- Group order intake significantly increased by 23% year-over-year; book-to-bill well above 1, driven by both divisions.

- Group sales increased by 23% year-over-year to CHF 698 million.

- Group operational EBITDA increased by 31% compared to the prior year, leading to an operational EBITDA margin of 17%.

- Confirming full-year guidance.

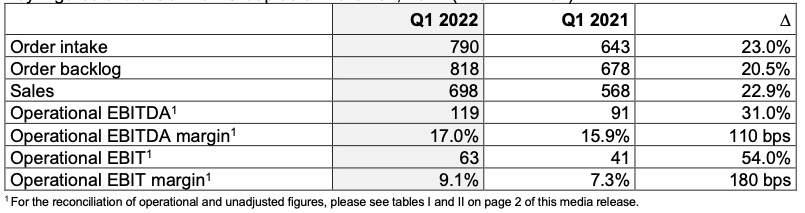

Key Figures of the Oerlikon Group as of March 31, 2022 (in CHF million)

“We achieved strong growth in both top line and profitability in the first quarter, continuing our growth trajectory and confirming our strategy to deliver sustainable profitable growth,” said Roland Fischer, CEO Oerlikon Group.

“Polymer Processing Solutions recorded another very strong quarter, with orders and sales growth, driven by both filament and non-filament businesses. Surface Solutions saw an increase in sales in general industries and aerospace, while supply chain shortages continued to impact some markets,” added Fischer.

“We are pleased to have published our 2021 Sustainability Report at the end of the first quarter, highlighting the sustainability progress in our operations toward our 2030 targets and many examples of how we support customers to improve their climate footprint and efficiency,” concluded Fischer.

Strong First-Quarter Performance

Group orders increased by 23.0% to CHF 790 million. Group sales improved globally by 22.9% to CHF 698 million, driven by both divisions. At constant exchange rates, Group sales increased by 25.5%.

Group operational first quarter EBITDA was CHF 119 million, or 17.0% of sales, representing a year-over-year improvement of 110 basis points (bps). The margin improvement was attributed to sustained cost control and positive operating leverage. First quarter operational EBIT was CHF 63 million, or 9.1% of sales (Q1 2021: CHF 41 million; 7.3%).

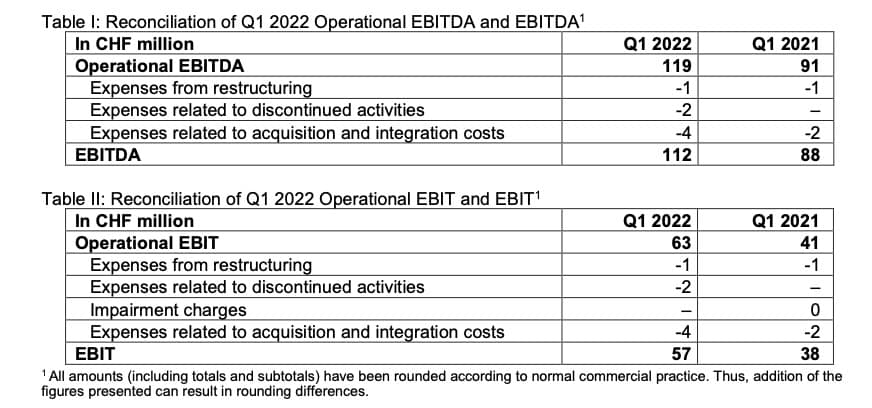

Group first quarter EBITDA was CHF 112 million, or 16.1% of sales (Q1 2021: CHF 88 million, 15.4%), and EBIT was CHF 57 million, or 8.2% of sales (Q1 2021: CHF 38 million, 6.7%). The reconciliation of the operational and unadjusted figures can be seen in the tables below.

Division Overview

Surface Solutions Division

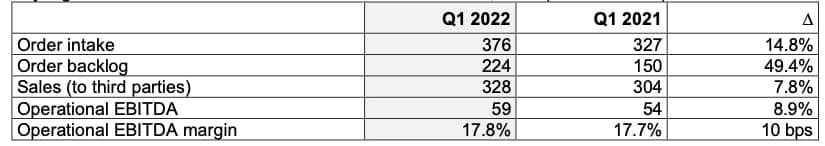

Key Figures of the Surface Solutions Division as of March 31, 2022 (in CHF million)

The division increased order intake by 15% and sales by 8%, attributed to higher demand in general industries and a slight recovery in aerospace in the US. The book-to-bill ratio was higher than 1.1, reflecting the ongoing demand in the longer-cycle business. At constant exchange rates, division sales increased by 10.4%.

Operational EBITDA improved by 8.9% to CHF 59 million, or 17.8% of sales, compared to CHF 54 million, or 17.7% of sales in Q1 2021. Positive operating leverage and cost control were largely offset by temporary shortages in some high-margin businesses. Operational EBIT was CHF 21 million, or 6.2% of sales (Q1 2021: CHF 15 million, or 4.8% of sales).

First quarter EBITDA was CHF 56 million, or 17.0% of sales, compared to CHF 53 million, or 17.5% of sales in the previous year. EBIT was CHF 18 million, or 5.4% of sales (Q1 2021: CHF 14 million, or 4.6% of sales).

Polymer Processing Solutions Division

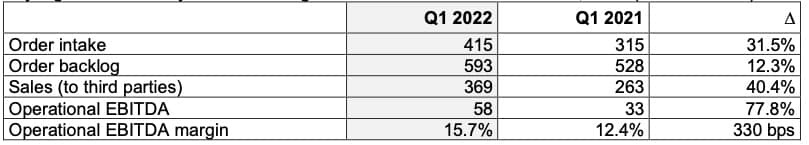

Key Figures of the Polymer Processing Solutions Division as of March 31, 2022 (in CHF million)

The division delivered another strong quarterly performance. Order intake increased by 31.5% to CHF 415 million. Sales significantly increased by 40% to CHF 369 million year-over-year across all regions. Growth was driven by filament and non-filament end markets and includes a 15% sales contribution from Oerlikon HRSflow, which was acquired in 2021. At constant exchange rates, sales increased by 42.9%.

Operational EBITDA notably improved by 78% to CHF 58 million, or 15.7% of sales, compared to CHF 33 million, or 12.4% of sales, in Q1 2021. Margin improvement was driven by positive operating leverage, cost control and the INglass acquisition. Operational EBIT was CHF 44 million, or 12.0% of sales (Q1 2021: CHF 24 million, or 9.3% of sales). EBITDA was CHF 58 million, or 15.7% of sales (Q1 2021: CHF 33 million, 12.4%). EBIT was CHF 44 million, or 12.0% of sales (Q1 2021: CHF 24 million, or 9.3% of sales).