Discover how European companies bolster Africa’s textile industry in an insightful interview with the Kenya Export Promotion & Branding Agency. European investments, technology transfers, and market access initiatives are pivotal in shaping Africa’s textile landscape.

In parallel, explore Kenya’s textile potential, marked by its burgeoning industry, government support, and vibrant fashion scene. Gain insights into KEPROBA’s strategic programs, from market intelligence and export promotion to capacity building and policy advocacy, driving Kenya’s textile sector towards sustainable growth and global competitiveness.

European Contributions to Developing the African Textile Sector

European companies and organizations play a significant role in the development of the African textile sector. The following are some of the initiatives undertaken by the companies in the sector:

i. Investment and Partnerships: European companies invest in African textile factories, providing capital, technology, and expertise. Collaborations between European and African firms enhance production capacity and quality.

ii. Market Access: European companies facilitate market access for African textiles by importing and distributing them within the EU. This exposure helps African producers expand their customer base.

iii. Technology Transfer: They also share knowledge and best practices with African counterparts, improving production processes, design, and sustainability.

iv. Capacity Building: Training programs, workshops, and skill development initiatives organized by European entities empower African textile workers and entrepreneurs. One of the agencies that has undertaken capacity building programs for the textile sector as well as other sectors is the German Agency for International Cooperation (GiZ).

v. Sustainable Practices: European companies encourage sustainable practices in African textile production, emphasizing eco-friendly materials, fair wages, and ethical working conditions.

2. Evaluating Africa’s potential in the textile sector: Kenyan Context

Kenya’s textile and apparel industry plays an important role in the country’s economy, providing jobs and income for many of its citizens. The industry is primarily focused on the production of clothing and textiles for export, with major markets including the United States, United Kingdom, and European Union.

Kenya’s textile and apparel industry has been growing in recent years, with a focus on increasing productivity and improving the quality of products. The government has implemented several initiatives to support the growth of the industry, such as providing tax incentives for textile and apparel manufacturers and investing in infrastructure to improve the efficiency of transportation and logistics.

One of the main advantages of the Kenyan textile and apparel industry is its access to cotton, one of the main raw materials used in the production of textiles. Kenya is the third-largest cotton producer in Africa, and the cotton is used for both local consumption and export. The country also has a well-established textile manufacturing sector, with several textile mills producing a variety of fabrics, including cotton, wool, and synthetic materials.

In addition, Kenya is known for its vibrant fashion industry, with many local designers producing a wide range of clothing and accessories. Some of these designers have gained international recognition and have been featured in prestigious fashion events such as the New York Fashion Week.

However, the industry is not without challenges, such as the need to improve efficiency and reduce cost of production, and the need to increase competitiveness in the global market. Despite these challenges, the Kenyan textile and apparel industry continues to grow and evolve, providing significant economic benefits for the country.

Kenya’s trade in textile and apparel is mainly in the following categories:

i. Knitted or crocheted fabrics (HS 60),

ii. Articles of apparel and clothing accessories, knitted or crocheted (HS 61)

iii. Articles of apparel and clothing accessories, not knitted or crocheted (HS 62)

iv. Other made-up textile articles; sets; worn clothing and worn textile articles; rags (HS 63).

Kenya’s Trade of Apparel and Textile Accessories to the World

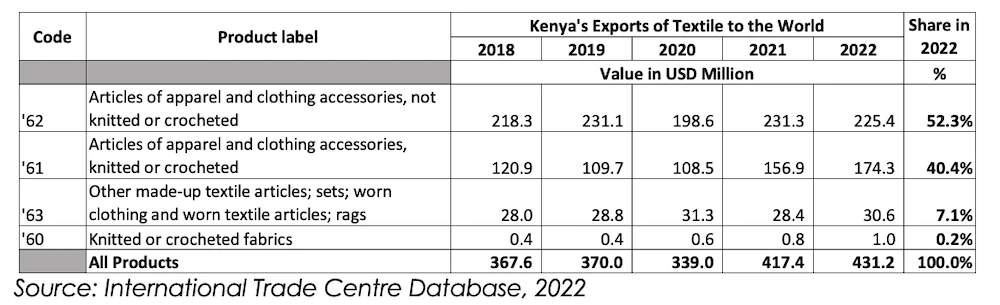

Table 1: Trends on Apparel and Textile accessories

- The leading Kenyan export product of apparel and textile product to the World was articles of apparel and clothing accessories, not knitted or crocheted (52.3%) followed by articles of apparel and clothing accessories, knitted or crocheted (40.4%), other made-up textile articles (7.1%) and finally Knitted or crocheted fabrics (0.2%).

