The textile and fashion industry in Palestine is the second largest employer. The sector is made up of hundreds of tiny businesses that operate out of people’s homes. Nablus has the biggest concentration of garment and textile industries in the West Bank, with 362 units.

There are 760 industries in Gaza, with the remaining 578 enterprises spread across the West Bank towns and communities. Micro-enterprises with one to four employees make up the majority of the industry (50 per cent). Only 1% of the sector employs more than 50 people. In the West Bank and Gaza, the final 49% of garment and textile industries employ around 5 and 49 people.

The textile and fashion industry in Palestine was a key pillar of the national economy in 2000, accounting for the largest sector in the Gaza Strip and the third-largest in the West Bank. Since then, a succession of international economic and political changes have made a highly competitive, low-margin sector even more difficult for Palestinian businesses, which rely on subcontracts with Israeli corporations to the tune of 95%.

The start of the ceasefire, China’s affirmation to the World Trade Organization, and the Turkey–Palestine Free Trade Agreement have all contributed to an Israeli industry hoping to move away from low and lower-middle goods in favour of fashionable goods and services, and a Palestinian company that has reduced and been chosen to take over by foreign products. Since 2001, the Palestinian textile and apparel industry has lost half of its domestic market share, two-thirds of its businesses, 60% of its revenues, and more than three-quarters of its salaried workers.

It is an industry in trouble, and it will need deliberate, fundamental transformation if it is to survive and develop again.

Historical overview

The textile and fashion industry in Palestine grew rapidly in the 1980s and 1990s, as Palestinian sewing factories and other businesses progressively entered into subcontracting agreements with Israeli manufacturers servicing both local and international markets.

This greatly boosted the potential demand for Palestinian businesses, which were previously virtually restricted to the small Palestinian market. The textile and garment industry has become an important component of the Palestinian economy by the year 2000. With a total of 2,650 businesses, it was the largest sector in Gaza and the third-largest in the West Bank in terms of several businesses.

They employed over 20,000 people and generated US$ 126 million in revenue, mostly via the manufacturing of high-volume, low-cost, and medium-cost items.

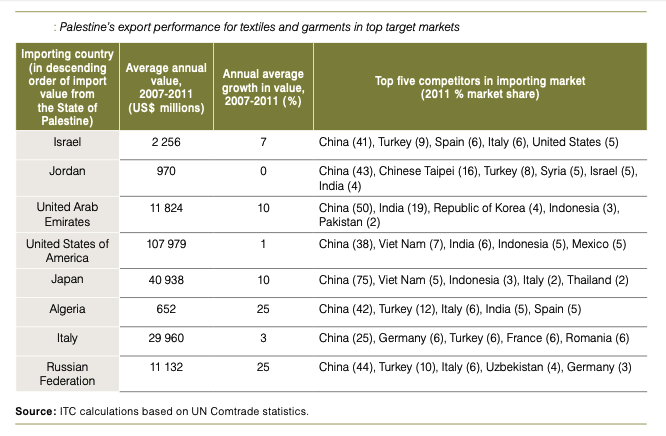

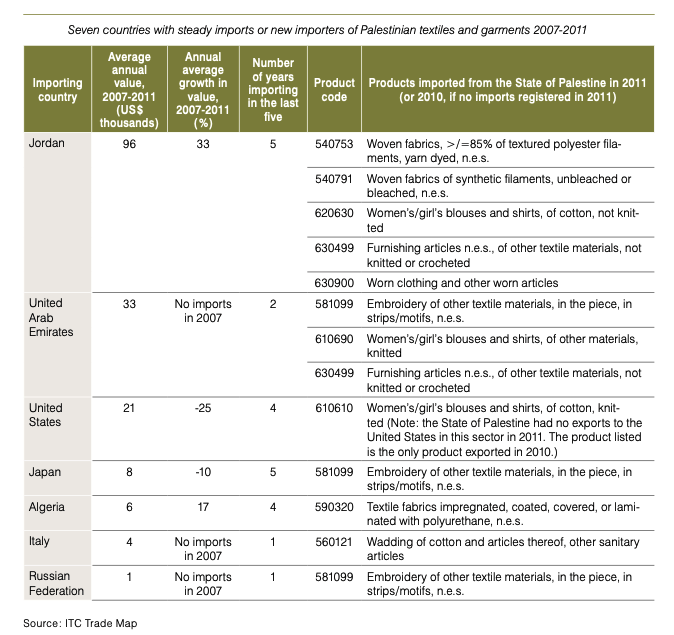

The State of Palestine exported textiles and garments to 23 nations between 2007 and 2011, however, most of them only imported items in one of those years.

This indicates that commercial ties have a very poor survival rate, with Palestinian exporters failing to turn new clients into regular customers. Only Israel, Jordan, and Japan received imports from the State of Palestine in each of the five years, in four of the five years, the United States and Algeria imported from the Palestinian Authority. These nations have untapped potential that should be pursued further.

