The Republic of Kenya is a country in Africa with 47 semiautonomous counties governed by elected governors. At 580,367 square kilometers (224,081 sq mi), Kenya is the world’s 48th largest country by total area. With a population of more than 52.2 million people, Kenya is the 27th most populous country. Kenya’s capital and largest city is Nairobi while its oldest city and first capital is the coastal city of Mombasa. Kisumu City is the third-largest city and also an inland port on Lake Victoria. Other important urban centres include Nakuru and Eldoret.

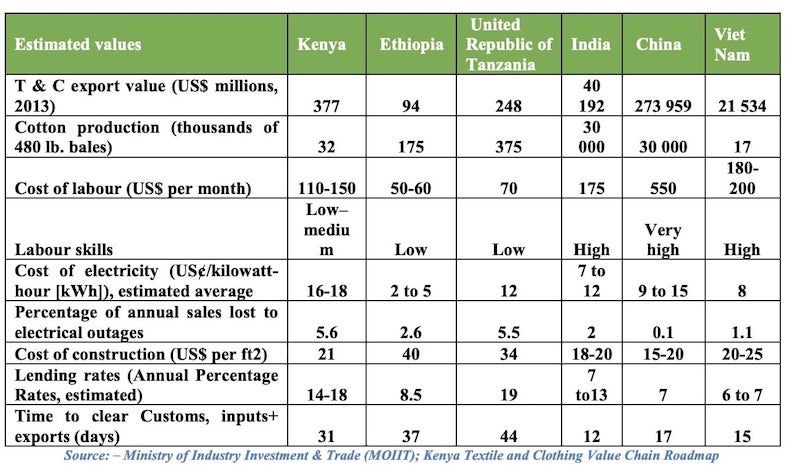

Kenya possesses immense potential and abundant resources, coupled with a thriving domestic market eager for import substitutes and a robust cotton cultivation sector. With a proactive and adaptable workforce, the country is well-positioned for success in the textile industry. By embracing technological advancements from India and leveraging outsourced technologies, Kenya can capitalize on new market opportunities and enhance its manufacturing capabilities.

Strengths of the Textile Industry in Kenya:

1. Educated Population: With an impressive 82% literacy rate, Kenya possesses the highest literacy rate in Africa. Additionally, 70% of the population is under 35 years old and proficient in English, providing a skilled workforce ready for training in textile production and management.

2. Natural Fiber Availability: Abundant cotton-growing soil and access to power and water resources contribute to Kenya’s strength in textile production.

