Adil Nalbant said that the textile machinery sector realised exports of 751 million dollars in 11 months of 2023 and added, “I hope that in 2024, we will experience a period in when our textile machinery manufacturers increase their competitiveness and make our sector stronger by creating differences. We interviewed with Adil Nalbant, Chairman of the Board of Textile Machinery and Accessories Industrialists’ Association (TEMSAD) for the special issue of “Turkish Textile Machinery Industry” in our Tekstil Teknoloji magazine. Nalbant, who evaluated TEMSAD’s activities, collaborations with sector associations and the year 2023, also announced his expectations for 2024. The highlights of Nalbant’s interview are as follows:

WE EMPLOY 9500 PEOPLE IN TEXTILE MACHINERY SECTOR

Founded in 1998, our Textile Machinery and Accessories Industrialists’ Association includes textile machinery, machinery spare parts and textile chemicals manufacturers. Almost all of our 225 members are domestic manufacturers. In the sector, 90% of our companies operating in this field have TEMSAD membership. In addition, 85% of our member companies are exporter companies.

According to TurkStat labour force data; textile machinery sector employs 9500 people. 22 of our companies have R&D and 4 of our companies have Design Centres. Especially in the last 5-6 years, the increase in the number of R&D and design centres in the textile machinery sector is one of the important concrete developments in our sector.

WE EXPORTED 751 MILLION DOLLARS OF TEXTILE MACHINERY IN 11 MONTHS OF 2023

As you know, 2023 was a year of difficulties for the whole world and our country. Effects such as the earthquake disaster in our country, wars in different parts of the world, global economic contraction negatively affected our textile machinery sector as well as other sectors. The fact that our textile industry was particularly affected by this process; the fact that textile, which is one of the largest sectors of our country’s industry in terms of production, employment and exports, was damaged, and the slowdown in domestic investments had a negative impact on textile machinery sales.

Factors such as exchange rate pressure, high production costs, decreased purchases in target markets and increased market diversity for textile and raw materials purchases, especially in Europe and America after the pandemic, which negatively affected the global competition of the Turkish textile industry, caused the textile industry to have a difficult time.

For these reasons, although domestic textile machinery sales and imports decreased, our sector companies focused on exports and aimed to increase their activities in our target markets. The contraction of the textile industry in the target markets also negatively affected our textile machinery exports. As you know, we closed the year 2022 with exports of 919 million dollars.

When we look at our 11-month exports since the December data of 2023 has not been published yet; We see that we exported 751 million dollars. Compared to the same period of the previous year, our exports decreased by 9.2%. When the year-end data is completed, we calculate that we will have an average export of 820 million dollars and an average export decrease of 10%.

The share of our country in the world textile machinery exports, which is approximately 31 billion dollars annually, is 3%. In addition, our country ranks 8th among the top 10 textile machinery exporter countries. Considering that the export loss experienced by our sector in 2023 is similarly experienced in the world, we think that the share we received in 2023 will be at similar levels.

Imports were at a record level of 2.45 billion dollars in 2022. We see that imports amounted to 1.9 billion dollars in the 11 months of 2023 and decreased by 18% compared to the same period of the previous year. With the announcement of December figures, we estimate that total textile machinery imports will decrease by approximately 20% and fall below 2 billion dollars. Our country’s share in world textile machinery imports, which averages 31 billion dollars annually, is 7.5%. In addition, our country ranks 4th among the top 10 textile machinery importer countries.

OUR TEXTILE MACHINERY EXPORTS TO RUSSIA, EGYPT AND SOUTH AMERICAN COUNTRIES INCREASED IN 2023

75% of our textile machinery exports consist of textile dyeing, washing, finishing machines. More than 60% of sales, including machinery and spare parts, are made up of foreign sales. The countries to which our textile machinery industry exports the most in 2022 are respectively; Uzbekistan, Bangladesh, Pakistan, Egypt, India, Persian, Russia and Brazil.

In 2022, our exports to Bangladesh increased by 46%, to India by 42%, and to Brazil by over 100%. When we look at our exports in the announced 11-month period of 2023, we can state that our exports to our main markets, Bangladesh and Pakistan, decreased compared to the previous year, our exports to Uzbekistan, India and Persian remained at similar levels, and our exports especially to Russia, Egypt and South American countries increased. Although there is a general decrease in our textile machinery exports, we can see from these results that our companies are making intense efforts to evaluate opportunities in different markets. We think that especially Russia, Egypt, Portugal and South American countries will contribute to our market diversity in exports.