- The annual growth rate for Kenya’s Exports to Africa was increasing at an average rate of 2.4% throughout the period 2018 to 2022 and by 5.2% between 2021 and 2022.

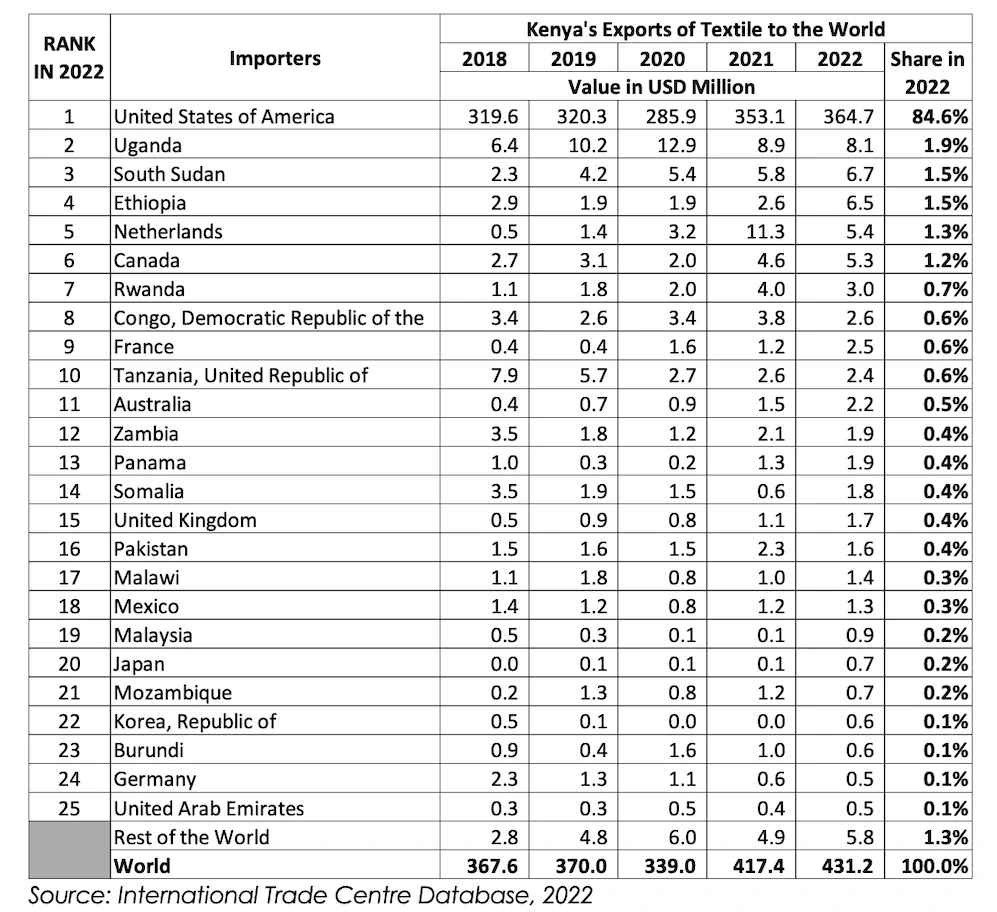

Table 2: Destination markets on Kenya’s Apparel and Textile accessories

• Kenya’s exports in 2022 was valued at USD 431.2 Million. This was a 3.3% growth from 2021 which recorded USD 417.4 Million. The average growth in the last 5 years was 4.7% and the Average value of exports was USD 385 Million

• The lead destination for Kenya’s exports was United States of America (USD 364.7 Million – 84.6%). The bulk of all Exports was taken by this country.

