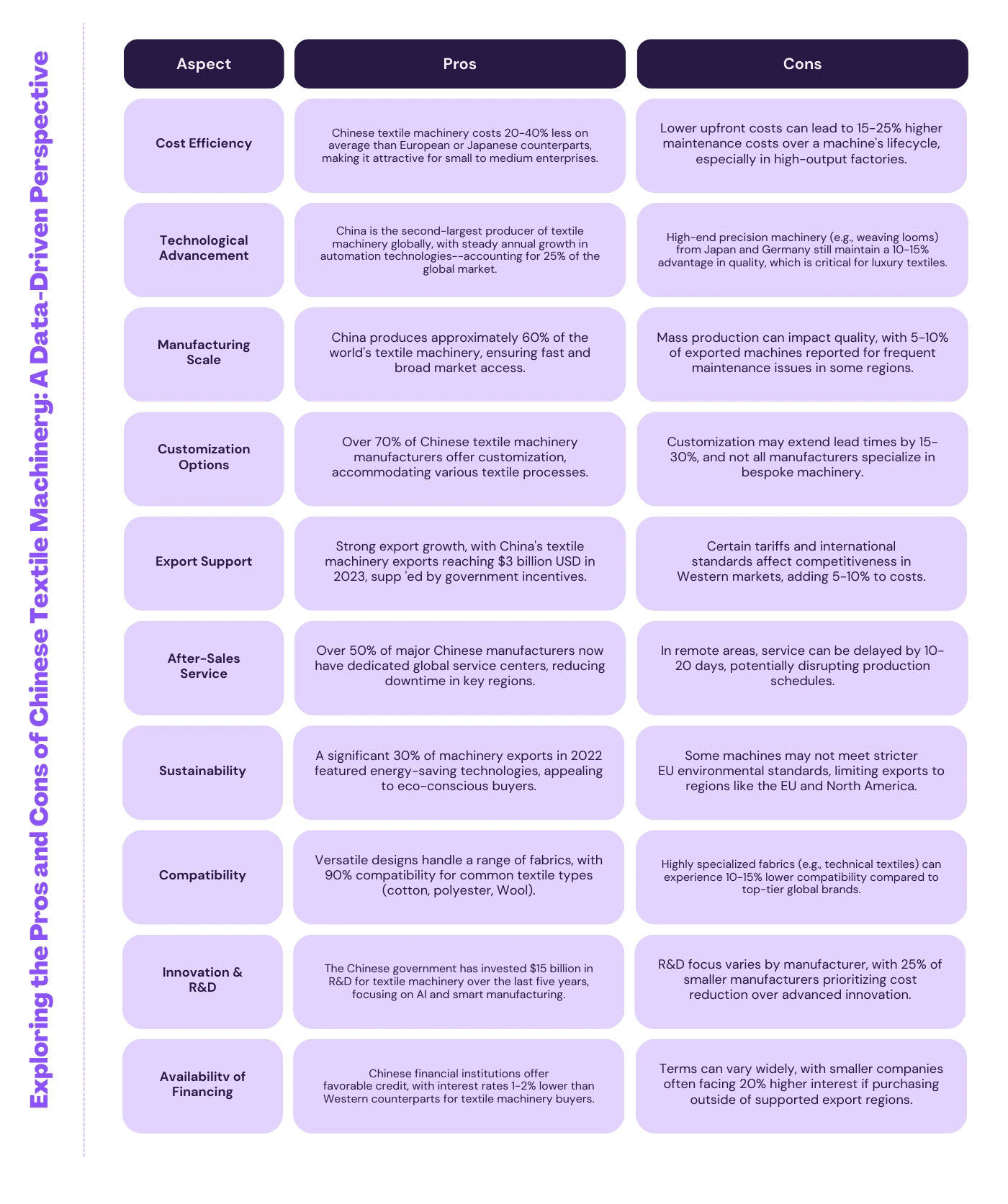

As China solidifies its position as a global leader in textile machinery manufacturing, more companies are evaluating Chinese Textile machinery for its competitive pricing, rapid technological advancements, and expansive production scale. Chinese manufacturers now provide high levels of customization, with approximately 70% of companies accommodating specialized textile processes. Additionally, the sector has seen strong export growth, reaching $3 billion USD in 2023 alone, supported by government initiatives and an increasing commitment to energy-efficient machinery.

However, while Chinese textile machinery offers considerable savings—often 20-40% less than Western brands—some challenges remain, including higher long-term maintenance costs and limited compatibility with technical fabrics. This article dives into a comprehensive comparison of the strengths and weaknesses of Chinese textile machinery, backed by statistics and insights into innovation, cost, after-sales support, and global market trends.

Below you can access all the aspects in a compact and useful table: