By: Mahmut Nevfel Elgün (Assist.Prof., Necmettin Erbakan University, Faculty of Political Sciences, Department of Business Administration, Konya, Turkey)

Mine Üzümcüoğlu (Asst., KTO Karatay University, Faculty of Economics and Administrative Sciences, Department of International Trade and Logistics, Konya, Turkey)

ABSTRACT

As World trade volume increases, countries are taking steps to increase their competitiveness in order to increase their market share and to be successful in international competition. The concept of international competitiveness is considered at country, industry and firm level.

When evaluated from these aspects; elements of international competitiveness, key determinants, and even measurement techniques have been handled more frequently and carefully in the academic world and among economic decision-makers. Among the measurement methods developed on the concept of competitiveness at the firm, industry and country level, the Revealed Comparative Advantage approach, introduced by Balassa and developed by Vollrath are the most effective measurement methods in the hands of researchers, especially at industry-level studies.

This study aims to reveal whether the carpet industry has competitive advantage in the period covering 2007-2017 by using the Reaveled Comparative Advantages approach and other measurement methods determined to support the results of the study. According to the results obtained in the study; Turkey carpet industry has a very high competitive advantage based on the foreign trade data in the period covering the years 2007-2017.

Similarly, when other measurement methods and statistics are taken into account, it is understood that the industry has a very important competitive power and this power is increasing with a positive acceleration.

1. INTRODUCTION

The most important change observed in the world economy in recent years is the removal of borders between countries with the phenomenon of globalization. In today’s world, where trade is increasingly liberalized, communication is accelerated, innovation and technology requirements increase, borders are removed, and economic integrations are widespread, it is seen that sectors as well as firms, countries or economies as well as sectors, or even individuals are in competition.

In short, competition at all levels has become important for all economic units. At this point, with the phenomenon of sustainable competition‖, the concept of competitiveness‖ emerges. Competitiveness constitutes one of the cornerstones that sustain the economies of countries.

In this respect, competitiveness is accepted in both economic and political circles as a necessary and important tool in order not to be left out of the globalizing world, to increase market share in the ever-growing market or at least to take advantage of opportunities and advantages to protect market share.

Many theorists, researchers and organizations have tried to define or measure competitiveness. Some of these have been accepted, while others have been lost among the publications without acceptance. Today, there are many measurement methods and approaches that are generally accepted and agreed upon.

One of the most important of these approaches, especially the methods that measure competitiveness at the sectoral level, is the Revealed Comparative Advantage Index (Revealed Comparative Advantage Index), which was introduced by Bela Balassa in 1965 and later reinterpreted and developed by various economists such as Vollrath (1991).

Although it has been criticized by some economists for its various shortcomings and inadequacies, this method has been used by many researchers since its first introduction and continues to be used today. The main purpose of this study is to measure the international competitiveness of the Turkish carpet sector primarily through the Revealed Comparative Advantage approach and other measurement methods accepted in the literature, to determine the status of the national sector and to determine the necessary policies and strategies to increase the international competitiveness of the sector by evaluating the data obtained from the measurement results.

2. INTERNATIONAL COMPETITIVENESS

Since Adam Smith until today, the concept of competition has had a very important position in the economic literature. In the globalizing world conditions, the importance of international competition has increased day by day.

Especially in recent years, since countries have been interacting with each other both economically and socioculturally, the competition conditions in question have become international. In recent years, factors such as changing market conditions, liberalization in the movement of goods and services, and the size of the companies of countries, etc. have made this situation challenging.

Under the changing conditions of competition with the developments in communication technologies, each company is trying to survive in this tough competitive environment by adopting strategic policies to develop itself in the field where the level of success will be higher.

The situation that obliges companies not to stay only within the borders of the country in which they operate is the competition conditions that have rapidly increased in intensity and reached the highest points. In the current economic environment, the disappearance of the borders of countries and the increasing power of companies in both economic platforms and political environments have paved the way for competition conditions to become more fierce than before (Koç, 2014: 85).

Table 1. Definitions of Competitiveness

The statements in the table above show that there is no unity of definition in the literature on the concept of Competitiveness.