Export performance of textile and fashion industry in Palestine

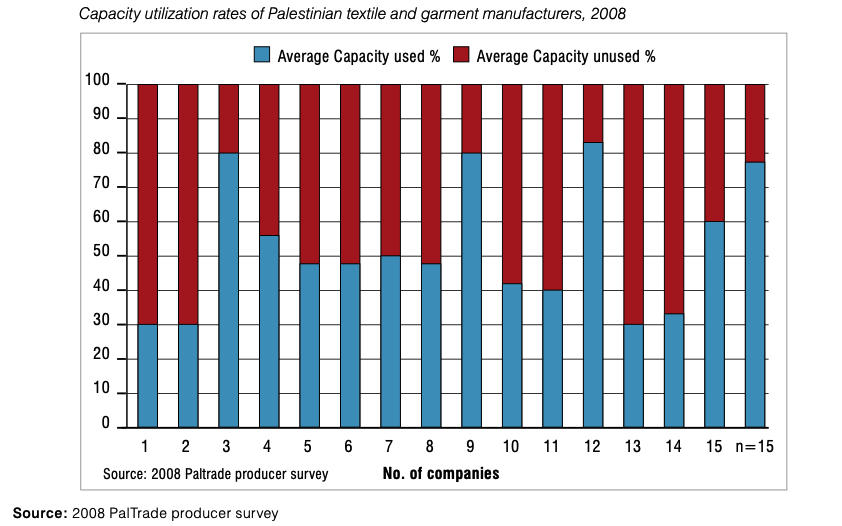

Only 5-7 of Palestine’s major businesses have exported before. Further pricing pressures from cheap imports will force businesses that are currently running at low capacity utilization rates to choose between exporting and shutting.

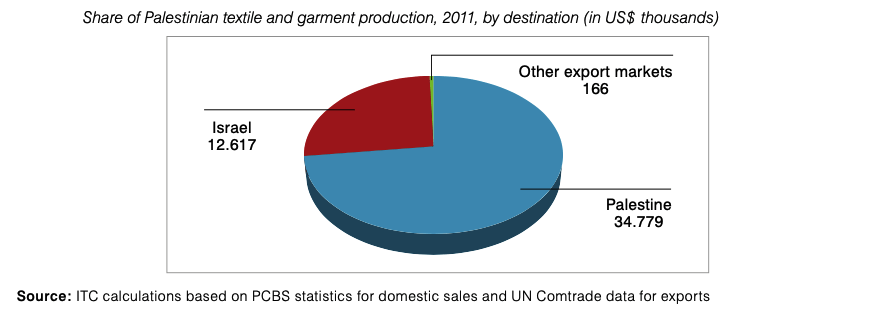

The size of the Palestinian domestic market has substantially recovered since 2005, reaching US$123 million in 2011, although local manufacturers’ market share remains low at 28 per cent.