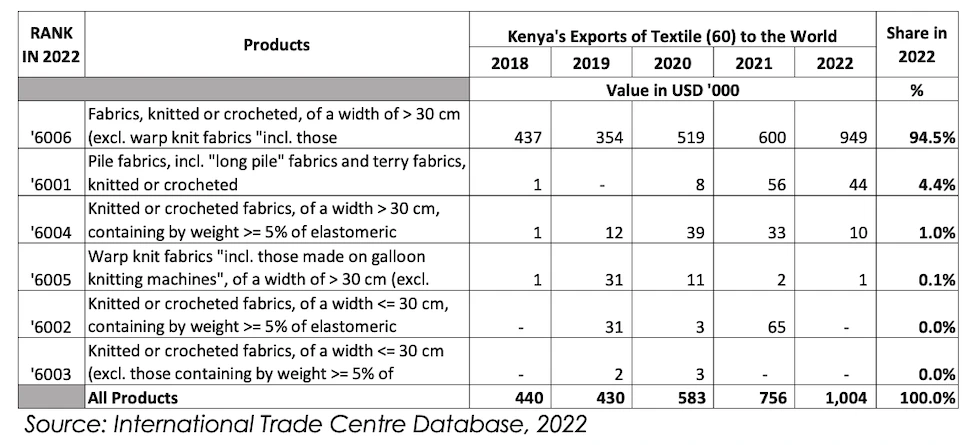

Table 3: Kenya’s Exports of Product: 60 Knitted or crocheted fabrics

• Kenya’s leading export product for Knitted or crocheted Fabric (HS 60), was Knitted or crocheted of a width of >30cm which accounted for 94.5% of Kenya’s total exports of this product.

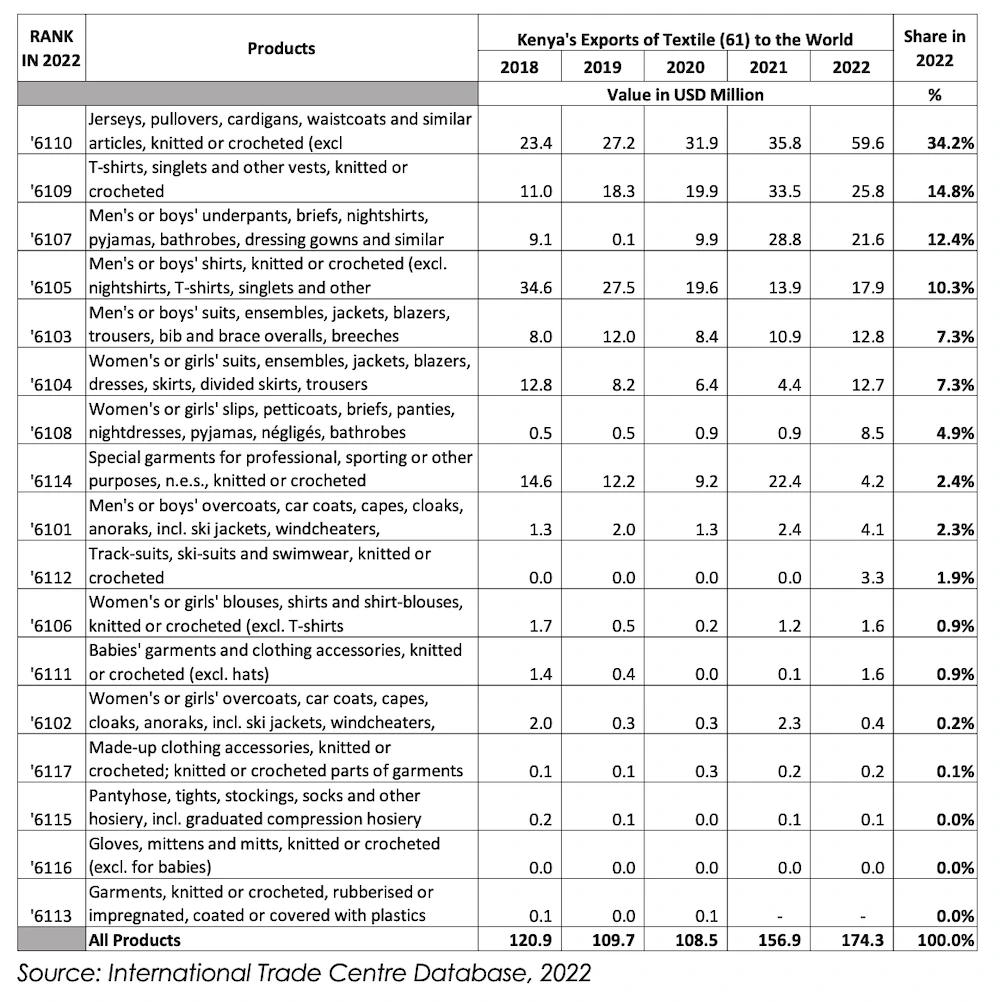

Table 4: Kenya’s Exports of Product: 61 Articles of apparel and clothing accessories, knitted or crocheted

• Kenya’s total exports of this product category were USD 174.3 million in 2022.

