Kenya, a nation renowned for its breathtaking natural beauty and cultural diversity, is also steadily emerging as a powerhouse in textile and apparel manufacturing. From the bustling factory floors of Nairobi’s industrial zones to the vibrant creativity of local designers, Kenya’s textile and apparel industry is not only one of its most promising economic sectors but also a symbol of the country’s capacity for innovation, resilience, and growth.

A Legacy Rooted in Tradition and Reinvented by Innovation

For centuries, Kenyan communities have crafted garments from locally-sourced cotton and wool, each ethnic group contributing unique styles like the iconic kikoy and leso. These colorful, handwoven fabrics have long been a part of Kenya’s cultural fabric. Today, these traditions coexist with modern manufacturing capabilities that enable large-scale production for global markets.

Kenya has become a beacon of textile innovation and sustainability in Africa, blending traditional craftsmanship with advanced technologies and sustainable practices. The industry now employs thousands, supports domestic cotton farmers, and contributes significantly to export revenues—especially through its access to duty-free markets under agreements like the African Growth and Opportunity Act (AGOA).

Kenya at a Glance: A Strategic Textile and Apparel Hub

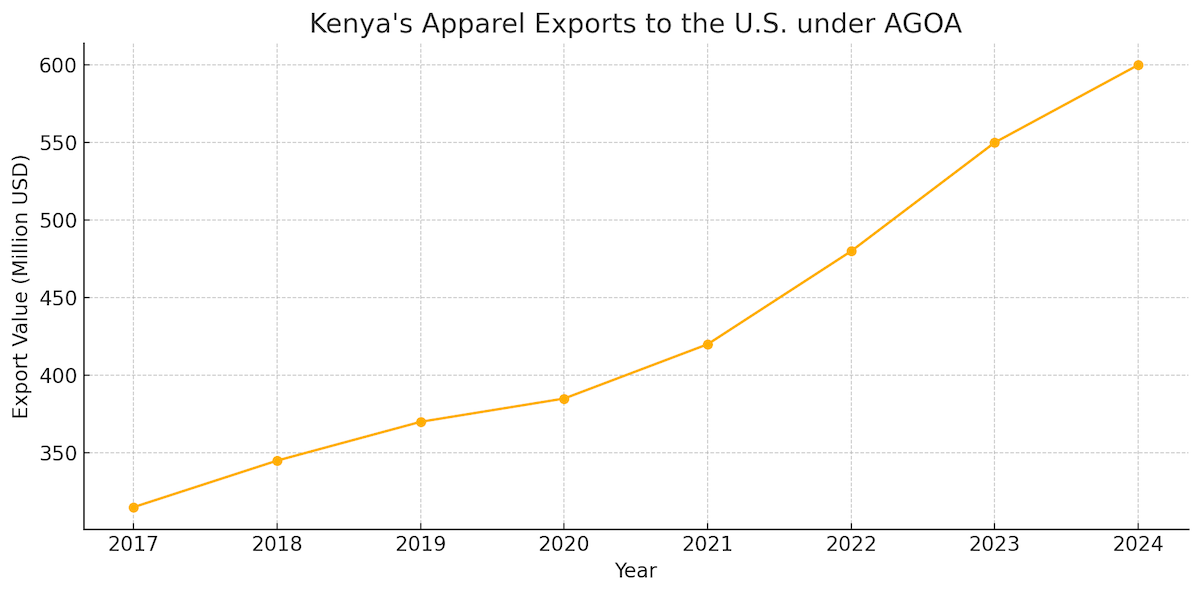

Kenya holds a strategic position in East Africa, boasting extensive trade infrastructure and a skilled, youthful population. It is the leading exporter of garments under AGOA, with apparel exports to the U.S. reaching close to $600 million annually. Kenya’s Export Processing Zones (EPZs) and Special Economic Zones (SEZs) have become hotspots for textile investment, offering modern facilities, tax incentives, and streamlined procedures.

The country’s textile ecosystem consists of 16 fabric suppliers, 14 apparel manufacturers, and 4 cotton production companies. While the potential for local cotton production remains largely untapped, the fertile land and suitable climate make Kenya an ideal location for scaling up raw material production.