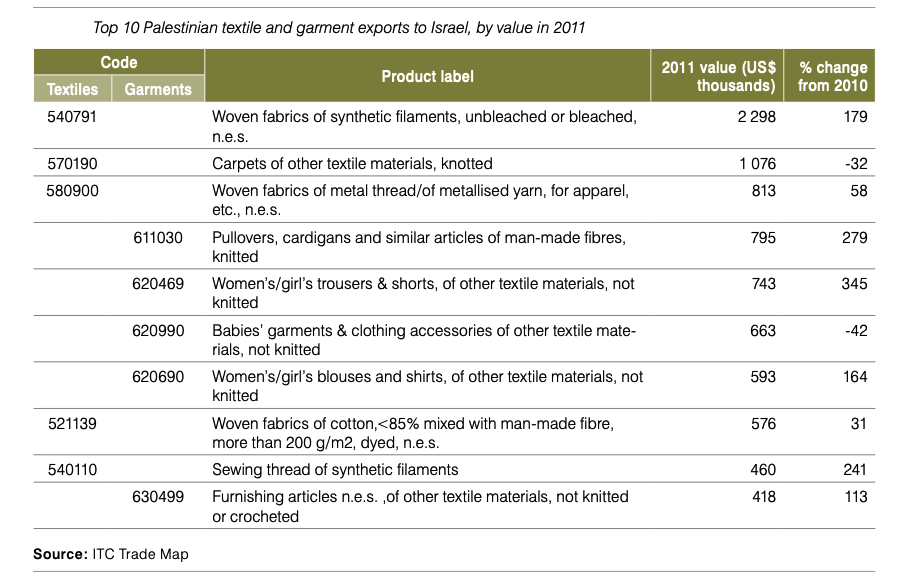

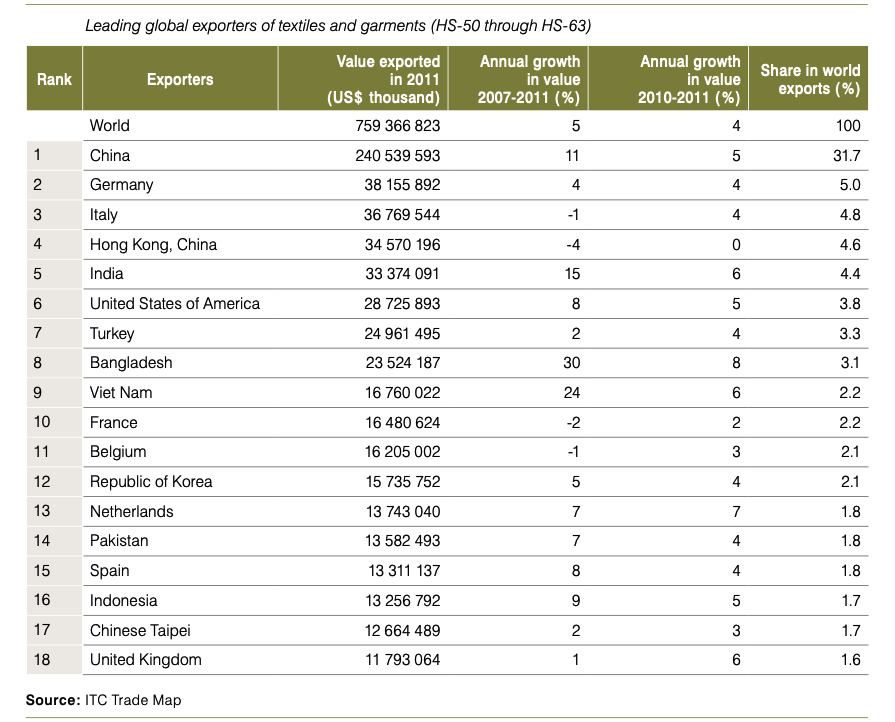

Between 2007 and 2011, the State of Palestine exported textiles and apparel worth an average of US$12.8 million each year. 98.4% of this travelled to Israel in the form of 82 distinct items classified at the 6-digit level of the Harmonized System (HS). Approximately half of this was finished apparel (HS-62 and HS-63), most of which was apparently for selling in Israel and did not indicate the type of output subcontracting operation that would allow Palestine entrance to a far larger worldwide market.

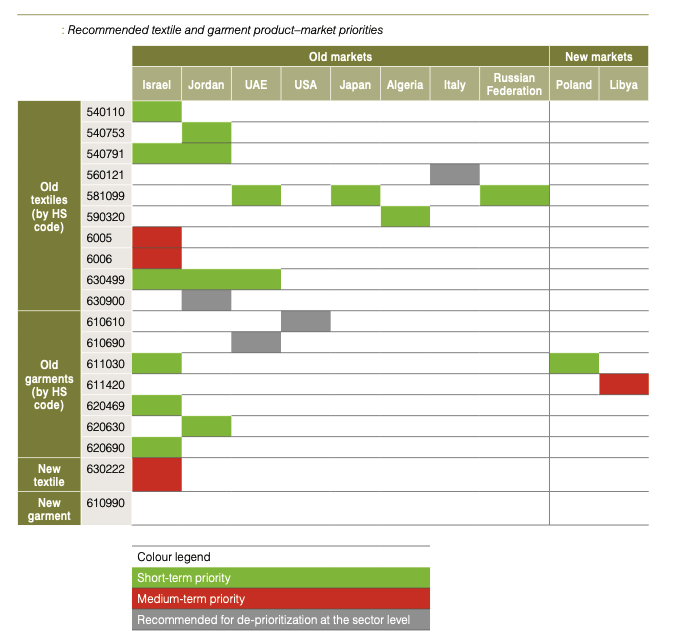

A decomposition study of Palestine’s negative export growth reveals that no new items are being exported, no new markets are being reached, and existing products sold in old markets are declining significantly. In reality, a large number of items are being phased out. This is the trend of a declining industry, and reversing it would need a different approach.

The global market of the textile and fashion industry in Palestine

A growing number of Palestinian businesses are exporting directly to the United States, Europe, and other Arab countries. Also, take pleasure in Palestine’s signing of free trade agreements with the United States and Europe, which offer them attractive export and investment terms.

The textile and fashion industry in Palestine had a huge impact on the global market. The State of Palestine exported textiles and apparel to 23 countries between 2007 and 2011. Only Israel, Jordan, and Japan received imports in all five years, whereas thirteen of these nations got imports in only one of the five years.