According to (Murths, 1998), it is a concept used to describe the economic strength of a country or sector or firm relative to its competitors in a global market economy where goods, services, people, skills and ideas move freely across geographical borders. (Atkinson, 2013).

Competitiveness is an indicator of the ability to supply goods and services at the time of demand by buyers, with better quality and/or better prices than other potential suppliers (Frohberg & Hartmann, 1997: 5).

With the increasing globalization of the economy, the term competitiveness has become ubiquitous. In most definitions the term is seen as synonymous with productivity.

According to Porter, “The only meaningful concept of competitiveness at the national level is productivity. ” The World Economic Forum’s Global Competitiveness Report defines competitiveness as “the set of institutions, policies and factors that determine a country’s level of productivity”. The IMD’s World Competitiveness Yearbook defines competitiveness in a similar way, but in a broader sense, “The economy manages the full range of its resources and capabilities to improve the welfare of its people” (Atkinson, 2013: 2).

In today’s world, sustainable competitiveness is closely related to all factors beyond the wealth of factors of production, including the resources and capabilities of companies and industries, the many institutional structures of the national economy, the capacity to produce technology and innovate, the quality of the company’s infrastructure and the richness of its human capital, and the economic environment in which companies operate, including external benefits or external losses.

In this way, the transition from the competitiveness of companies to international competitiveness, which has reached a more comprehensive quality, is given meaning (Adıgüzel, 2013: 28).

3. DEFINITION AND SCOPE OF CARPET SECTOR

Warp yarns are knotted differently with another pattern yarn on top of the warp yarns, passed through several rows of weft yarns between each other and compressed and shaped in an embossed form that contains the same or different heights, and have a pile surface are called carpets (Republic of Turkey Ministry of Economy, 2016).

According to the Turkish Language Association, a carpet is “a thick, embroidered, embroidered and embroidered spread, mostly woven from wool, with short and dense pile, to be laid on the floor or on furniture, to be stretched on the wall” (Turkish Language Association, 1983).

Carpets are analyzed under two main headings according to the production method: hand-made carpets and machine-made carpets. While handmade carpets have a labor-intensive production system, machine-made carpets have a capital-intensive production system. While handmade carpets exhibit a production structure based on motifs developed through laborintensive and historical cultural heritage, machine-made carpets have a production structure that can be considered as capital-intensive and technical textiles (Republic of Turkey Ministry of Economy, 2016).

Production and trade of machine-made carpets are experiencing a greater development phase compared to the trade of handmade carpets with the great contribution of developing technology. When current data are analyzed, machine-made carpets constitute approximately 84% of the world carpet market, while the remaining 16% belongs to handmade carpet products (Anonymous, 2011: 9). 36 The carpet sector, one of the most important sub-sectors of the textile industry, has an important place in the Turkish economy.

Carpet making activities have a long history in Turkey. The carpet sector, which belongs to an old and well-known industry, has also gained an important place in the socio-economic life of the people. The responsibilities of the carpet industry for reducing unemployment in rural areas and regional economic development are quite high.

Turkey has a great potential in terms of carpet production and trade. Turkey has a very important place among the world carpet exporting countries. With 2.3 billion dollars of carpet exports, Turkey ranks 2nd in the world export list after China (Bashimov, 2017).

4. IMPORTANCE OF THE SUBJECT AND RESEARCH

While the carpet sector is among the labor-intensive sectors today, it has become a sector in which products with high added value and integrated design studies have been developed. It is possible for a country to reach the status of an economy with maximum competitiveness only if the existing sectors contribute to the economy at the maximum level.

In order to ensure economic integrity, countries should attach importance to each sector separately. In this context, among the economic sectors, the carpet sector, which has a rapid growth momentum in the last 15 years, draws attention. The Turkish economy, which is one of the countries that attracts attention in the global economy with its growth rates, does not have many theoretical studies on the carpet sector.

It is very important to increase the number of studies that examine the status of the sector and put forward effective policies related to the carpet sector. With the large investments made in recent years, most of the production of the machine-made carpet sector in Turkey is realized in the Southeastern Anatolia region.

