Apparel and Textiles Sectors in Egypt :: Egypt may be best known for its impressive pyramids and colourful history, but it is also known as the most attractive African country for investment and one of the most developed in the Middle East – Africa, with a gross domestic product of $298 billion in 2018 achieving 5.3% growth, projected to be 5.9% in 2019.

Like many larger countries, the economy is dominated by the service sector (54 %), and agricultural sector (12 %), but it is also known for its industrial sector (34 %) which achieved 6.3% growth in 2018 & provided significant employment contributed to reaching the lowest level of the unemployment rate since 2011.

Textile and apparel industry is the second-largest sector, next to agro, and plays a major role in shaping the Egyptian economy.

Industry Overview:

The apparel sector accounts for 3% of GDP and 27% of the industrial output. 25% of the total industry is focused on textile production, of which 12% are engaged in home textiles, 8% in cotton yarn, and 5% in other textiles.

The public sector dominates the production industry with 50% in spinning, 60% in hemming, and 60% in weaving. Private sector owns 90% of the garment side of the industry. Spinning and weaving sector is being dominated by the large-scale industries with a strong influence of public sector.

ِEgypt textile sector consists of 3,243 companies with a total investment of 3.2 billion USD. Textile industries of Egypt produce 315 million apparels, and exports 305,000 tons of cloth and apparel annually. US constitute 80% of the countrys export market, followed by EU and Arabian countries comprising the remaining 20%.

The apparel sector in Egypt

The apparel sector plays an extremely important role in the Egyptian economy and it has seen a rebound and a new spurt of growth in recent years.

Egypt has more than 2,500 apparel factories and it is considered to be the first sector in terms of the labour force, which recorded 1.5 million workers, 50 % of which are women.

With about $1.6 billion exports in 2018, the apparel sector is the country’s most important industrial sector; it represents 6.5 % of total non-petroleum exports.

Apparel exports reached $1.604 billion for 2018 compared to $1.459 billion in 2017, achieving a rise of 10 % of which 50 % of the apparel production was exported to the U.S. and 30 % to Europe. Egyptian apparel sector enjoying many advantages

• International Trade Agreements: The U.S. is the main export destination for the Egyptian apparel industry. Apparel created within the Egyptian Qualified Industrial (QIZ) Zone are duty-free to the U.S. Under the protocol, goods made in Egyptian QIZs can use fabric imported from third countries and remain eligible for duty-free entry into the U.S. market providing 35% of their value is added in Egypt, including a minimum of 10.5% of Israeli content. Costs incurred in the U.S. also count towards the 35% threshold.

Egypt also enjoys duty-free market access to the EU with a double transformation rule of origin. With its fabric base and sourcing proximity to Turkey, exports to the EU are likely to increase

• Vertical integration and developed infrastructure: Egypt’s textiles and clothing sector are the most integrated on the African continent.

The country offers a well-developed infrastructure and is investing more than $15 billion in roads, electricity networks and irrigation projects, including 15 marine ports. Egypt is also the largest producer of Extra-long- staple cotton in Africa

• Proximity: Egypt offers shorter routes to the U.S. than Asian ports (12 days compared to over a month). Egypt also provides easy access to markets in Europe and Africa. Egypt is an intercontinental country, with multiple ports and facilities giving it a strategic advantage for exports to the U.S. and the EU.

• Egyptian Apparel Factories: Egypt is a sourcing hub for a large variety of apparel products. The region offers ethical, socially compliant factories with export experience. The supply chain is vertically integrated.

Many companies are certified by Wrap, ISO and OEKO-TEX.