This indicates that commercial ties have a very poor survival rate, with Palestinian exporters failing to turn new clients into regular customers. The assistance offered to the Palestinian textile and apparel industry by trade services institutions (TSIs) may be listed as follows:

• Policy support

• Trade services

• Business services

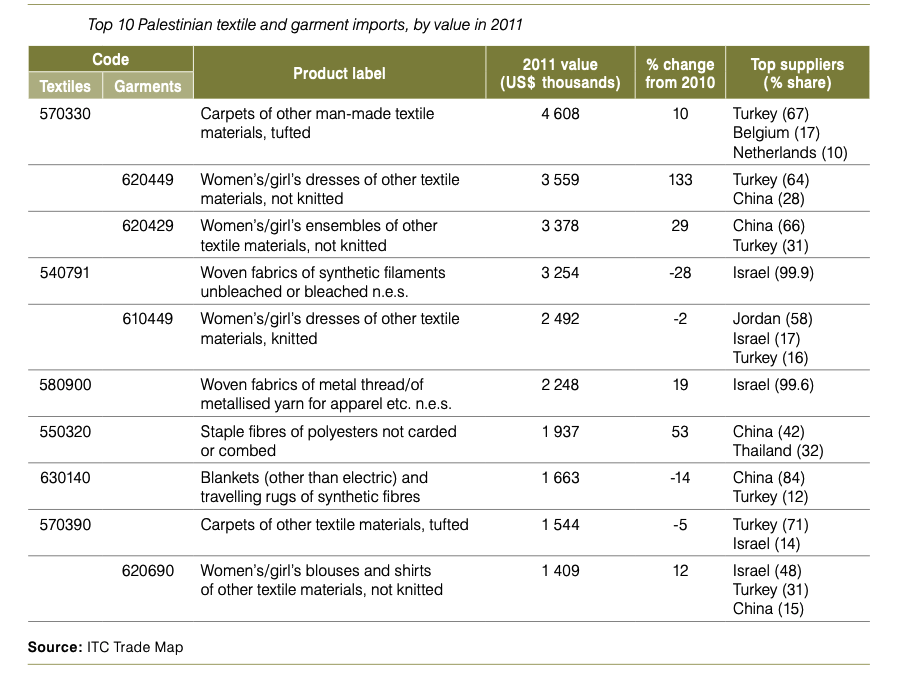

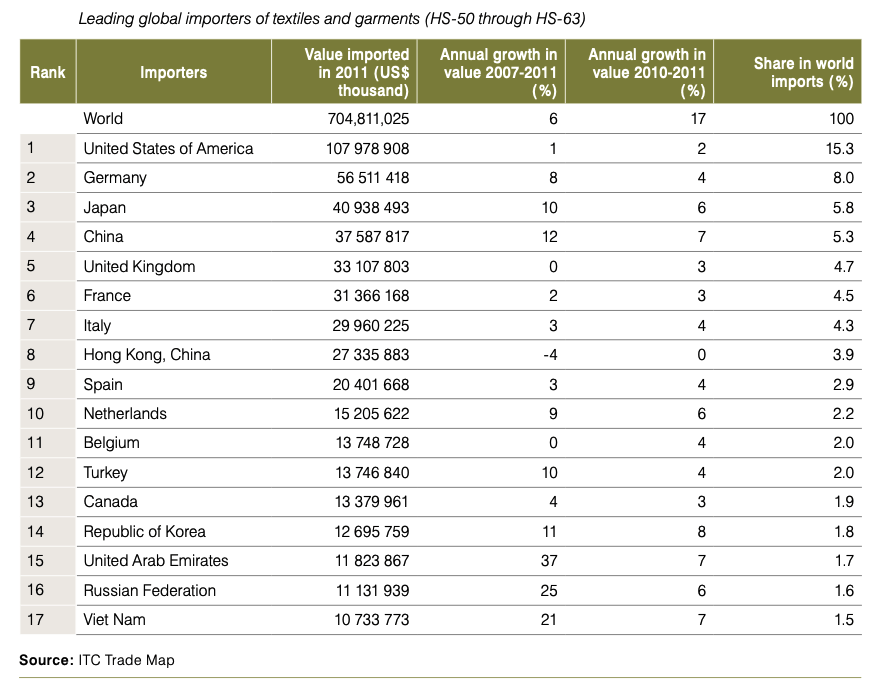

China is the most important exporter to the State of Palestine’s major market, Israel, as well as the other seven nations where Palestinian exporters have made significant advances. Other rivals vary per market, although Turkey, India, and Italy are all among the top five competitors in at least half of them.

Future of the textile and fashion industry in Palestine

The textile and fashion industry in Palestine was once a foundation of the economy, but it has been rapidly declining for a decade, by worldwide trends. In this context, an ambitious but feasible sector vision is to become an export-oriented sector with a high socioeconomic effect by specializing in higher-end and specialty goods and acquiring the necessary skills, technology, and market intelligence in a focused, coordinated, and decisive manner.