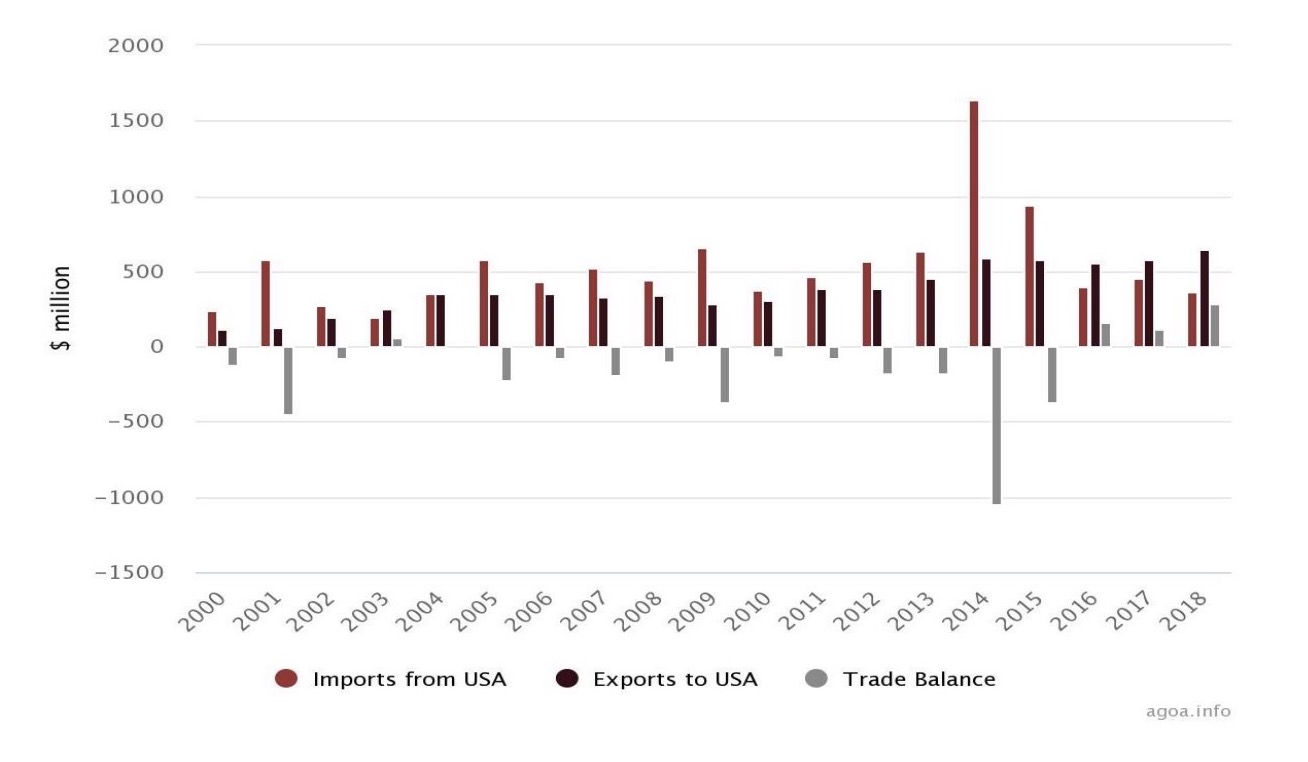

3. Market Access: Kenya benefits from free market entry into international markets through initiatives like the African Growth and Opportunity Act (AGOA).

4. Favorable for Foreign Direct Investment (FDI): As the third-largest economy in sub-Saharan Africa, Kenya offers a GDP of US$ 113.4 billion and maintains a 5% average annual growth rate, making it an attractive destination for foreign investment.

5. Well-Connected Infrastructure: Kenya boasts extensive logistical networks, ranking second in Africa in the Logistics Performance Index. With four international airports, two seaports, and two Inland Container Depots (ICDs), the country enjoys efficient transportation links. Nairobi, the capital city, is a burgeoning tech hub and home to a vibrant startup ecosystem, further enhancing Kenya’s connectivity and innovation capabilities.

Existing Textile Industry of Kenya:

Kenya’s textile industry comprises 65 manufacturers, including seven textile mills, with three mills specializing in cotton production. Additionally, 29 units operate within Export Processing Zones (EPZ), and four ginneries are in operation. Despite modest numbers, Kenya stands as a leading apparel exporter in sub-Saharan Africa to the USA under AGOA provisions, signalling the significant potential for further development and backward integration within the textile sector.

Kenya’s Economic Growth

Kenya’s macroeconomic outlook has steadily posted robust growth over the past few decades mostly from the mega-infrastructure road and railway projects. However, much of this growth has come from cash flows diverted from ordinary Kenyan pockets at the microeconomic levels. In 2017, Kenya ranked 92nd in the World Bank ease of doing business rating from 113rd in 2016 (of 190 countries).

Kenya’s real gross domestic product is projected to grow by 5.7% in 2019, a slight decrease from the estimated 5.8% growth experienced in 2018, according to the new World Bank, Kenya’s Economic Update. While the medium-term growth outlook is stable, Kenya’s economic growth is said to be soften this year. Mainly due to erratic weather conditions which will have a direct negative impact on agricultural products (The key driver of growth in Kenya and a major contributor to poverty reduction).

The growth forecast for 2020 stands at 5.9%. Growth in 2018 was driven by favourable harvests, a resilient services sector, positive investor confidence and a stable macroeconomic environment. Nonetheless, the demand side shows significant slack with growth driven primarily by private consumption while private sector investment remains subdued. So far in 2019, a strong pick-up in economic activity was underway for Q1 of 2019 as reflected by real growth in consumer spending and stronger investor sentiment. A current press realize of the world bank has read Kenya’s Economic Outlook remains stable amid threats of drought in 2019.

Overview of the Textile Industry in Kenya

Economic history shows that the clothing and textile industry in Kenya played an important role in the industrialization of today’s developed countries. This is because of the industry’s unique characteristics of being labor intensive and its links with other sectors of the economy such as agriculture. More strongly, it has been even suggested that developing countries wishing to industrialize should begin with clothing and textile industries, studies indicate.