Gaziantep has come to the forefront with 200 direct production companies, 950 looms and an annual production of approximately 300 million m2. This situation has caused Turkey to become an important center in the world carpet market (Southeastern Anatolia Carpet Exporters’ Association, 2011: 3).

5. PURPOSE OF STUDY

The carpet sector is one of the industries that has been in a breakthrough and developing especially in recent years. In this study, by using more detailed data and indicators, a comparison of the general judgment about the international competitiveness of the sector with the results obtained by scientific analysis methods has been tried to be revealed.

The aim of the study is to determine, analyze and evaluate the competitiveness position of the Turkish carpet sector. In line with this purpose, in the first stage, the international competitiveness of the Turkish carpet sector was revealed by using different indexes, and on the other hand, it was aimed to contribute to the carpet sector and to obtain results that will be a source and reference for future studies by conducting scientific research with the findings obtained in the study.

In our research, in addition to determining the competitiveness of the Turkish carpet sector, it has been tried to observe how the competitiveness has changed over the years, especially in the period covering the years 2007-2016.

5.1. Methodology And Data Set Used In The Study

Today, sectoral competition analyzes conducted at the national level are not sufficient to reveal the state of the economies of the countries in question. In this context, recently, there is a great need for studies in which the place of the economies of the countries subject to research in the world economy and in different country clusters and international competition conditions are taken into consideration.

In this study, which aims to measure the competitiveness of the Turkish carpet sector with various indexes, the method of Revealed Comparative Advantage (RCA), which is frequently used in determining whether a country has competitiveness in a sector and which has been explained in detail in the previous chapters and whose development was pioneered by Balassa, was utilized.

We have already mentioned the methodological features of the indexes used to measure the competitiveness of the sector in the analysis of the data used in the research under the heading 1.5. In addition to RCA, three different competition indexes developed by Vollrath, which can be characterized as a continuation of Balassa’s ECU method, were also used in the application part. The methods used are Relative Trade Advantage, Relative Exports Advantage and Revealed Competitiveness. In practice, these indexes are labeled RTA, RXA and RC.

Secondary data at the macro level constitute the data for the study. Harmonized Commodity Description and Code System was used in the study. Foreign trade data for the product group “Carpets and other floor coverings” coded 57 in the HS 2-digit product classification were used.

In the research, data on product groups obtained from trademap and coded according to the HS Harmonized System classification were used:

-HS Harmonized System: 5702-Woven carpets and other floor coverings of woven materials

-HS Harmonized System: 570242 – Woven carpets and other floor coverings made of woven materials – Synthetic or artificial

woven materials Foreign trade data for the period 2008-2016 were used in the measurement of Turkey’s international competitiveness in the carpet sector.

This period was preferred because Turkey has recently become more competitive in the field of foreign trade compared to the past with the effect of the globalization factor, and in addition to this, there is a general change of direction in the economic environment in the world, and it is a current period that has gone through important processes in crises and political movements.

The total export and import values of countries other than Turkey for the period 2008-2016 were calculated and compiled from the trademap database. The data used in this section have been organized and selected in a way to form the basis for scientific studies.

5.2. Research And Related Studies

There are many studies on measuring the competitiveness of the Turkish industry from past to present. The methodology used in these studies, the period range and the difference in the product groups subject to the study have tried to measure Turkey’s competitiveness in the world markets or in the framework of any country or country groups such as the EU and the USA.

Since the carpet sector constitutes the most important item of the Turkish textile sector in terms of foreign trade potential, studies on determining the competitiveness of the Turkish textile and apparel sector will be examined in this section.

Aynagöz Çakmak (2005) analyzed the competitiveness of Turkish textile and apparel industries by using Balassa’s index of revealed comparative advantage and Vollrath indexes. As a result of the study, it was concluded that the Turkish textile and apparel sector has a competitive power in the World economy. In addition, as a result of the research, it was mentioned that there is a high competitiveness in woven ready-made goods, carpets and knitted garments.

Eraslan, Bakan and Helvacıoğlu Kuyucu (2008) examined the competitiveness of the Turkish textile and apparel industries within the framework of Porter’s diamond model and made recommendations for the industry to have a sustainable competitive power.