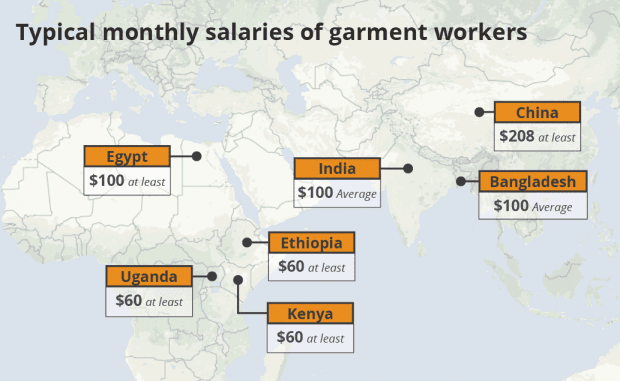

• Competitive factor costs: Egypt offers a large, cost-effective, skilled labour force. Labour costs are low in Egypt, with minimum labour wages of $115, compared to competitors like China, Cambodia, India, or Vietnam.

Electricity costs around 7 cents a kilowatt-hour compared to three to four times that amount in China.

• Well-Developed Infrastructure: Egypt offers well-developed infrastructure and continues to invest in upgrades, including investments of more than US$ 15 Billion in roads, electricity networks and irrigation projects with 15 marine ports.

• Business Climate: Egypt is making progress with economic reforms and is “open for business”, it has maintained a lot of political, social and economic stability according to rating agencies, and international institutions.

S&P revised Egypt’s Sovereign Credit Outlook up to stable then positive in Nov.2016&2017 and Upgraded Egypt’s Credit Rating to “B” In May 2018. Fitch Ratings Affirms Egypt’s Credit Rating at “B” with a Positive Outlook in August 2018.

• Policy Initiatives: The government is working on multiple policy initiatives to Help Drive Apparel Sector Growth. In May 2017, the Ministry of investment issued the New Egyptian Investment Law No. 72 of the year 2017, this law attracted investors for the incentives, guarantees, facilitation and advantages provided for in it.

• In November 2017, the new Industrial Licenses Law was issued by the Ministry of Industry and Trade, which has been reflected in the investor’s transactions with the State. The law contributes to an integrated reform to raise the competitiveness of the industry.

1. Shortening the time required to issue industrial licenses from 634 days to one week for low-risk projects.

2. Shortening the period for high-risk industries to one month.

3. Reduction of internal procedural processes from 154 to 19 procedures.

4. One of the most important advantages achieved by the law is to deal with the manufacturer and investor with one hand is the Industrial Development Authority – one of the bodies of the Ministry of Industry and Trade instead of 11 parties, which was a kind of bureaucratic constraints facing manufacturers.

5. The General Authority for Industrial Development issued 7,500 permits and operating licenses for factories, in addition to issuing building permits for the first time after issuance of the Industrial Licensing Law and its executive regulations.

The Textile Sector .. Rising Present & Promising Future

With evidence of textile industry emerging in Ancient Egypt since 5500 BC; Egyptian textile industry has been geared to be a major supplier of primary textile materials to the garment, home textiles manufacturers and many other applications nationally and worldwide.

In 2016; the textile sector was among the five industries selected by Ministry of Trade & Industry to be the backbone of the Egyptian economy. In conformity with the “Sustainable Development Strategy (SDS): Egypt Vision 2030” industry stakeholders are working to achieve three main targets; deepen the industry, rationalize imports and increase exports.

Within this framework; Egypt is set to complete 13 industrial complexes in 2019, according to H.E Minister of Trade and Industry Amr Nassar. The government aims to build a total of 22 complexes by 2020.

The complexes will be completed in 12 governorates and will have 4,300 industrial units. Currently; the ministry is to begin work on the first phase of a textile industry zone in Sadat City and an industrial zone in Abu Zenaima, South Sinai governorate.

Egypt Textile sector (fibres, yarns and fabrics) represents 3.2% of private-sector production with an industrial force of about 3000 firms and 300,000 workers. The industry is dominated by the private sector mainly constituted of small and medium-sized firms (about 75%) whereas technology-intensive textile production is undertaken by large-scale companies.

