In this exclusive interview, we delve into the world of India’s apparel industry with Mr. Mithileshwar Thakur, Secretary General of the Apparel Export Promotion Council (AEPC). AEPC is the apex body of apparel manufacturers and exporters under the aegis of the Ministry of Textiles, Government of India.

Over the years, AEPC has transformed from a traditional trade promotion body into a comprehensive resource for apparel exporters, providing vital support and guidance to both Indian exporters and international buyers.

In this interview, Shri Mithileshwar Thakur sheds light on AEPC’s history, mission, and strategies for expanding Indian apparel exports globally, particularly in regions like the Middle East, Africa, and beyond. He also discusses the advantages of the Indian apparel industry compared to competitors like Turkey and China, as well as the role of government support through initiatives such as the MAI Scheme.

Join us as we explore the past, present, and future of India’s thriving apparel sector and AEPC’s instrumental role in its success.

India AEPC:

Empowering Apparel Exporters for Global Success

The Apparel Export Promotion Council (AEPC) is an apex body of apparel manufacturers and exporters under the aegis of the Ministry of Textiles, Government of India.

It has evolved from a mere trade promotion body involved in organizing traditional exhibitions/fairs abroad to a one-stop shop for apparel exporters providing trade facilitation services on one hand and hand-holding to apparel exporters on the other.

AEPC’s policy advocacy efforts are based on stakeholder consultations and industry feedback on the variety of issues including policies and schemes related to apparel manufacturing, exports, tariff and non-tariff barriers, rebates/ refund of duties and taxes, FTA negotiations/utilization, Rules of Origin issues and other important policy interventions in the textile value chain to promote export of apparel and garments.

AEPC’s trade promotion, capacity building and outreach activities are centred around Buyer-Seller Meets, reverse-seller meets, and roadshows. training programs, seminars/webinars, market intelligence and research services, online grievances redressal platform, virtual B2B platform, efforts on sustainability and traceability, focus on Industry 4.0, media outreach, etc.

With its head office in Gurugram and pan India offices in major garment manufacturing clusters/regions of the country, the AEPC collaborates with the union government, state governments, startups, young/women entrepreneurs, international organizations, global media, academia and other agencies involved in the entire supply chain of readymade garment manufacturing and export to bring industry issues to the forefront.

AEPC’s Mission:

Empowering Indian Apparel Manufacturers for Global Expansion

AEPC is the official body of apparel exporters in India that provides invaluable assistance to Indian exporters as well as importers/international buyers who choose India as their preferred sourcing destination for garments. We aim to promote ‘Made in India RMG’ to the world.

For Indian apparel exporters, AEPC is quite literally a one-stop shop for information; advice, technical guidance, market intelligence, policy advisory and trade facilitation. Members have access to updated trade statistics, potential markets, information on international fairs and assistance in participating in these fairs. It also plays a large role in identifying new markets and leading trade delegations to various countries.

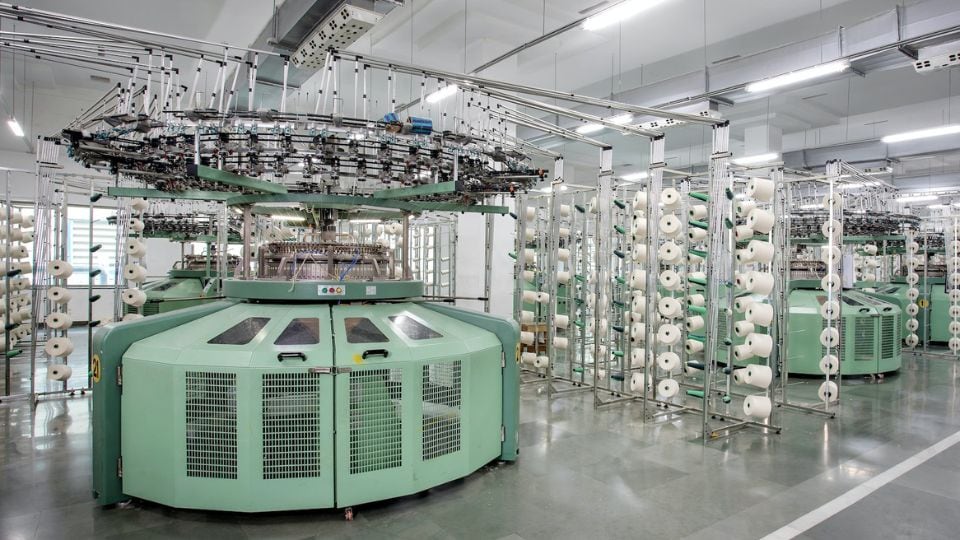

In recent years AEPC has worked tirelessly in integrating the entire industry – starting at the grass root level of training the workforce and supplying a steady stream of manpower to the industry; identifying the best countries to source machinery and other infrastructure and brokering several path-breaking deals for its members and finally helping exporters to showcase their best at home fairs as well as international fairs the world over.

Unlocking Growth:

Indian Apparel Manufacturers in the Middle East and Africa

Africa’s apparel import was USD 7175.05 million in 2022 in comparison to USD 7093.16 million in 2021 registering a growth of 1.15% as per data sourced from ITC 2023. Similarly, the Middle East’s apparel import increased to USD 19639.71 million in 2022 compared to USD 18312.22 million in 2021 registering a growth of 7%.