Utkulu and Imer (2009) tried to determine the competitiveness of the Turkish textile and apparel industry against the European Union. In the study, the method of explained comparative advantages was used and it was concluded that the relevant sector is advantageous and competitive against the EU-15.

Bostan, Ateş and Ürüt (2010) tried to determine the competitiveness of the Turkish textile and apparel industry against the EU-15. As a result of the analysis using the RCA index, it was revealed that the Turkish textile and apparel industry had a high competitiveness against the EU-15 countries, but there was a decline in the data in the last years of the relevant period.

Yılmaz and Karaalp (2012) examined the competitiveness of the Turkish textile and apparel industry by using Balassa and Vollrath indexes for the period 1988-2008. As a result of the research, they found that Turkey has high competitiveness in textiles and especially in apparel. However, it was also stated that there were significant declines in ready-to-wear clothing during the relevant period.

Özçalık and Okur (2013) examined the competitiveness of the Turkish textile and apparel industries within the framework of EU-15 countries with the Explained Comparative Advantage (ECU) approach and concluded that foreign trade gains were not large in the last years of the relevant period.

Gacener Atış (2014) calculated the competitiveness of the Turkish textile and apparel industry in the EU, USA, Middle East and North Africa regions for the period 1995-2012 by using Balassa and Vollrath indexes. As a result of the research, it was determined that Turkey has a competitive advantage in the relevant sector, but this advantage has been found to have declined in the last periods of the relevant period.

Şahin (2015) analyzed the competitiveness of Turkey’s textile and apparel sector in comparison with China within the framework of the Explained Comparative Advantage approach between 1995 and 2013. As a result of the study, it was concluded that both countries have high competitiveness in the textile and apparel sector. It has been determined that Turkey’s competitive advantage in the relevant sector is higher than that of China.

In their study, Kaya and Oduncu (2016) tried to determine the competitiveness of Turkey’s textile and ready-towear sector between 2006-2013 with the data provided from the WTO database and Balassa’s RCA index and then Vollrath’s RXA, RMA, RTA, RC indexes.

It can be said that the Turkish textile sector has a competitive advantage since the RCA values are always above 1 in the relevant period. However, when other indexes come into play in the research, it was determined that there was a decrease in competitiveness especially until 2012.

6. FINDINGS

In our study, first of all, by using Turkey’s foreign trade data for 2008-2016, competition measurement with certain methods and the course of the values in the annual period were tried to be seen. Afterwards, the competitiveness of Turkey’s carpet sector was revealed by comparing Turkey’s competitiveness measurements with the values of certain other countries using 2016 world trade data.

6.1. Findings According to Balassa Index

According to the Balassa Index result, if the resulting value is greater than one, the country is considered to have a comparative advantage in product j. If the resulting value is less than 1, it is understood that the relevant country is disadvantaged in terms of explained comparative advantages in the relevant good. The table below shows the values of the Turkish carpet sector in 2008 and 2016 according to the values calculated according to the RCA formula.

RCAij = ( Xij / Xit ) / ( Xwj / Xwt )

Xij = total exports of country i in product j; Xit = total exports of country i; Xwj = total world exports in product j; and Xwt = total world exports

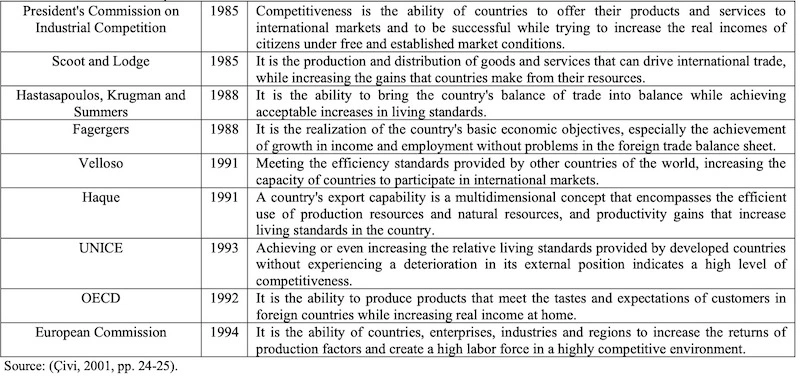

Table 2. 5702 RCA Index Results

When we examine the data in Table 2, while it was 7.90 in 2007, it reached the highest level by reaching 47.69 in 2013. It can be said that the carpet sector had hyper competition between 2010-2016.