Last year, Al Jazeera had just read the fact that Kenya looks to boost the local textile industry. However, it highlighted the impediments out surfaced in this sector in Kenya. Second-hand clothing donations are creating a dilemma for the Kenyan economy and the growing trend of imported second-hand clothing.

Government figures show that in 2014, second-hand clothing contributed $95m to the Kenyan economy that grew to $128m dollars by 2016. Following the Economic activity being notably subdued in the first quarter of 2019, relative to the performance recorded in the same quarter of 2018. During the period, the economy expanded by 5.6 percent compared to 6.5 percent in the corresponding quarter of 2018 according to the Kenya National Bureau of Statistics.

The growth, albeit significantly slower than that of the first quarter of 2018, was mostly supported by growths in the service sector industries such as wholesale and retail trade, transportation, accommodation, and food services, financial and insurance activities.

Cotton, Apparel, and Textiles Industry Structure in Kenya

The cotton, textiles, and apparel (CTA) industry is Kenya’s second-largest manufacturing industry after food processing and has been classified as a core industry. Kenya’s CTA manufacturing value chain comprises researchers, ginners, farmers, spinners, input suppliers, textile manufacturers, and extension service providers, to name but a few.

It is estimated that approximately 40,000 farmers are involved in cotton farming, while the overall sector provides livelihood to approximately 200,000 households according to Kenya Investment Authority (2016). Cotton in Kenya is mainly grown by about 30,000 to 45,000 smallholder farmers in arid and marginal regions, under rain-fed conditions on small land holdings of about one hectare.

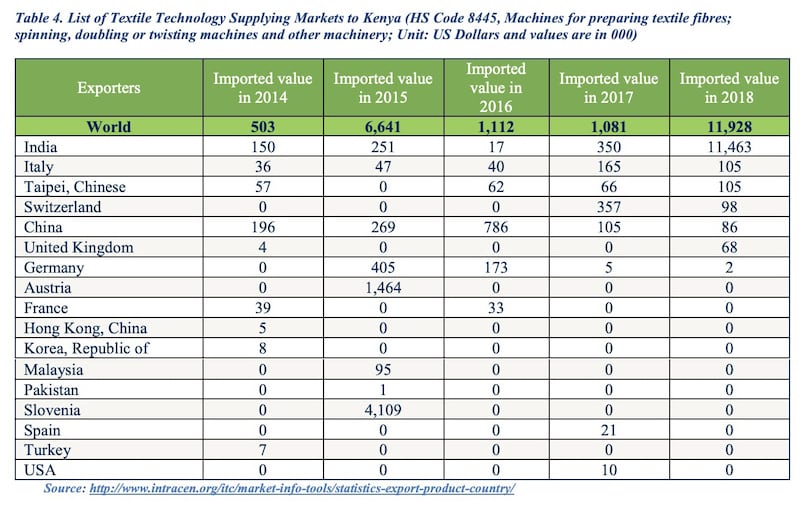

spinning, doubling or twisting machines and other machinery; Unit: US Dollars and values are in 000)

Most of the country’s cotton is cultivated in the Coast Province, Western Province, and Eastern Province, and the rest is cultivated in Central and Rift Valley Provinces. Kenya has an estimated 385,000 ha of land that is suitable for cotton – 350,000 rain-fed and 35,000 irrigated – with a production potential of more than 300,000 tons of cotton seed. Nevertheless, only a fraction of that land is under cotton cultivation.

The current production of cotton lint in Kenya is approximately 7,000 tons versus a potential production of 200,000 tons of lint or 750,000 tons of seed cotton. The production has been volatile for the last few years and has not been sufficient to meet the domestic mill requirement. As a result, Kenyan firms import cotton from neighboring cotton-producing countries such as Uganda and Tanzania.

The Kenyan textile and apparel value chain consists of input providers, yarn spinning companies, semi and wholly integrated weaving/knitting/dyeing/finishing mills and plants, and design and sewing firms. The sector is under the auspices of the MOIED and is supported by broad private sector associations and training institutes. Crucially, no single association exists to represent the apparel and textile sector as a whole vis-à-vis the government and each other.

Of Kenya’s top ten apparel exports, six are cotton products and four are man-made fiber products. Almost half of Kenya’s apparel exports to the US are in women and girls’ cotton trousers, slacks, and shorts, and manmade fiber slacks, breeches, shorts, knit shirts, and blouses.