However, India’s apparel export to Africa has not kept pace with the increasing demand in the African market and has declined to USD 586.22 million in 2022 in comparison to USD 743.12 million in 2021 (a decline of 21%). Similarly, India’s apparel export to the Middle East declined to USD 2107.87 million in 2022 in comparison to USD 2685.60 million in 2021 (a decline of 21.5%). All this clearly implies that there is untapped potential for growth of the Indian apparel sector in the African and Middle East markets.

The Indian apparel sector has immense potential to grow in the Middle East and Africa due to a variety of reasons: Within the Middle East region UAE and Saudi Arabia are two major apparel export destinations for India with a share of 7.6% and 2.3% respectively in 2022-23 in the overall apparel export from India.

Also, India is well placed in manufacturing various types of yarns and fabrics catering to the demand from Middle East and African markets while African apparel manufacturing firms have cut, make and trim capability and rely on imported textile materials arranged by buyers and brands. The same goes for cotton production. Most of the cotton produced in the African region is sold to Asian countries that process it into yarns and fabrics.

Another major reason for India to grow in Africa and Middle East is that in comparison to European or Japanese buyers, African and Middle Eastern buyers tend to give bulk order of basic clothes which allows workers to focus less on designs and trends.

The tariff on the import of apparel from India though is very high in most African countries. With FTA with UAE, Indian apparel now enjoys duty-free access and thus over the next few years, there will be substantial growth in Indian apparel export to this region through the UAE route as UAE acts as a major gateway to Western Asia and the African Continent.

Exploring the African Frontier:

India’s Plan for Textile Market Expansion

Indian apparel exports have largely been USA & EU centric over the years. This has made apparel external trade vulnerable to any recessionary trend or downturn in these economies. The need of the hour is thus to aim at every possible means of market diversification.

Recent data of BGMEA also suggest that Africa’s apparel import from some of the Indian competitors like Bangladesh is very high and is registering a double-digit growth annually (for example, Bangladesh exported apparel worth USD 74.55 million between Jan-July 2023 to South Africa resulting in an increase of 23.63% over exports of USD 68.29 million made during the same period in previous year.

This clearly indicates that India also needs to focus on some of the key markets in Africa such as South Africa, which can emerge as an important market in future.

With regard to the future action plan, AEPC is adopting a 3-step approach:

- Diversification from cotton apparel products to MMF-based apparel and technical textiles products; bringing FDI in MMF segment – (a) encouraging FDI in the entire value chain of MMF apparel product segment, to correct the product mix in India’s export basket in order to bring it in sync with the global demand (b) extensive promotion of Government of India’s PLI and PM MITRA schemes among apparel exporters.

- Market diversification with a focus on new trading partner countries; organizing a series of Reverse Buyer Seller Meets (RBSM) focusing on FTA market countries, for example in February 2023 AEPC organized RBSM targeting Japan. Similarly, organising a series of Buyer Seller Meets (BSM) and participating in garment fairs in traditional as well as new market countries such as South Africa.

- For overall apparel export promotion, organizing a number of capacity-building programs, webinars/seminars and road shows on NTBs, FTA utilization and fashion/design trends in external markets.

These steps will result in the overall growth of Indian apparel exports in all overseas markets including the African market.

India’s Apparel Industry:

Competing with Turkey and China in MEA Markets

India already has an FTA with the UAE. It is its 2nd largest trading partner with a substantial share. With zero tariff across due to India- UAE CEPA, Indian apparel now, post FTA, enjoys a tariff advantage in the region vis-à-vis other countries like Turkey and China.

India is now attempting to catch up with Turkey and China in apparel exports. For example, data suggest that India’s apparel export growth was 30.4% in 2022-23 compared to 6.27% in Turkey and 3.60% in China during the same period.

India’s unique advantage in the textiles sector like in the abundance of raw materials and the presence of the entire value chain in all the fibres. India is capable of producing various types of yarns and fabrics at low cost and able to produce basic clothing at a competitive price and is thus well placed to cater to the growing demand for apparel in Middle Eastern and African markets.

The production-linked incentive (PLI) scheme which aims to incentivize capacity development of identified MMF garments, fabrics and technical textiles has been a first-of-its-kind support providing the much-needed stimulus to the MMF value chain.

Since the global apparel demand has been largely growing in the MMF segment, the PLI scheme is expected to enhance exports, especially of the value-added MMF garments. The PM MITRA Scheme aimed at creating seven mega parks compliments the other initiatives to attract investment and create infrastructure.

Both PLI and PM MITRA schemes aim at long-term capacity development and growth of the apparel sector. With these industry-friendly initiatives, apparel export from India in the MMF sector is expected to boost in the coming years.

Indian Government’s Support for International Market Expansion:

MAI Scheme

MAI Scheme of the Department of Commerce, Government of India supports wide arrays of export promotion activities. In the recent past coverage of the scheme has been widened in keeping with the demand of the exporting community, so as to give further impetus to the promotional activities undertaken by the EPCs and Trade Bodies.

This Scheme was launched in FY 2002-03 with a meagre budget of ₹14 crore, and had a corpus of ₹325.00 crore in 2019-20. A broad 20% increase was proposed in funding for WANA, West Europe, USA, CIS, NEA, ASEAN, LAC and Oceania.

As per the market for reverse BSM, there is assistance for reimbursing airfare to the visiting buyers. The government also provides support for meeting the statutory compliances and setting up testing labs for various products. Support is also offered for branding and international marketing of brand India products. For MSMEs, support in the form of freight subsidization is also given.