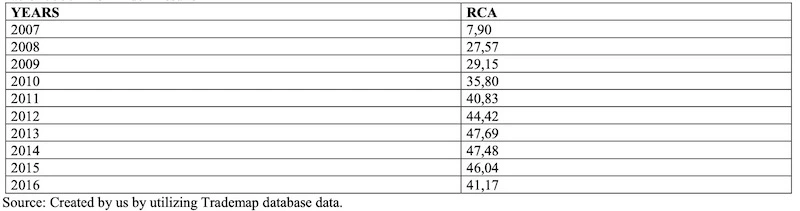

Table 3. 57042 RCA Index Results

When we look at Table 3. The value of 14.07 in 2007 reached 55.37 in 2008. After the decline in 2011, the competitive advantage of the sector continued to increase in the following years according to the RCA index.

After 2014, although there is a small decline in proportion, Turkey’s very high competitive power in the carpet sector belonging to the 570242 code continues to exist.

6.2. Findings According to Vollrath Index

‘’RXA ij = (X i j/ X nj) / (X ir / X nr)

RMA ij = (M ij / M nj) / (M ir / M nr)

RTA ij = RXA ij – RMA ij

RC ij = ln (RXA ij) – ln (RMA ij)

In here,

RTA ij = relative trade advantage of country j in good i

RXA ij = relative export advantage of country j in good i

RMA ij = relative import advantage of country j in good i

RC ij = relative competitive advantage index of country i in good i

X = exports, M = imports, n = all remaining goods, r = rest of the world” (Engin, 2013: 104-105)

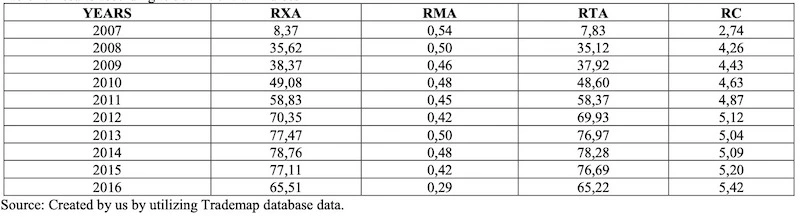

Table 4: Results according to 5702 Volltrah Indices

The Relative Export Advantage Index (RXA) takes into account only export data. The RXA, which shows

similar results to the Balassa index, had a value of 8.37 in 2007. When we look at the 2014 index value in Figure 3.3, which covers a 10-year period, this figure has reached 78.76, which is a significant increase.

These values of RXA indicate a very strong and increasing export advantage. When we look at the results of RC, the Revealed Competitiveness Index (RQ), one of the Vollrath indexes, we see that between 2007 and 2016, the Turkish carpet sector was well above zero with a value of 2.74 in 2007.

In this context, it can be understood that it has high competitiveness according to RC results. If we evaluate the results of RXA, RMA, RTA and RC indexes together, the competitiveness of the Turkish carpet sector between 2007 and 2016 is at a very high level and its competitiveness has increased with a rapid growth acceleration. The reason for the stable structure of the RC index between 2007-2016 may be due to the relatively low level of imports compared to exports.

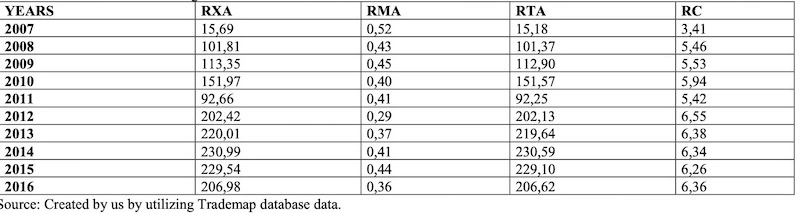

In Table 5, which is calculated with the data of 570242 gtip code, it is seen that Turkey has high competitiveness in the carpet sector between 2007 and 2016 as in the table of 5702 gtip code.

