- Q2 Group order intake increased 1% year-over-year at constant FX, supported by both divisions. Polymer Processing Solutions orders up sequentially for the second quarter in a row.

- Group sales down 10% year-over-year at constant FX, reflecting subdued order intake in Polymer Processing Solutions in 2023. Surface Solutions outperformed in stagnant market conditions with sales up 2% at constant FX.

- Robust operational EBITDA margin despite negative operating leverage, supported by cost efficiency and innovation. Surface Solutions with ~230 bps improvement year-over-year.

- 2024 guidance: Confirming sales guidance with slightly better-than-expected performance in Polymer Processing Solutions. Operational EBITDA margin raised to 15.5-16.0% (previously 15.0-15.5%).

Michael Suess, Executive Chairman of Oerlikon, stated:

“We achieved a strong first half-year performance in a challenging market environment. Our decisive execution resulted in organic order growth for the second quarter despite soft manufacturing PMIs. The strong focus on proactive cost management, innovation and rigorous pricing led to robust margins in both divisions. Our plans to separate Polymer Processing Solutions are on track.”

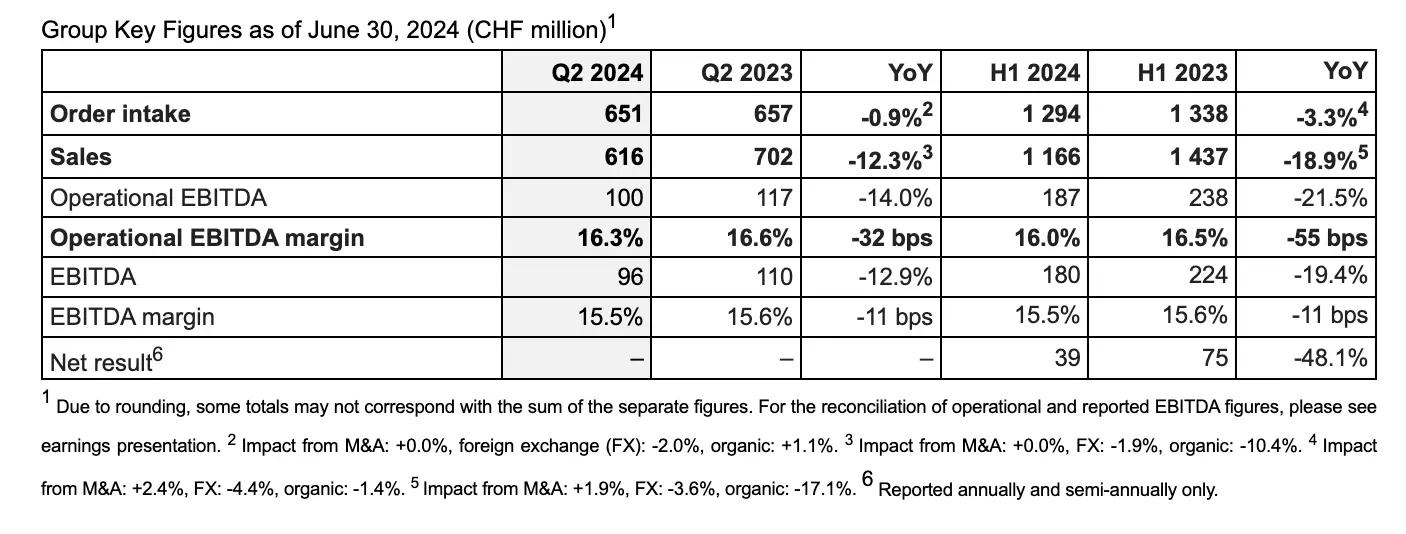

Oerlikon Group 2024 Half-Year Overview

In the first half of 2024, the Group’s order intake slightly decreased by 3.3% year-over-year to CHF 1 294 million and sales decreased by 18.9% to CHF 1 166 million, attributed to the transitory weakness in the Polymer Processing Solutions market.

Operational EBITDA was at CHF 187 million, or 16.0% of sales, due to the downturn in Polymer Processing Solutions that was not compensated by the improvement in Surface Solutions margins. The net profit for the first half of the year decreased by 48.1% to CHF 39 million as a result of lower EBITDA.