• Kenya’s leading export product for Articles of apparel and clothing accessories, knitted or crocheted (HS 61), was Jerseys, pullovers, cardigans, waistcoats and similar articles, knitted or crocheted which accounted for 34.2% of Kenya’s total exports of this product.

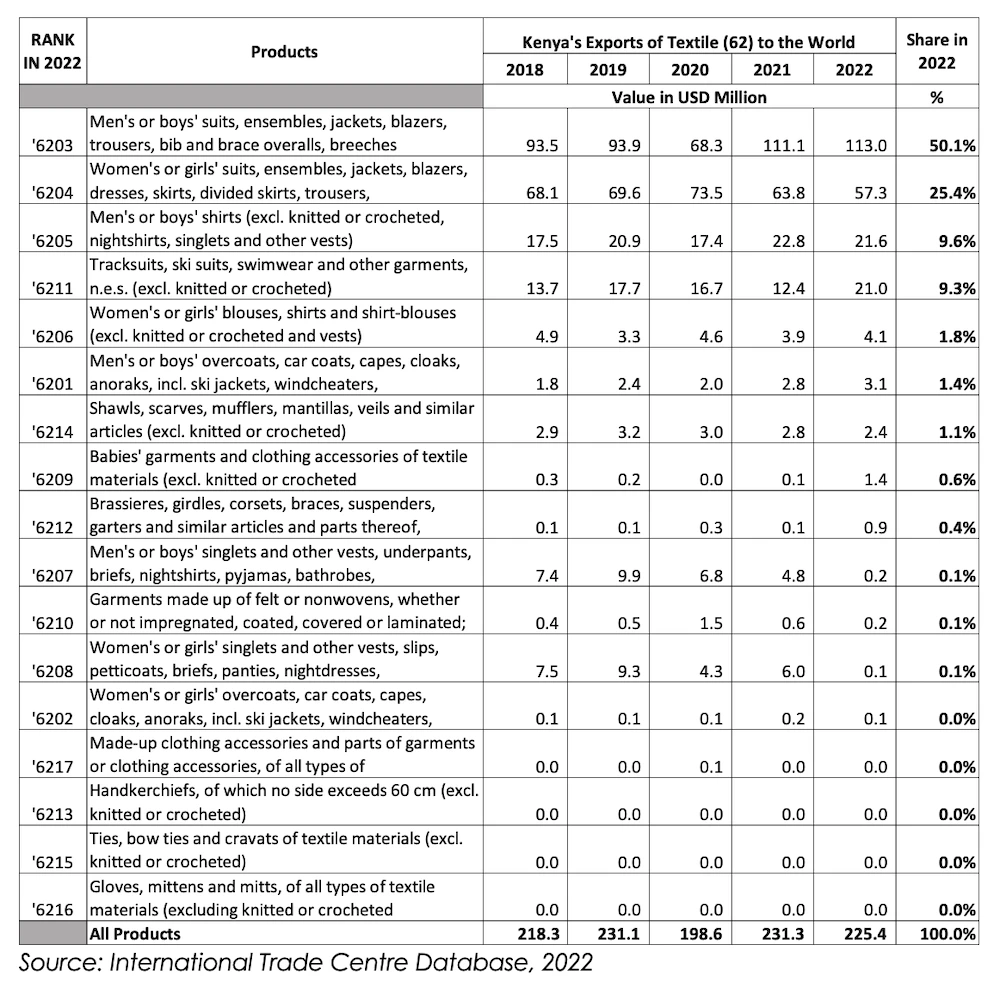

Table 5: Product: 62 Articles of apparel and clothing accessories, not knitted or crocheted.

• Kenya’s leading export product for Articles of apparel and clothing accessories, not knitted or crocheted (HS 62), Men’s or boys’ suits, ensembles, jackets, blazers, trousers, bib and brace overalls, breeches which accounted for 50.1% of Kenya’s total exports of this product.

• The average growth rate for the last 5 years for this product was 1.4% and declined by 2.6% between 2021 and 2022.