Table 5: 570242 Results according to Volltrah Indices

The Relative Trade Advantage Index (RTA), which is defined as the Relative Trade Avantage Index (RTA), is very close to the RXA. According to Table 5, in the last 10-year period, the RTA value increased from 15.18 in 2007 to 206.62 in 2016. The reason for this situation may be the high increase in the volume of imports since 2007 in proportional terms.

6.3. Analysis of the Sector According to Other Competition Measurement Methods

The methods used to measure competitiveness at sectoral level are not limited to Balassa and Vollrath indexes. There are many methodologies that have been previously used in the literature and have been used in a comparative manner with Balassa and Vollrath methods and have been accepted in order to reach a more objective result by evaluating the results together.

In this part of the study, the available data will be analyzed with the Export and Import Shares Index, Net Export Index, Export/Import Ratio. At the same time, it will be investigated whether there are binding conclusions to the evaluations formed in the previous section.

6.4. Export and Import Shares Index

In its simplest definition, the export and import shares index can be expressed as the ratio of the export or import amount of a particular product or product group to the total export or import amount of the country concerned. In summary, these ratios, which are analyzed over a certain period of time according to the formula shown below, mirror the change in the share of the relevant product or product group in the exports or imports of the country in question and enable a comparison between the overall performance of that country and the relevant sector in terms of foreign trade.

XPij = (Xij / Xi)

In this formula, Xij is the export value of product j (product group, product category or sector) in country i and Xi is the total export value of that country. (Filiztekin & Karaata, 2010, s. 10)

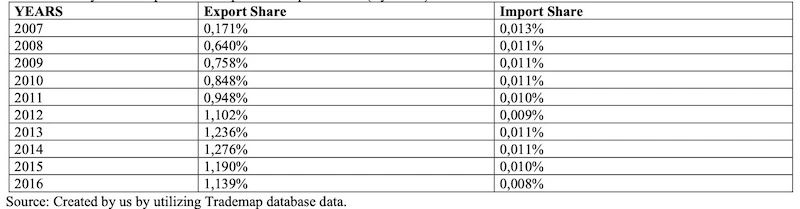

Table 6. Turkey 5702 Carpet Sector Export and Import Shares (By Years)

Looking at the data for the period covering the years 2007-2016, the export share index of the Turkish carpet sector increased from 0.171% to 1.139%. Between the years 2007-2014, each ratio has increased regularly with a significant acceleration. Even if there has been a small decline in the last 2 years, when we look at the 10-year period, Turkey’s carpet sector has increased its share and importance in terms of Turkey’s exports day by day.

When we look at the import data for the period covering the years 2007-2016, there is a fluctuation, with a rate falling from 0.013% to 0.008%. These values reflect very small data. In 2008, it dropped to 0.011% and there was no increase or decrease in this ratio until 2011. After 2012, there was a small increase, but after 2015, the import share continued to decline.

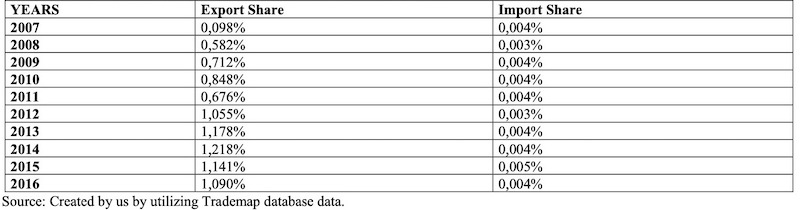

Table 7: Turkey 570242 Carpet Sector Export and Import Shares (By Years)

Looking at the period in Table 7, which covers the values calculated with the data of 570242 gtip code in 2007- 2016, Turkey’s carpet sector export share index reached 1.090% from 0.098%. Between 2007 and 2014, the rates are in an upward trend.

Although there is a small decline in the last 2 years, when we look at the 10-year period, Turkey’s carpet sector has gradually increased its share and importance in the 570242 item in terms of Turkish exports. When we look at the import data within the period in Figure 3.10 covering the years 2007- 2016, there is a fluctuation and the value calculated as 0.004% in 2007 was the same in 2016.

These values reflect very small data. In 2012, it dropped to 0.003% and then experienced a very small increase in the following years.