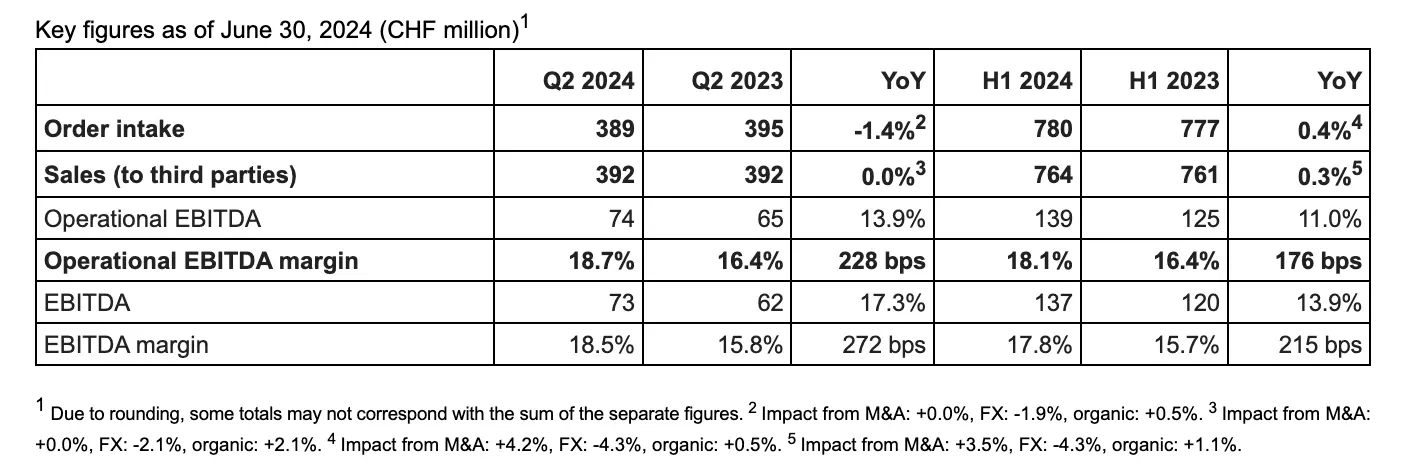

Surface Solutions Division

Surface Solutions achieved 0.5% order growth year-over-year in Q2 at constant exchange rates despite weak markets. Customer purchasing behavior remained cautious due to soft industrial activity. While manufacturing PMIs in the Eurozone stayed in contraction, they were at neutral levels in the US and China.

The division increased sales in Q2 by 2.1% year-over-year at constant exchange rates. Growth was particularly supported by strong performance in Oerlikon’s equipment and materials businesses for the aviation industry.

Operational EBITDA margin improved 228 basis points to 18.7% despite higher input costs. The increase was supported by efficiency, innovation, pricing and mix.

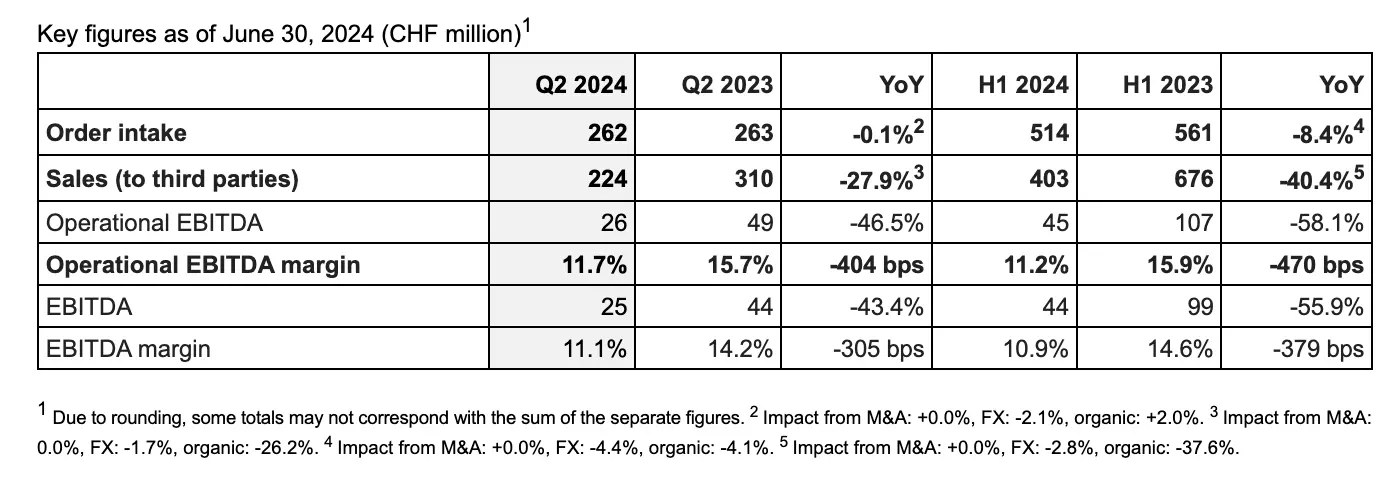

Polymer Processing Solutions Division

Polymer Processing Solutions achieved improvement in its order intake sequentially for the second quarter in a row (Q2 2024: CHF 262 million; Q1 2024: CHF 251 million; Q4 2023: CHF 182 million). At constant exchange rates, order intake increased by 2.0% year-over-year. The division continued to see positive momentum in small- and mid-sized orders. The division’s sales declined 26.2% in constant currencies, reflecting the low order intakes in 2023.

The division achieved a robust operational EBITDA margin of 11.7% despite lower sales volume. The margin was supported by proactive cost actions, counteracting operating leverage and limited pass-through of higher input costs to maintain volume.