to its status as a fashion and shopping destination.

UAE Textile Statistics

Exports: The UAE’s textile and apparel sector exports amounted to USD $4521.96 million.

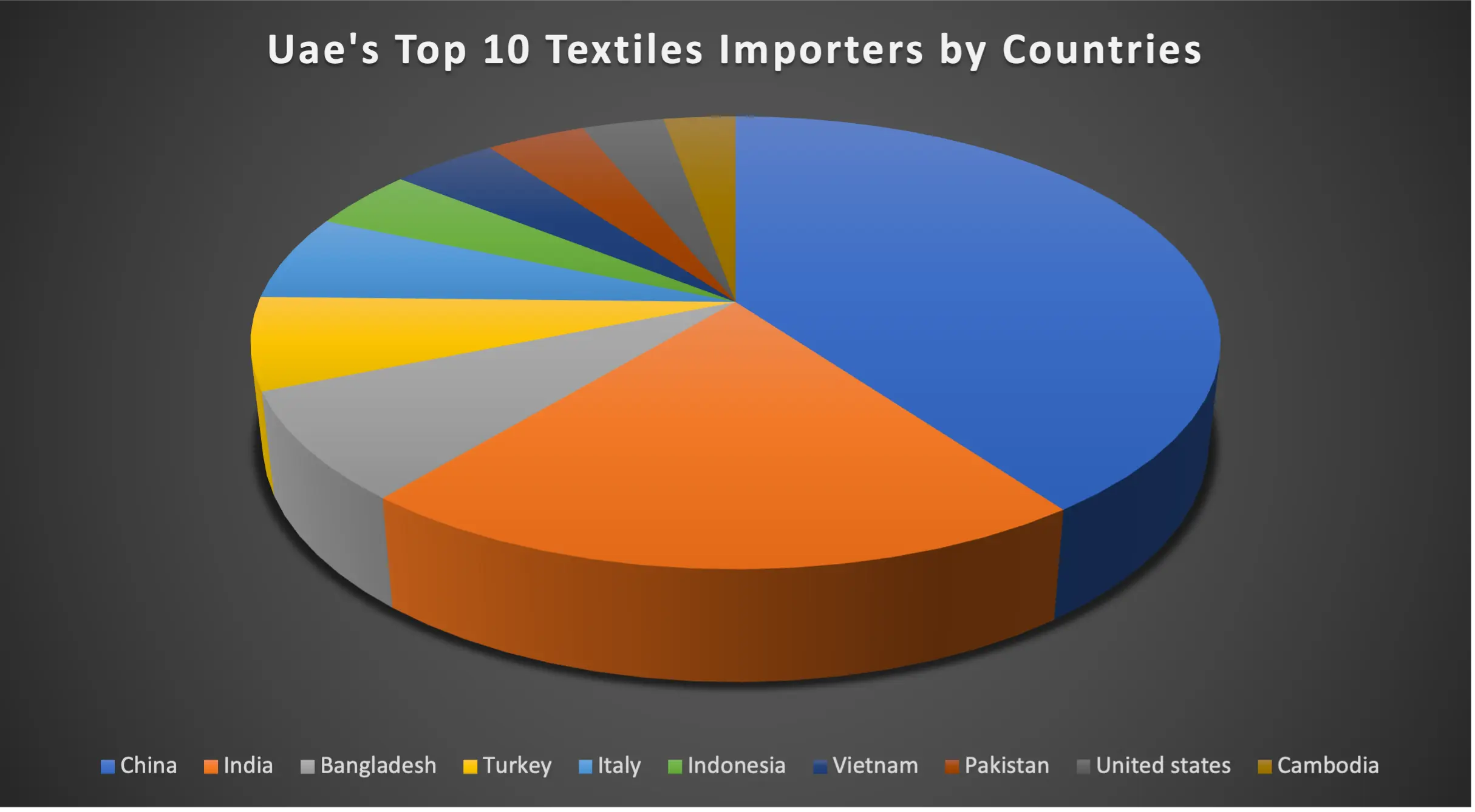

Imports: The sector’s imports totaled USD $7075.4 million.

Top Import Sources: Major import sources include China, India, Bangladesh, Turkey, and Italy.

UAE Textile Dynamics

Strong Consumer Base: The UAE’s large expatriate population with diverse cultural backgrounds leads to substantial demand for a variety of textiles and apparel.

Global Fashion Hub: The UAE’s position as a global fashion and luxury hub increases demand for high-end textiles and designer clothing.

Government Support: Initiatives like Dubai Fashion Week and other government-backed events promote the textile and fashion industries.

Dubai Textile City (DTC) is a TEXMAS and Dubai Port and Customs Authority venture, providing a duty-free platform for textile traders, enhancing re-export activities and global market reach.

The UAE is a significant importer and exporter of textiles and garments, benefiting from its strategic location and advanced infrastructure, which facilitate efficient global trade.

The UAE’s textile market is expected to expand immensely in the coming years, driven by increasing demand, strategic investments, and a growing global presence. This growth is fueled by advancements in infrastructure, trade opportunities, and a robust economic environment.

The UAE has world-class infrastructure that is critical for the textile industry, providing state-of-the-art facilities, advanced logistics, and efficient transportation networks. This infrastructure supports seamless production, import-export operations, and global trade connectivity.

The United Arab Emirates (UAE) benefits from strategic advantages that fuel its textile industry’s growth. Its prime location as a shipping hub boosts trade opportunities, while booming economies attract businesses with tax incentives and expand the customer base. Initiatives like the International Apparel and Textile Fair (IATF) and Domotex Middle East in Dubai foster industry collaboration and global visibility. Additionally, the UAE’s expansion into Africa leverages lower production costs and central shipping routes, enhancing competitiveness and market reach.

Textile Challenges in the UAE

International Competition: The UAE competes with other textile manufacturing countries that offer lower production costs and greater capacities. The industry faces stiff competition from Turkey, which, due to its central location and similar goods, threatens the UAE’s market share.

Environmental Concerns: The textile industry’s environmental impact, including water consumption and waste generation, necessitates a shift towards more sustainable practices.

Energy crises remain a concern, with power outages and soaring natural gas prices driving up manufacturing costs and reducing the competitiveness of textile products.

The UAE’s complex import regulations require Dubai garment buyers and UAE garment importers to be well-informed and compliant.

Lack of market information among traders, including knowledge of textiles, market statistics, and trends, limits the demand for textiles in the global economy.