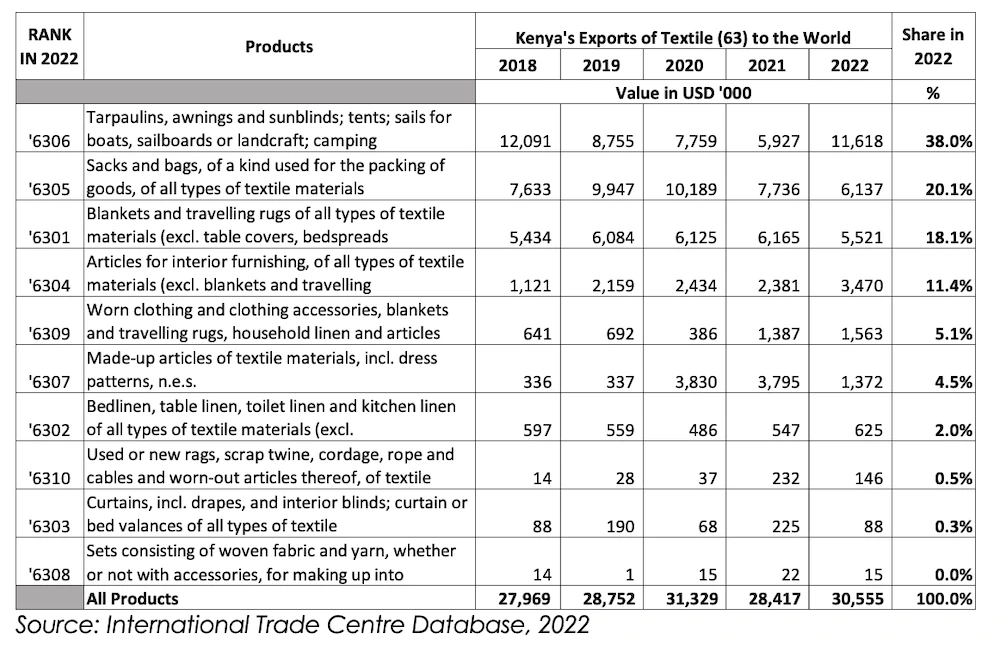

Table 6: Kenya’s Export Product: 63 Other made-up textile articles; sets; worn clothing and worn textile articles; rags.

• Kenya’s leading export product for Other made-up textile articles; sets; worn clothing and worn textile articles; rags (HS 63), Sacks and bags, of a kind used for the packing of goods, of all types of textile materials which accounted for 38% of Kenya’s total exports of this product.

• The average growth rate for the last 5 years for this product was 2.5% and 10% between 2021 and 2022.

Kenya’s Export Potential for Textile and Apparel

The markets with greatest potential for Kenya’s exports of apparel & textile products are United States, United Kingdom and Netherlands. United Kingdom shows the largest absolute difference between potential and actual exports in value terms, leaving room to realize additional exports worth $41 mn. In summary, Kenya still has a huge potential for export of textile and apparel in existing and emerging markets.

3. Kenya Export Promotion & Branding Agency’s Initiatives

KEPROBA focuses on promoting Kenyan exports, including textiles. The following are programmes and initiatives undertaken by the Agency for the sector:

i. Market Research & Intelligence: KEPROBA analyzes global textile trends, identifies target markets, and assists Kenyan exporters in positioning their products effectively.

ii. Export Promotion Initiatives: KEPROBA organizes trade missions and participates in international exhibitions, connecting Kenyan textile exporters with potential buyers in various markets e.g. Ambiente, NewYork Now, Birmingham Trade Fair.

iii. Branding and Marketing: The Agency supports creation of a distinct Kenyan textile brand, emphasizing quality, authenticity, and uniqueness through the “Made in Kenya” mark of identity. KEPROBA also supports businesses in improving product packaging to meet international standards.

iv. E-commerce and Digital Platforms: KEPROBA encourages the the use of e-commerce and digital platforms for exporters to reach a wider audience and also supports businesses in establishing an online presence and leveraging digital marketing platforms. The Agency recently launched an e-commerce platform to promote Kenya’s products (www.makeitkenya.go.ke )

v. Capacity Building: Training programs enhance Kenyan exporters’ skills in areas like product adaptation, export documentation, and negotiation, among other export. The Agency partners with various Government bodies and development partners to undertake capacity building programs.

Some of the partners the Agency has collaborated with include German Agency for International Cooperation (GiZ), International Trade Centre (ITC), (Swedish International Development Agency (SIDA) and Trade Facilitation Office- Canada.

vi. Policy Advocacy: KEPROBA advocates for policies that support the textile sector’s growth and competitiveness by collaborating with government bodies to advocate for policies that support the growth of the textile industry, such as tariff reductions or trade agreements e.g. the AGOA agreement.