6.5. Export / Import Ratio

Export / Import Ratio Index (XMR):” It is an indicator used to measure the level of specialization of a sector in foreign trade. ” (Demir, 2002, p. 232)

XMRi =(Xi / Mi)*100 (2.9)

Xi: i sector exports, Mi: i sector imports.

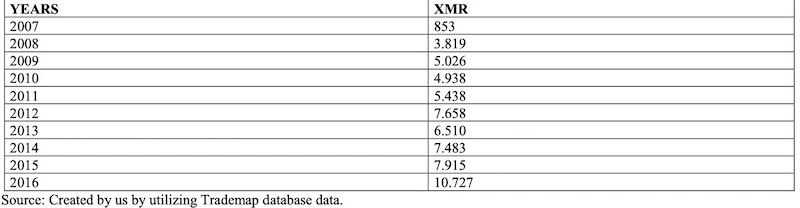

Table 8. 5702 Turkey Carpet Sector Export/Import Ratios between 2007-2016

Assuming that a value of 100 represents the equilibrium situation, when the data in Table 8 are analyzed, it is seen that there are values much higher than 100. The value of 853 in 2007 reached a very high rate of 10,727 in 2016. These values should be considered as another proof of how high the competitiveness of the Turkish carpet sector is in terms of trade balance in terms of export/import ratio.

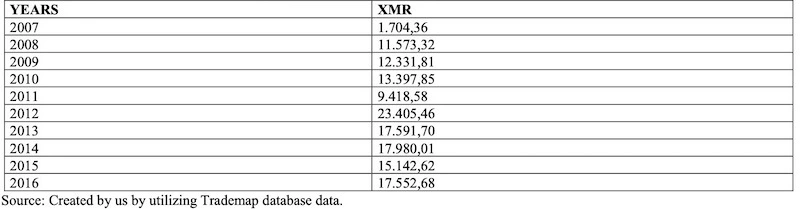

In the period from 2007 to 2016, the export/import ratio has always been at very high levels. The conclusion we can draw from this situation can be explained by the rapidly decreasing import level against the intensely increasing export amount. When we look at the values calculated with the data of 57042 Gtip code in Table 9, the value of 1.704,36 in 2007 reached a very high rate of 17.552,68 in 2016. As in the table of 5702 gtip code, the export / import ratio of the Turkish carpet sector should be considered as another proof of how high its competitiveness is in terms of trade balance.

Table 9. Turkey 570242 Carpet Sector Export/Import Ratios between 2007-2016

2016 trademap data in the light of the world’s most exported carpet countries in the light of the foreign trade data of the world’s most exported carpet countries calculated according to the Balassa and Vollrath’s indexes, it is aimed to examine Turkey’s competitiveness in comparison with other countries in the sector.

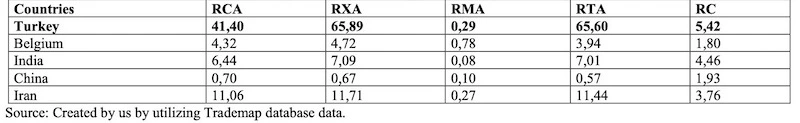

According to 2016 data, the carpet export volume of the 5 countries in Table 10 below, calculated using the foreign trade data of the 5702 Gtip code, is 3.2 billion dollars, which constitutes 75% of the world export volume of 4.3 billion dollars.

Table 10. 5702 LULUC Indices of Top Exporting Countries According to 2016 Data

According to the RCA, RXA and RTA indexes, Turkey has the highest competitiveness among the five largest countries in the world exports in the carpet industry.

This is related to the fact that the carpet industry is a sector with a high export share for Turkey. RCA and RXA index results may be similar. According to 2016 data, Iran(11.06 and 11.71), India (6.44 and 7.09), Belgium (4.32 and 4.72) and China (0.70 and 0.67) have the highest competitiveness after Turkey (41.40 and 65.89). According to the indexes in the table, it is understood that Turkey is the leader in the relevant market.