The apparel sector in Kenya has a three-tiered structure: in the EPZ, there are 21 large companies, and outside the EPZ there are 170 medium and large companies and more than 70,000 micro and small ones. Raw materials and overheads are the main cost drivers of these firms. The government of Kenya’s Vision 2030 identifies the garment and textile sector as a driver of industrialization.

Currently, the sector contributes to 7 percent of the country’s export earnings. Sub-Saharan Africa. Kenya. Textile, leather, garment, shoes, and textile services. It employed about 30 percent of the labour force in the national Cotton Farming Ginning Weaving& Knitting Dyeing & Finishing Garment Making manufacturing sector. The industry also supports the livelihoods of over 200,000 small-scale farmers by providing markets for cotton.

Opportunities for Investors

The main policy instruments for promotion include a combination of tariffs and import quotas supported by foreign exchange allocation measures. In March 1996, the presidents of Kenya, Tanzania, and Uganda re-established the East African Community (EAC). The EAC’s objectives include: harmonizing tariffs and customs regimes, free movement of people, and improving regional infrastructures.

In March 2004, the three East African countries signed a Customs Union Agreement. Kenya’s inclusion among the beneficiaries of the US Government’s African Growth and Opportunity Act (AGOA) has given a boost to manufacturing in recent years. Since AGOA took effect in 2000, Kenya’s clothing sales to the United States increased from US$44 million to US$270 million (2006).

AGOA was set to expire at the end of 2015, and this may have spurred companies to grow to take advantage of its last few years. AGOA was renewed in June 2015 for another 10 years. This is expected to be a game-changer as it provides both investors and companies with a significant window of time to capture market opportunities duty and quota-free.

Kenya is in a strong position to capitalize on AGOA: the country already captures more than a third of all apparel exports from Sub-Saharan Africa to the US. In addition, 70 percent of Kenyan apparel firms have a US dominant market orientation. Other initiatives to strengthen manufacturing have been the new government’s favorable tax measures, including the removal of duty on capital equipment and other raw materials.

The key challenges are:

• Lack of policy coherence and institutional alignment,

• Low level of value addition and a disconnect between the apparel sector and the rest of the value chain segments,

• Supply-side constraints with regards to quality and price of fabrics, with focus on afro-centric cloth and garments,

• Weak business environment,

• High cost of production and built-in systemic inefficiencies,

• Lack of market readiness,

• High cost and difficulties to access credit and finance,

• Predominance of SMEs operating in the informal sector,

• Lack of visibility of Kenya’s design capabilities and absence on the formal retail platform,

• Illicit imports and negative impact of second-hand clothing,

• Lack of a clear national policy on textile and apparel.

List of Some Local Companies in the Apparel and Textile Industry in Kenya

Here you can find most of the textile manufacturers in Kenya with design, production, and distribution of quality clothing and fabrics which are generally made through weaving, knitting, binding, or crocheting.

1. Spin Knit Limited

It is a leading textile manufacturing company with 100% facilities of acrylic hand knitting yarn, machine knitting yarn, knitwear, Maasai shuka, baby shawls, and blankets.

Location: Eldoret

Contacts: +254 722 825 348

2. Rivatex East Africa Limited

It is an integrated textile manufacturer that converts cotton lint through various processes to finished fabrics.

Location: Eldoret

Contacts: +254 5320 30901-3

3. Thika Cloth Mills

It is a renowned textile company known for manufacturing textile and fabrics such as corporate uniforms, school uniforms, household furnishings and promotional textiles.

Location: Thika

Contacts: +254 0723 410 200/ 0733 410 200

4. Sunflag Textile & Knitwear Mills

The company’s operations range from yarns, fabrics, garment and household textile which are all made using the latest technology and modern equipment.

Location: Nairobi

5. Spinners & Spinners Ltd

Location: Kamiti

Contacts: +254 0722 206 959/ 0733 900 015

6. Fine Spinners Ltd

Location: Off Lunga Lunga Road, Industrial Area, Nairobi

Contacts: +254 20 545 439

7. Alliance Garment Industries Ltd

Location: Nairobi

Contacts: +254 728 607 632

8. KEMA East Africa Ltd

It is a leading manufacturer and distributor of various types of garments such as protective clothing, high visibility garments, disposable clothing and workwear.

