Textile industry has been an age-long cottage industry in Nigeria, considering that Aso-Oke, Akwete as well as the dyeing pits of Kano constitute part of our cultural heritage. They are still there today because clothing is one of the major needs of man.

However, modern textile manufacturing in the country started in the 1950s. The first factories were those embarked upon by the regional governments as deliberate programmes of promoting industrial development through policy of import substitution industrialization.

This led to the establishment of Kaduna Textile Mills Limited in Kaduna in 1956, Nigerian Textile Mills Limited in Lagos, Aba Textile Mills Limited in Aba, and Bendel Textile Mills Limited in Asaba in the early 60s.

The next major outfits came on board when erstwhile textile importers/merchants, invariably of Lebanese and India origins decided to transform themselves into manufacturers. The Indian dominated the Lagos axis while the Lebanese dominated Kano. This transformation was the single most significant impetus to the growth of the textile industry in Nigeria. These groups still dominate the industry. Later, the Chinese and other nationals joined the investors in the industry. It is on record that from less than 5 units in the early 1960s, the textile industry had as many as 175 units by mid-80s.

Also Read: CBN invests N120 bn to revive Nigeria’s textile sector

Various government policies led to further development in the industry so that later, many units are fully integrated i.e. their operations cover the entire processes of textile production – spinning, weaving, printing, dyeing, finishing and make-up. Some have also integrated backwards into cotton farming.

Some involved themselves in high-technology projects for the manufacture of polyester stable fibre (PSF), Partially Oriented Yarn (POY) and Polyester Filament Yarn (PFY) all of which have direct linkage with the Petrol-chemical industry. There was the promise, from the Government, That the country’s Petrol Chemical industry would provide necessary raw materials for these factories. The non-functioning of the petrol-chemical industry in Nigeria has left the huge investment to waste away.

In its flourishing days, the industry had state-of-the-art textile machinery which surpasses any other sub-Saharan country., and the total textile machinery in the country far surpasses that of all remaining sub-Saharan countries put together.

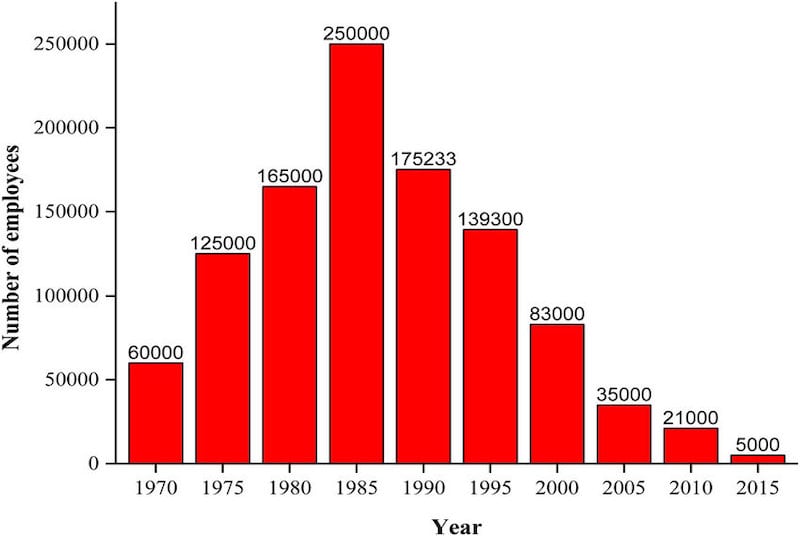

The industry had an installed capacity of about 1.7 billion metres of fabrics and is capable of providing direct employment for about 250,000 workers, that is besides those who are employed in the cottage sector of the industry, especially in garmenting, and used to be the largest employer of labour after the government.

THE HISTORY OF NIGERIA’S TEXTILE INDUSTRY

In the 1960s, there was a belief that the key to economic growth was in manufacturing. This was before the blessing and the curse of crude oil was discovered in the Niger Delta. At independence and in every successful economy in the world manufacturing was to be a major component as in the case of textiles in Nigeria.