According to the RTA method, which also includes the import factor in the index, Turkey (65.60) is followed by Iran (11.44) and India (7.01) in terms of competitiveness.Based on the RC index, Turkey has the highest value among the 5 countries with 5.42. In this index, Turkey is followed by India with 4.46. The last 3 countries are Iran with 3.76, China with 1.93 and Belgium with 1.80.

7. AN OVERALL ASSESSMENT OF THE COMPETITIVENESS OF THE TURKISH CARPET

INDUSTRY

According to Balassa’s and Vollrath’s indexes, the Turkish carpet sector’s high competitive power in 2007 gained a serious upward momentum in the following year and reached very high values.

Since 2008, according to Vollrath’s RXA, RTA and RC indexes, the sector, which has a very important competitive power, has continued its upward momentum in the relevant period every year. In the section where the Turkish carpet sector is analyzed in comparison with the 5 leading countries in world exports, it is concluded that the carpet sector has a very important competitive advantage compared to other countries on a country basis.

Turkey is the market leader when we look at the export data of 2016. Ranking first according to RCA and RXA indexes, Turkey is also at the top in RTA and RC indexes where imports are also taken into consideration in the carpet sector. To summarize briefly, in line with all the competitiveness measurement indexes subject to the research and the comparisons made with the relevant countries, the Turkish carpet sector has a very important competitive power in terms of foreign trade data.

In addition, it can be concluded that it has moved its position to a more important position in the 10-year period between 2007 and 2016. In addition, within the framework of the indicators reached, it can be said that the existing competitiveness will continue to increase in the coming years.

8. CONCLUSION

Looking at the foreign trade data of the Turkish carpet industry, the sector has shown a great development between 2007 and 2017, increased its competitiveness and became one of the world’s leading producers and exporters with the positive momentum achieved. In fact, the sector has maintained its leading position in some items for years.

When the results of the application study prepared according to Balassa’s index of revealed comparative advantages and Vollrath’s competitiveness indexes as well as the foreign trade data of the Turkish carpet sector are examined, the sector defined as 570242 (Floor coverings made of synthetic or artificial woven materials) is in a leading position in the world markets.

In terms of evaluating the competitiveness of the sector in order to support the application study, the sector has high competitiveness and comparative advantage when the results of the Export and Import Shares Index, Net Export Index and Export / Import Ratio analysis are analyzed.

This situation has fluctuated between 2007 and 2017. Turkey, which is experiencing rapid growth in the carpet sector, is expected to maintain its current position in carpet production in the world in 2018 and carry it forward.

Therefore, in addition to the predictions that the carpet sector will maintain its high competitive power and gain a better place for itself in this developing sector worldwide, it points to a challenging process in terms of the continuing tendency to shift production from developed countries to developing countries such as China and India.

It can be said that Turkey has an advantage over countries such as China and India in terms of maintaining and increasing its competitiveness, especially in Europe and the Middle East countries, which it has identified as its main market in foreign trade. The reason for this is that there is a clustering in the carpet sector in Gaziantep region. The fact that many products of various prices and quality in the sector can be found together gives a serious advantage over other countries.

The most important risk factor in the Turkish carpet industry is that the companies in the carpet industry work with deferred payment terms. For this reason, there are many firms that have gone bankrupt.

The most important factors that can affect the competitiveness of countries in the global consumption increase and global competition environment, which started in the 1990s and started to grow in the 2000s, can be listed as cheap and high quality raw materials, qualified and cheap labor force, strong distribution channels and marketing network, effective R&D activities and the use of automation-based technology.

Efforts to increase competitiveness, strategies and policies to be developed to capitalize on opportunities and turn threats into advantages are some of the main elements that will make the greatest contribution to the development of the sector. In this sense, the importance of university-industry cooperation, sectoral organization and scientific studies once again reveals its importance.

In this context, in areas that we cannot fit within the limited scope of our study, for example, measuring Turkey’s competitiveness against the European Union, conducting comparative studies with European countries in the Middle East market, measuring the general competitiveness and comparative advantages of sectors other than the carpet sector, trying to reveal the existing or non-existing relationships between the increase in the competitiveness of the country and sectoral competitiveness can constitute the main areas of study.

Publish in:Open Access Refereed E-Journal & Indexed & Puplishing (IDEA STUDIES Journal)