EPZs: Driving Growth and Attracting Global Investors

The Export Processing Zones Authority (EPZA) has played a central role in catalyzing growth in Kenya’s apparel industry. By offering tax holidays, quality infrastructure, and investment-friendly policies, EPZs have attracted global manufacturers and significantly boosted Kenya’s exports. The Athi River EPZ, in particular, has become a hub for textile manufacturing, supported by dedicated water recycling systems and reliable power supply.

The strategic importance of the EPZ model cannot be overstated. It offers investors access to low-cost, sustainable resources and an efficient regulatory framework, enabling Kenya to position itself as a reliable sourcing destination for major global retailers.

Sustainability at the Core

Kenya is increasingly adopting green practices in textile production. From water-efficient dyeing methods to the use of recycled materials and organic cotton, manufacturers are aligning with global sustainability standards. The country’s reliance on clean energy—over 86% of its power comes from renewable sources such as geothermal and hydropower—gives it a competitive edge in sustainable manufacturing.

Efficient waste and water management systems, especially in textile-dedicated industrial zones, reflect Kenya’s commitment to eco-friendly production. This shift not only reduces environmental impact but also appeals to sustainability-conscious consumers and international buyers.

Competitive Advantages: Infrastructure, Workforce, and Policy Support

Kenya’s competitive advantage lies in a combination of factors:

Young, Educated Workforce: With a median age of 20 years, a literacy rate of 82%, and over 60,000 university graduates annually, Kenya offers a large pool of trainable talent. Technical training provided by over 1,400 TVET institutions ensures that the industry has access to skilled machine operators and quality controllers.

Modern Infrastructure: Deepwater ports like Mombasa and Lamu ensure smooth logistics for import and export. The Standard Gauge Railway connects inland industrial areas with port cities, reducing transport costs and improving efficiency.

Affordable Operating Costs: Minimum monthly wages for skilled textile workers remain competitive, and with affordable energy rates, Kenya presents an attractive proposition for manufacturers.

Strategic Air Access: Nairobi’s Jomo Kenyatta International Airport serves as a major logistics hub for exports to the U.S., Europe, and Asia.