In the 1960s, foreign investors came from the United Kingdom. This was typical because Nigeria was a former colony of the United Kingdom. During the same period Chinese investors came to the Kaduma region of Nigeria. These were Chinese people from Hong Kong and saw Nigeria as a golden opportunity to establish their businesses in the post-colonial era. There are a few facts worth noting:

Kaduma became the textile capital of Nigeria just after independence. About 1 million workers were employed directly in the textile industry.

Several million Nigerians were employed in the textile supply chain as farmers and gin processors and distributors of finished cloth.

In the 1970s, Nigeria produced textiles not only for domestic consumption but for regional export throughout West Africa. At the time, Nigeria produced 50% of all of West Africa’s textiles and was the 2nd largest producer in Africa. Nigeria exported textiles to the United Kingdom.

In the 1980s, the textile industry was the largest private employer in Nigeria. The textile industry in Nigeria was the 2nd biggest employer after the government.

However, the textile industry in Nigeria, collapsed for various reasons:

Inept government officials

During the 1980s, the Nigerian Naira collapsed after the decline of in crude oil prices. The Nigerian government had borrowed money under the assumption that oil prices would continue to rise. At the time, the government was over leveraged with debt equal to the size of the country’s GDP.

Foreign supply chain vs local suppliers

The textile industry also collapsed because, as Nigerian companies became extremely profitable they abandoned local suppliers and neglected to purchase raw materials and equipment from the local industry. The Nigerian thought process because of low self-esteem valued imports and textile firms tended to purchase overseas materials. Equipment companies closed and when the local industry profits began to decline the owners could not afford the spare parts or new equipment which made manufacturing less efficient and more costly.

Technology

Another reason the textile industry collapsed is because, Asian countries such as South Korea and China improved technology and efficiency in their production and forced American companies to move to Asia, Europeans textiles to moved to Asia and of course African countries could not compete with these efficiently run firms.

Economic espionage from China

Lastly, the Nigerian textile industry collapsed because the Chinese stole Nigerian patents and intellectual property. China is accused of stealing designs and cloths. Although history proves otherwise, there is an unsubstantiated theory that the key to Africa’s growth is the ability to attract foreign investors. Though there is no data to back up this belief system African policy makers. It is evident from the textile story that local manufacturing is more important than foreign investors, yet all the focus is on foreign investors. Lets start local.

The Nigeria fashion industry, with its creativity in the use of fabrics to produce alluring styles, is merely standing on one leg.

Past governments, through their unstable policies, succeeded in diminishing efforts of enterprising designers, including Frank Oshodi, Zizi Cardow, Lanre Da Silva, Lisa Folawiyo, Deola Sagoe, among others, who, despite all these, are making waves across the world, while exploring the African Ankara and other local fabrics with flora and fauna prints.

These designers now spend huge sums of money to import fabrics, which is 1980 and 1990 were sourced locally.

Reports say currently, out of the over 300 textile companies that were scattered across the country, providing numerous fashion designers with quality fabrics to dress Nigerians, and for export, only 25 of them are still in operation. This number, aside from being too low and malnourishing, the haute couture sub-sector of the fashion industry, becomes a source of concern when the textile mills are operating very well below capacity – about 20 per cent of their installed capacity.

And from the look of things, the situation may not improve any time soon as virtually all the textile mills are laden with a plethora of challenges, including funding and inadequate power supply. This means, if the authorities concerned are not proactive in sustaining the height, which the fashion industry has reached, it would get to a level where its productivity will nosedive, and those making waves within and outside the country thrown into the already saturated labour market or forced to migrate to other countries to showcase their talents. This would not only mean loss of Internally Generated Revenue (IGR), but also a drop in the nation’s Gross Domestic Product (GDP).

According to research findings by Euromonitor published in 2019, the African fashion market is worth $31b, with Nigeria accounting for about $4.7b (15 per cent) of it. The figure is not only lower than South Africa’s current share of ($14.4b), though Nigeria has nearly four times its population, it can be improved upon with the nation’s rising population and resourceful youth.