Location: Off Shimo la Tewa Road, Industrial Area, Nairobi

Contacts: +254 0720 821 970/ 0734 600 867

Email: [email protected]

9. Supra Textiles Ltd

Location: Nairobi

Contacts: +254 020 650 496

10. Specialised Towel Manufacturers Ltd

Location: Nairobi

The company manufactures cotton bath towels, cellular blankets, bed covers, bed sheets, bath mats, counterpanes and hospital linen.

Contacts: +254 0713 439 373/ 0720 696 376

11. United Footwear Ltd

It manufactures boots using the vulcanising process, men’s and children’s shoes on special orders, sandals and sports shoes.

Contacts: +254 66 32868

12. African Leather Industries Ltd

It was established in 2011 as a subsidiary of Leather Industries of Kenya. It manufactures all types of men, kids and safety shoes.

Contacts: +254 20 328 0000

13. C&P Industries Limited

The company manufactures a variety of products such as sports shoes, leather shoes, PVC moulded shoes, rain boots, PVC coated fabrics, zip fasteners, shoelaces and unit soles.

Location: Along Mombasa Road, Nairobi

Contacts: +254 722 809 865

14. Bantu Shoes

It is a footwear manufacturing firm that specializes in the production of leather formal footwear for men and school shoes.

Location: Nairobi

Contacts: 0718 842 108

15. Peponi Footwear Industries

Location: Mikamba Road, Mombasa

Contacts: +254 041 222 6526

16. Macquin Shoes Ltd

Location: Refinery Road, Mombasa

Contacts: +254 413 434 514/ +254 41 343 2990

17. Crown Industries Ltd

The company makes PVC shoes/footwear for ladies, gents and children.

Location: Enterprise Road, Nairobi

Contacts: +254 020 650 720

18. Adix Ltd

It specifically manufactures PVC gumboots, shoes and slippers.

Location: Nairobi

Contacts: 0722 423 600/ 0736 650 000

19. United Aryan EPZ ltd , Location: Nairobi

20. Brother Knitwear factory Ltd , Location: Nairobi

21. Kenyamasken Garments Ltd , Location: Nairobi

22. Specialised Towel Manufacturers Limited , Location: Nairobi

23. Ken Knit (Kenya) Ltd , Location: Eldoret

24. Kenya Association of Manufacturers , Location: Nairobi

25. Exporting Processing zone Authorities , Location: Nairobi

26. Ashton Apparel EPZ Mombasa

27. Cotton Development Authority Nairobi

28. Association of Fashion designers Nairobi

29. Kenya Private Sector Alliance Nairobi

30. Kenya Revenue Authority – Nairobi

18 Kiboko Leisure wear Ltd Nairobi

31. KIKOROMEO (Kiro Ltd) Nairobi

32. Kimili Africa Nairobi

33. Kitui Ginneries Ltd Kitui

34. LOULOU CREATIONS Nairobi

35. Makueni Ginnery Makueni

36. MEFA Creations Nairobi

37. Micro & Small Enterprises Authority/Federation Nairobi

38. Midco Textiles (EA) Ltd Nairobi

39. New wide Garments Kenya EPZ Ltd Athi River

40. Rupa Mills (EPZ)td Athi River

41. Sandstorm Nairobi

42. Technology Development Center Athi River

43. Tosheka Textiles Makueni

44. TSS spinning & weaving mills Nairobi

45. Ultra Kenya Ltd Nairobi

46. Africa of Women Entrepreneur Program Athi River

47. Alltex EPZ Ltd Ruiru

48. Alpha Knits Limited Nairobi

49. Equator Apparels Nairobi

50. Export Promotion Council Athi River

51. Fair Trade Africa

52. Global Apparels

Main Cotton Growing Areas In Kenya

Cotton is one of the main cash crops grown in Kenya. Kenya currently produces an average of 25,000 bales of cotton, which is way much below the current demand of about 200,000 bales. This means that a lot of cottons are imported from other neighboring countries to cover the deficit.

Cotton is drought tolerant and is mostly grown by small-scale farmers in semi-arid regions in the country. It takes about 6 to 8 months to mature. In Kenya, cotton is sown between April- June and harvested from November- February.

• Siaya

• Lamu

• Homa Bay

• Tana River

• Embu

• Kitui

• Meru

• Machakos

• Part of Busia County

• Kirinyaga

• Makueni

Online Clothing Stores In Kenya

Online Shopping stores have basically revolutionized how many people do their shopping and online cloth stores are just some of the major players in the Kenya online shops’ industry.