Market Access and Trade Agreements

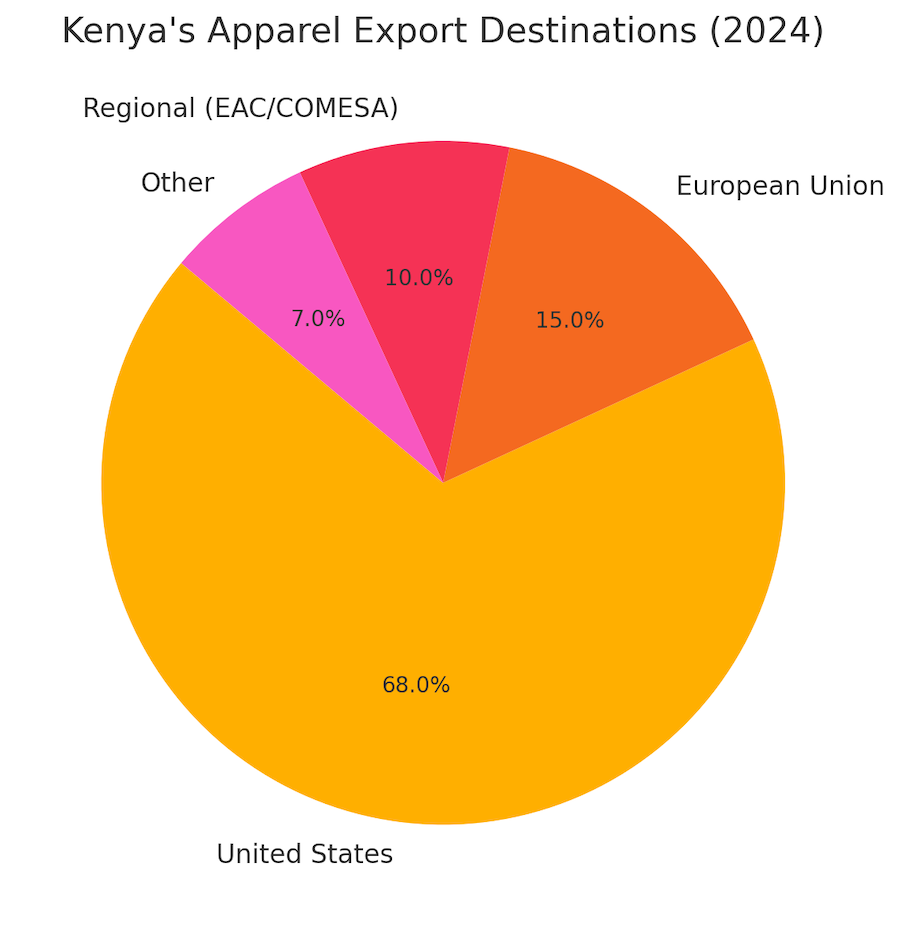

Kenya’s access to global markets through trade agreements like AGOA, the EU’s Economic Partnership Agreements (EPA), and regional trade blocs such as the East African Community (EAC) and COMESA has opened up extensive market opportunities.

Under AGOA, Kenya has grown to become the top apparel exporter to the U.S. from sub-Saharan Africa, with the majority of exports consisting of denim jeans, trousers, and knitwear. The upcoming African Continental Free Trade Area (AfCFTA) presents further opportunities by granting Kenyan apparel producers access to a market of over 1.3 billion consumers across the continent.

Opportunities and Challenges

Opportunities:

- Vertical Integration: Kenya has room to grow in vertically integrated manufacturing, from cotton farming to fabric and finished garment production.

- Raw Material Development: Expanding domestic cotton and organic fiber production can reduce dependence on imports.

- Product Diversification: Introducing technical textiles, performance wear, and eco-textiles can broaden Kenya’s product offering.

- Digital and Smart Manufacturing: Investment in automation, AI, and digital supply chain solutions can enhance productivity and transparency.

Challenges:

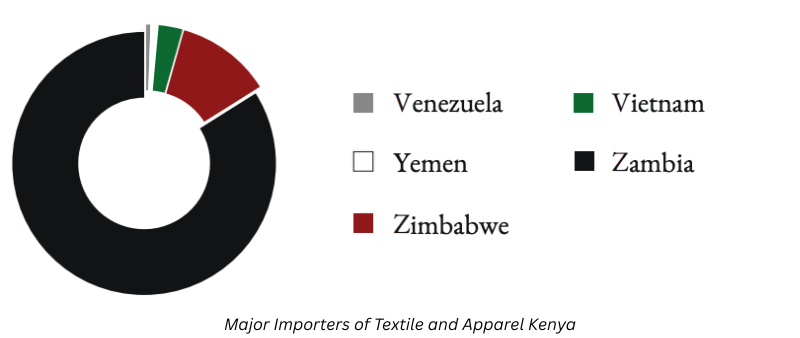

- Import Dependence: Despite its production strength, Kenya still relies heavily on imported raw materials like fibers and yarns.

- Second-hand Market: The popularity of mitumba (second-hand clothing) presents a challenge for domestic producers competing for consumer attention.

- High Input Costs: Limited local production of inputs and fluctuating exchange rates can drive up production costs.

Empowering Growth: Policy and Industrial Support

Government support remains pivotal to Kenya’s success in textile manufacturing. Through initiatives like the “Big Four Agenda” and Vision 2030, Kenya is focusing on revitalizing the textile sector to create jobs and enhance local value addition.

Agencies like the Kenya Investment Authority (KenInvest) and the State Department for Investment Promotion are working to facilitate investment through industrial parks such as Konza Technopolis SEZ and Nairobi Gate Industrial Park.

The Future: A Global Leader in Ethical Fashion?

Kenya is on track to becoming a global leader in sustainable and ethical fashion production. Designers are gaining international attention by blending traditional aesthetics with contemporary silhouettes. The convergence of heritage, modern infrastructure, and environmental consciousness makes Kenya an attractive destination for sourcing high-quality, responsibly-made apparel.

With continued government backing, increased investment in sustainable practices, and a growing reputation in international markets, Kenya’s textile and apparel industry is not just surviving—it is thriving.