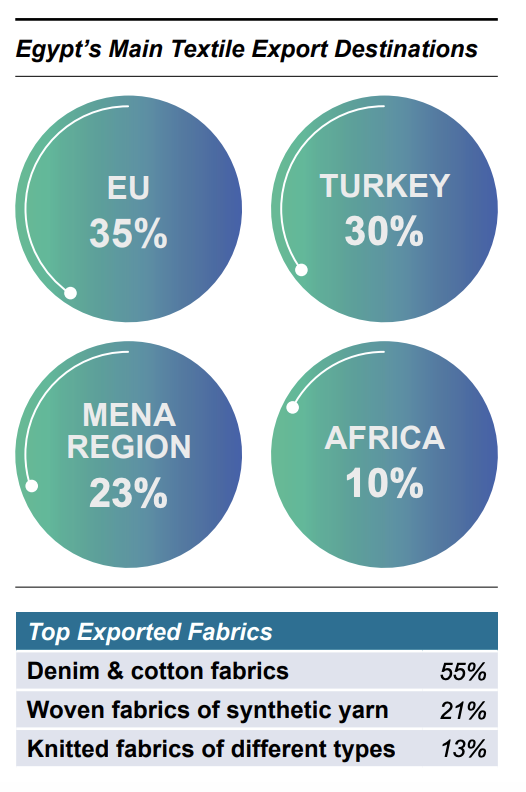

In 2018; Egypt Textile exports achieved a rise of 8% representing 4% of total nonpetroleum exports directed to more than fifty-five markets.

“Currently; Egypt enjoys the capability to supply fibres of flax & acrylic – yarns and sewing threads of cotton, polyester, acrylic, flax, wool, viscose, modal, polypropylene, nylon & lycra”

In terms of products; the cotton cluster (HS 52) has the largest share of exports (40%), followed by non-woven textiles (HS 56) with (20%) and then the man-made fibre products (HS 54) which accounted (15%) of total textile exports.

Textiles FDI projects to Egypt has also witnessed an increase, especially in apparel and woven fabric sectors. FDIs Issued Capital account for 38% of total investments from 2014 to 2018.

Total number of new projects in 2014 was 296, increased to 575 in 2018 achieving more than 90% increase. Which indicates the encouraging environment that Egypt currently has.

Egyptian Superior Cotton & More

Known as the “white gold” for its unique characteristics; Egyptian cotton kept the position of the finest natural fibres in the world for its unmatched strength, a soft weave with maximum versatility, and natural lustre, emitting a very special pearly and gleaming light. Egypt produces about 150,000 hectares of cotton fibre yearly, while cotton yarn exports equal to 400 M$ mostly to Turkey and EU markets.

However, with the entrance of the private sector in recent years, synthetic filament yarn – like polyester & acrylic – is gaining momentum in the market, especially for exports with a wide range of specs for both weaving & knitting applications.

In addition, Egypt has witnessed continues growth of woven & knitted fabrics production, mainly for apparel& home textiles industries.

Moreover; Egypt succeeded in attracting new investments in technical and non-woven textiles fields, which created a new horizon for sector exports adding more industries to supply like healthcare, military wear, automotive and packaging. Egypt, the Ideal Sourcing Destination of Fibers, Yarns & Fabrics.

• Stable & Sustainable Production: recently; the government of Egypt has made concrete actions towards sustainability in textile production. In 2018; H.E Minister Hisham Tawfiq announced a comprehensive development plan for the spinning & weaving public companies to be implemented within three years. Besides; Egypt applied a pilot project of BCI programme aiming to enhance the cotton production supply chain.

• Shorter Lead Times: Egypt’s unique location and the well-built maritime & air freight systems enabled it to be the link of Africa continent to the world. Shipping time from Egypt to Europe is about (6 to 12 Days), to USA is (12 Days) to Arab & Gulf Countries takes (2 to 4 Days) and shipments to North Africa consumes (10 to 18 Days). With an approximate of 3 to 7 days for sample production; Egypt offers the ideal, faster and reliable sourcing destination.