IT MAKES US HAPPY THAT OUR COMPANIES GIVE IMPORTANCE TO R&D INVESTMENTS

In addition to global problems, the problems experienced by our country in its own right naturally reflect negatively on our textile machinery manufacturers. Many problems such as production costs, inability to find qualified personnel, and access to finance problems affect our sector. On the other hand; The decrease in production capacities, new investments and modernizations also negatively affects domestic textile machinery sales.

When we look at the investment incentive lists, we see that investments in the textile sector decreased by more than 40% this year compared to the previous year. Existing factors such as prices of textile products remaining more expensive than competing countries and global buyers prioritizing costs and shifting their demands to different regions are effective. In addition to these factors affecting the country; Ensuring diversity in our foreign markets and opening up to new markets is an important issue for our industry. It is important for our industry that Egypt makes new investments, India’s similar efforts to increase its capacity, and different markets such as Russia, Portugal, Poland and South America are countries where we can diversify our exports.

We believe that our companies will increase their power in their current main markets by keeping up with the changing conditions after the pandemic, and will achieve success in exports by taking advantage of opportunities in new markets. In addition, we are happy to see that our companies attach more importance to R&D investments every day. Currently, 22 of our members have R&D centers, and we think this number will increase further. Despite all the difficulties, our companies continue to develop their technologies and create differences.

AS THE TEXTILE MACHINERIES INDUSTRY, WE ARE HOPEFUL FOR 2024

We think that the first half of 2024 will continue similarly to 2023. It is obvious that it will take time for the global slowdown and the macroeconomic problems in our country to end. As you know, the movement in the textile industry is determined by the preferences and tendencies of global buyers. Again, in this context, green transformation and sustainability issues will be one of the main agenda items for our textile industry. In addition, some specific developments are expected to affect the mobility in textile geographies. One of these is India reaching a free trade agreement with EU countries.

In other words, the trading of textile products within the scope of the free trade agreement between India and the EU will inevitably affect our country’s textile industry. Despite all these conditions, the experience gained over the years in our textile and textile machinery sectors and our strong structure in keeping up with the conditions and surviving require us to be more hopeful for the coming period. I hope that we will experience a period in which our textile machinery manufacturers increase their competitiveness and make our industry stronger by creating differences.

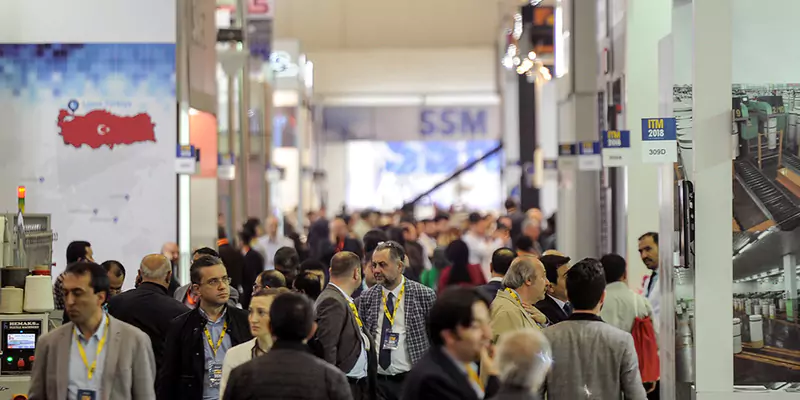

ITM IS AN EXHIBITION WHERE THE LATEST TECHNOLOGIES IN TEXTILE MACHINERY CAN BE EXHIBITED IN THE BEST WAY

ITM Exhibitions have succeeded in becoming one of the few exhibitions in the world in the field of textile machinery technologies. Due to the location of our country, ITM has become a meeting point where potential customers from abroad can visit more easily and which is important for domestic textile investors. Our country, one of the most important locations of textile in the world, hosts ITM with the cooperation of our industry, which has made great progress in the field of textile machinery and continues to do so. We see ITM as an important exhibition where the latest technologies of the industry can be exhibited in the best way. We believe that the exhibition, which was very successful in 2022, will meet the demand and have a successful conclusion in 2024 as well.