- Tique a Bou Clothing Line

www.tiqueabouclothing.com - Kilimall

www.kilimall.co.ke - Sarai Afrique Clothing line

www.saraiafrique.com - Style Connection Kenya

www.styleconnection.co.ke - Vivo Activewear

www.vivoactivewear.com - Airi Online Shopping Mall

www.airionline.com - 2nu Online Shopping Store

www.2nu.co.ke

Why the Textiles and Apparels Sector?

The textiles and apparels sector has been identified as a priority sector by the Kenyan Government. Its prominence in the manufacturing pillar under the Big 4 Agenda and the Kenya Industrial Transformation Program is a manifestation of its soft spot in the government’s thought processes. But why should the government concentrate on growing the textiles and apparels manufacturing sector?

Kenya has an unemployment rate of 39.1%. The textiles and apparels sector has the ability to create a large number of employment opportunities within a short duration of time. The development of sector’s farm–fashion value chain presents the country with immense opportunities in cotton farming, textile mills and apparels/fashion industry. A fully developed value chain has the capacity to employ about 10% of the country’s population. Additionally, cotton farming and apparels manufacturing are very labour intensive; thus being a source of much-needed employment opportunities. The value chain is also an important driver of inclusivity as it employs women in excess of 60%.

The apparels textile industry in Kenya is currently a critical foreign exchange earner in the manufacturing industry. Kenya as of now is the largest exporter of apparel under AGOA with about Ksh. 35billion worth of exports in 2017. With the changes in the global apparels sourcing supply chain in the world, Kenya has been able to attract a substantial number of world buyers and these figures can grow when we enhance our competitiveness and diversify our markets.

Kenya can borrow best practices from Bangladesh, a rising giant exporter of textiles and apparel. Bangladesh exports about 33 billion dollars worth of apparel to the world. 6 billion of these exports are to the United States while about 27 billion are to the European Union and the rest of the world.

Putting these figures into perspective, Bangladesh’s textiles and apparel exports are about 700 billion Kenya Shillings higher than Kenya’s 2017 National Budget. Secondly, Bangladesh exports performed about 18 times better than Kenya in the US market in spite of the fact that Kenya enjoys duty-free access to the US market which is not the case with Bangladesh. Thirdly, Bangladesh performs very well in the European market, in spite of the fact that both Kenya and Bangladesh have duty-free access to that market.

The textiles and apparel sector has historically been the pioneer industry that drives industrialization around the world. An analysis of major international companies illustrates this as many of them started out with operations in the textiles and apparel sector value chain. The situation is not different in Kenya as many of Kenya’s top companies have their genesis in the textiles and apparel sector. The growth of the value chain in Kenya will translate to more players in the manufacturing space and who will ultimately diversify into other manufacturing sectors.

The sector has the ability to fill in the gaps in our economy, our social challenges, and our industrialization journey. With the coming of the 4th industrial revolution and the changes in the global manufacturing, consumption, and sourcing dynamics; Kenya lies in a good position to turn the waves into energy that will propel the country to the next frontier.

Sources:

www.kam.co.ke/why-the-textiles-and-apparels-sector/

https://www.aljazeera.com/news/2018/01/kenya-boost-local-textile-industry180118130358382.html

http://industrialization.go.ke/index.php/state-corporations

Kenya Investment Authority (2016). Kenya Vision 2030

http:// www.vision2030.go.ke

https://www.businessdailyafrica.com/markets/marketnews/Kenya-s-clothing-sector-on-themend-/3815534-4200142-i4mbpmz/index.html

Ministry of Industry Investment & Trade (MOIIT);

Kenya Textile and Clothing Value Chain Roadmap Kenya-apparel-and-textile-industry-diagnosis-strategy-and-action-plan https://sw.wikipedia.org/wiki/Kenya

Daily nation newspaper

http://www.industriall-union.org/kenya-union-success-in-growing-garment-andtextile-sector

http://www.intracen.org/itc/market-info-tools/statistics-export-product-country/

Dear sir I am work experience weaving 21 years textile industry air jet loom towel and jacquard

I am a textile technologist practising tie and dye as an income generating activity alongside the usual dyeing processes of cotton, wool acrylic, nylon, and polyester. I would wish to join one of the largest textile mills in Kenya. Kindly link me with any one of them.