• Duty-Free Access: With the advantageous Free Trade Agreements Egypt has signed, Egyptian products enjoy a duty-free access to; EU countries, USA, Turkey, Mena Region, 18 African countries of COMESA and 4 countries of MERCOSUR.

• Egyptian Textile Manufacturers: Once a successful business is dependent on the chosen supplier; Egypt would make a perfect sourcing option. Offering a wide variety of yarns and fabrics products, superior quality, modern spinning, weaving, processing and state-of-the-art facilities mostly are Wrap, ISO and OEKO-TEX certified.

• A Ready to Help Partner: More than 10 years ago, the Ministry of trade & industry has boosted the rule of the “Export Council” assigned it to facilitate, support and provide information to all interested buyers and investors. EC Egypt is the focal point between Textile industry stakeholders and overseas partners.

Egypt, with its adaptability to European standards and regulations, is aiming to move into the production of more and more value-added products, complete supply chain locally and regionally.

India to step up cooperation with Egypt in the textile sector

India today vowed to step up its collaboration with Egypt in the textiles sector and said talks were on to increase textile machinery supplies to the Arab country. India stands ready to work with Egypt towards the attainment of its new textile policy goals in production as well as in trade and investments

India is very well known in the market of man-made fibers and it has a very wide presence globally as India’s textile industry is the second in the world. The Indian fabrics have a range of products with both expensive products as well as products with reasonable prices.

The other especially of the Indian textile industry is that it manufactures a lot of textile machinery. The Indian side is currently in discussions with the Egyptian side to expand the presence of textile machinery supplies from India to Egypt. Indian textile machinery is not only very good in terms of quality but also because India and Egypt have similar large populations and large labour force. So this kind of machinery will be very good for the Egyptian market.

Indian and Egyptian textile experts believe that Indian companies come to Egypt not to compete with the local industry but to cooperate with their Egyptian counterparts. The objective is to strengthen the trade between the two countries, particularly in the fast-growing area of Man-Made Fibre (MMF) textiles.

India exported around USD 240 million worth of textiles and clothing products to Egypt during 2018. Man-made fibre textiles were one of the important products in the export basket, which is valued at USD 97 million, along with cotton (USD 131 million), apparel (USD 2.32 million), Jute (USD 4.4 million) and carpet (USD 0.36 million)

The main items of Indian MMF Textiles that are exported to Egypt include polyester viscose fabrics, polyester blended fabrics, synthetic filament fabrics, shawls/scarves, laces, viscose spun yarn, polyester spun yarn, texturised yarn, and polyester staple fibre. Egypt has traditionally been one of India’s most important trading partners in that region. During the year 2016-17, bilateral trade between India and Egypt was about USD 3.23 billion. India is Egypt’s 10th largest export destination and also the 10th largest import source.

I am often to running a blog and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your website and preserve checking for brand spanking new information.

Hello. As M&H ASL textile group of companies, we would like to contact you. We introduce our fabrics, which we trust in their elegance and quality, and which we produce in our own factories, to the world. We request an online meeting with you on this matter.

Hi,,,this is Touhidul Islam Nayem, We wanna to work as buying argent from Bangladesh that’s why I wanna to introduce Our Buying house ‘Clothing Source BD’. We are specialized in all kinds of Men/Women/Children/Kid garments including knitted T-Shirts, Polo-Shirts, Sweater, Shirts & Pants for men and women, Denim Shirts & Pants, Ladies Tops & Pants, Hoodies, Jackets, Twill & Sweat Pants, Trouser & Vest, Executive Wear, Uniform & Work Wear. As well as if you have any requirement for garments, please inform us. Please give us a chance than see what kind of facilities we provide.

Good morning

Dido you printing on silk or sheffon

And the minimum quantity per order