Mayer & Cie. reports it has above average, increasing market share in Turkey

In pandemic year 2020, circular knitting machine manufacturer Mayer & Cie. (MCT) has further improved its position in Turkey. The country continues to be one of the company’s strongest and most consistent sales markets.

Even in difficult years, the manufacturer and its longstanding Turkish representative Mayer Mümessillik have achieved positive results.

The reasons for this year’s success, as Mayer & Cie. sees it, are the transfer of production to locations close to Europe, Turkey’s state-of-the-art machinery and the increase in demand for comfortable clothing that is suitable as home office wear.

Turkish market is a growth market despite corona setback

“Compared to 2019, we anticipate a growth in the Turkish market even though the corona situation was a serious setback in the second quarter of 2020,” said Stefan Bühler, Mayer & Cie.’s regional sales manager for Turkey.

Mayer & Cie. got off to a strong start on the Bosporus in the first quarter of 2020 with additional positive effects until mid-March. This was due to a desire for production locations close to Europe. In the second quarter, during the lockdown, demand largely ground to a halt. Government measures helped to cushion the downturn.

Ahmet M. Öğretmen, general manager of MCT’s Turkish sales partner Mayer Mümessillik, noted: “In the second quarter, GDP was down by about 10 percent, so we got off lightly.”

Since July 2020, orders for Mayer & Cie. circular knitting machines have bounced back again. Ahmet M. Öğretmen sees an interplay of reasons for this recovery. The main reason, he said, is the low exchange rate of the Turkish lira, which has boosted exports of ready-made textiles.

The Turkish daily Hürriyet reports, with reference to the Turkish state news agency, 11 percent year-on-year growth in August 2020. The most important export markets, the newspaper says, are Germany, the United Kingdom and Spain. Between them, they account for around half of exports totaling 1.27 billion euros. “This demand

must be fulfilled,” Öğretmen says. “That leads to investment in machinery by manufacturers.”

Relanit Is Synonymous With Single Jersey

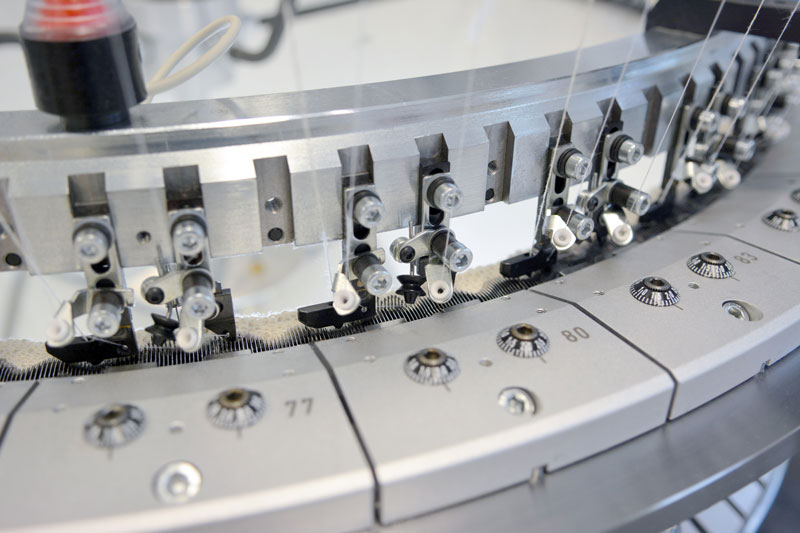

The machines of choice for Turkish knitwear manufacturers are regularly Mayer & Cie. machines. The long-established German firm’s share of the Turkish market is substantially higher than in other markets. The manufacturer’s position is particularly strong in the market for plain single jersey fabrics, with the Relanit 3.2 HS being the machine of choice. It achieves an extraordinarily high level of productivity, especially in processing elastomer yarns. It also handles a wide range of yarns reliably.

“Interlock Is Mayer & Cie.”

Mayer & Cie. is a specialist in the second major circular knitting discipline, rib and interlock fabrics. “Interlock is Mayer & Cie.,” says Ahmet M. Öğretmen, putting it in a nutshell. The machines used for double jersey fabrics are the OV 3.2 QCe, the D4 2.2 II and the D4 3.2 II.

The OV 3.2 QCe knits interlock, 8-lock structures, spacers and fine gauge with 3.2 systems. The D4 2.2 II is another stalwart for rib, 8-lock and interlock. The 8-lock D4 3.2 II is the machine of choice for firms that want to manufacture structures such as piqué, Punto di Roma or thermal in addition to interlock.

The MBF 3.2 is another top seller in Turkey. A three-thread fleece machine, it knits fabrics for sports and leisurewear such as hoodies and is very much in keeping with the trend in home office year 2020. “Comfortable clothing is circular knitted,” says Ahmet M. Öğretmen, “and we benefit from that of course.”

State-Of-The-Art Machine Parks Are In Turkey

Another advantage is the modernity of the Turkish machine park, which is doubly attractive in view of Turkey’s weak currency. “In the past 10 to 20 years there has been very heavy investment in high-quality machines,” said Mayer Mümessillik General Manager Öğretmen. “As a consequence we have the world’s youngest and most up-to-date production facilities.”

Combined with geographical proximity to the main export markets in Europe that should prove a growth driver in the years ahead — and keep demand for Mayer & Cie. machines brisk and high.