While the report also puts the estimated value of Africa’s share of the global fashion industry market at about $2.5t, some designers and stakeholders in the industry believe that Nigerian couturiers would only get a sizable part of the market if different tiers of governments partner with them to remove all bottlenecks that are crippling the sector, and stopping it from emerging the leader in the sub-Saharan market.

In the past, the National Bureau of Statistics (NBS) revealed that the textile, apparel and footwear sector has, since 2010, recorded a growth rate of 17 per cent, which was as a result of an increase in demand for and, partly by unprecedented initiatives that continue to push the Nigerian fashion globally.

Many designers and stakeholders have noted that what is happening is not healthy for the sector, and the nation’s economy, as it has negatively affected pricing, aside from rendering able-bodied people jobless.

They also observed that for the country to sustain its pride of place and have a flourishing haute couture, which is a major part of the fashion industry, its textile mills must be functional.

Outset Of The Rot

FROM the 1980s to 1990s, Nigeria was known across the West African sub-region and the world for its burgeoning textile industries, which recorded a yearly growth of 67 per cent, and engaging about 25 per cent of workers in the manufacturing sector.

During this period, about 600,000 local farmers across the country grew and supplied cotton to the Cotton, Textile, and Garment (CTG) industries. But today, many of these industries have gone underground and the 25 that are still operating are not meeting up with local demands, making the nation to depend heavily on imported fabrics from Europe, United States, China, India, Saudi Arabia, among others to sustain its local fashion industry.

The Acting General Secretary, National Union of Textile, Garment and Tailoring Workers of Nigeria, Ali Baba, but the woes of the Textile, Garment and Tailoring sector on government and its never-ending policy somersault.

He traced the origin of the problems to 1995 when Nigeria replaced the Multi-fibre Agreement (MFA) with the World Trade Organisation’s (WTO) Agreement on Textiles and Clothing (ATC).

The scribe pointed out that with the replacement, Nigeria had to remove all protection of its local textile industry, adding that it would have been proper for the nation’s policymakers to first, secure special arrangements with the WTO, such that its local textile industries would be protected until they were able to stand on their feet.

According to him, the WTO agreement opened the Nigerian market to cheaper textile imports, predominantly from China, as well as second-hand clothing from the United States and Europe.

However, before the expiration of the MFA, the United States had introduced the African Growth and Opportunity Act (AGOA), an initiative that opened up the American market to African countries to export to the U.S., but instead of African countries enjoying the window opened to them, China with its textiles proved stronger and took over the U.S. market.

This, on its own, set most African countries backward, as many of them, particularly Nigeria, is yet to recover from the setback.

Ailing Textile Industries In Kaduna, Kano

In Kano, quarters including Sharada Phase I and II, Challawa and Bompai are well-recognised as industrial hubs with textile companies manufacturing different fabrics scattered around it.

Largely dominated by Lebanese businessmen, the old famous sector has a history of providing employment opportunities for the teeming youths in the North.

Conversely, the good old stories of the 1980s and 1990s of textile industries in Kano have changed. The booming sector that accounted for almost 20 large-scale industries can hardly produce five ailing factories, running above 50 per cent capacity.

The acting General Secretary, National Union of Textile, Garment and Tailoring Workers of Nigeria, Ali Baba, identified epileptic power supply, lack of patronage, and invasion of foreign fabrics dominating the markets as part of factors hindering the growth of the local textile industries.

According to him: “Power remains one of the critical challenges killing textile industries in northern Nigeria, especially in Kano and Kaduna, where factories dominate. Our power generation has not exceeded 5, 000 megawatt in a long time. Sometimes, we have as low as 2,500 or 3,000 megawatts. This is not enough to run a successful textile industry.

“Aside from smuggling and counterfeits, foreign textiles are another major challenge. Local fabrics are synonymous with Nigeria and northern Nigeria in particular because the first textile industry in Nigeria was situated in Kaduna State.

“Unfortunately, we now have a situation where criminal elements take the best of our designs to China to reproduce and return to Nigeria to sell them within the range of N3, 000 to N4, 000.”

Baba disclosed that Nigerians and not Chinese are to be blamed for our woes in the sector because it is the Nigerian businessmen that usually take the samples of our local fabrics to China to reproduce.

He noted that even with the closure of the country’s borders, Nigerians could not exhaust Chinese fabrics already stocked in different warehouses across the country for the next seven years.

Commenting on various interventions aimed at rejuvenating the sector, the Acting General Secretary noted that such interventions have not begun yielding any meaningful fruits because of other issues, including infrastructure, quality, and standard, the market, taxation, among others have not been properly handled.

“Textile factory owners pay the cost of demurrage when they have not even sourced funds to clear their raw materials at the seaports, or transport them up North. There are multiple taxes on the road, aside from other risks. The Federal Government needs to reduce all these liabilities and make policies that will mandate agencies and departments to patronise locally produced products,” he stated.

A National Council member of the Manufacturer Association of Nigeria (MAN) and Managing Director of Tofa Textile Limited, Sulaiman Isiyaku Umar, also decried the sad state of textile industries in Kano, considering the huge economic viability and employment opportunity abound in the sector.

Umar also attributed the failing state of the textile industry partly to inconsistent government policies that stagnate the system as soon as there is regime change, aside from the huge and multiple taxations from various government agencies.

Saving A Sinking Sector

REALISING that Nigeria is losing over $4b yearly for opening its borders to foreign textile companies to bring in fabrics into the country, the government placed a ban on imported finished textiles, in order to protect local manufacturers and designers. Despite this, smuggling has persisted, especially through the Benin Republic, Chad, and Niger borders.

According to the Director-General, Nigerian Textile Manufacturers Association (NTMA), Mr. Hamma Kwajaffa, about 85 per cent of textiles sold in the country are smuggled, and the country loses around $325m in potential Value Added Tax (VAT) revenue annually from this.

To revamp dormant textile industries, the Bank of Industry (BoI) in 2010, released N30b as a grant to the textile industry, as part of the Cotton, Textiles and Garment Industry Revival Scheme passed at the end of 2009. The Kaduna textile industry received an N24b grant, which was part of the N100b expected to be injected into the industry.

The then Vice President, Namadi Sambo, disclosed that the initiative would create jobs for more than 2, 000 Nigerians. After the presentation, the programme went like others, as nothing much was heard of it. The factories are still not producing as expected.

However, in continuation of the government’s intervention, the Central Bank of Nigeria (CBN), early last year, placed a restriction on the sale of foreign exchange to importers of textiles and other clothing materials in the country, stating that the measure would reposition the textile, cotton and garment industry to provide jobs, create wealth and ginger the economy.

In addition to this, the government would provide loans at 4.5 per cent interest rate to textile manufacturers at a single digit interest rate to enable them to retool and upgrade their factories to produce high-quality textile materials for the local and export markets.

Aside the Anchor Borrowers Programme, the CBN Governor, Godwin Emefiele, said not long ago that the bank would support local farmers to grow cotton for textile firms, as well as support efforts to source high-yield cotton seedlings to ensure that yields from cotton farmers meet global standards.

Emefiele also disclosed that the apex bank would support the creation of textile production centres in designated areas, stressing that the government has begun discussions with the Kano and Kaduna states’ governments to establish textile industrial areas to guarantee stable electricity in those industrial areas.

The Real Situation

THE former National Chairman of the Nigerian Textile Manufacturers Association (NTMA), Ibrahim Igomu, said the ban placed on imported textile and finished clothing does not mean that the country would automatically stop buying textiles or clothing from other countries.

He explained that the policy would only discourage importers from sourcing textile materials from overseas, but to look inwards and source their raw materials locally.

For Hilary Nwosu, a fashion designer, repositioning the textile industry was beyond mere policymaking as most times, the government would speak from both sides of their mouths, a development, which made operations in the sector unstable.

Nwosu, the proprietor of Hilary Couture, called for a sustainable blueprint, which subsequent governments would use as a guide to steer the fashion industry in the right direction.