-

Introduction:

The definition of Nonwovens, as per the nonwovens association EDANA (European Disposables and Nonwovens Association), is a sheet of fibres, continuous filaments, or chopped yarns of any nature or origin, that have been formed into a web by any means, and bonded together by any means, with the exception of weaving or knitting. It is also to be noted that all the nonwovens are technical textiles, but all technical textiles are not nonwovens.

The stability of non wovens market is questionable because of the volatile raw material prices. Nonwoven fabric feedstock is derived from crude oil, and any rise in global crude oil prices increases the cost of production and reduces the profit margins of manufacturers. Price, therefore, is a determining factor in the global nonwovens market.

-

Global Non Wovens Market:

According to a report, disposable nonwovens (single use product like hygiene, wipes, medical and other disposables) surpassed durables (including work-wear, interlinings, shoe inserts and synthetic leather goods) in value growth between 2008 to 2013, increasing from USD 9.1 billion to USD 12.5 billion, resulting in annual growth of 6.7%.

Within the same timeframe, durable non-wovens grew from USD 15.3 billion to USD 20.6 billion tons, at an annual growth rate of 6.1%.

This trend is expected to continue over the next 5 years until 2018, when disposable non-wovens will exhibit a 7.7% growth rate, increasing from USD 12.5 billion to USD 18.3 billion, while their durable counterparts will increase at 7.4%, with sales growing from USD 20.6 billion to USD 29.5 billion.

For the total period (2008-2018), annual growth rates for disposable non wovens projected at 7.2% while durable nonwovens at 6.7%.

The global non wovens market can be further analysed by production process technology, such as drylaid, spunlaid, airlaid and wetlaid as well as bonding technologies such as needle punched or spunlace. According to the report, spunlaid is projected to grow at the highest rate of all processes, with consumption projected to reach 5.8 million tons by 2018.

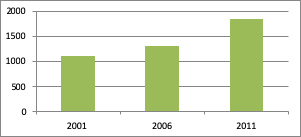

Chart 1: Worldwide production of nonwovens in ‘000 tonnes from 2001 to 2011

Freudenberg, Dupont, Ahlstrom, Kimberly Clark, Polymer Group Inc (PGI), Glatfelter, Fitesa, Johns Manville, Suominen, Bonar, TWE Group, Companhia Providencia, Georgia Pacific etc are the major players in nonwovens sector globally to pen down a few in a long list of more than thousand companies.

-

Non Wovens By Geography:

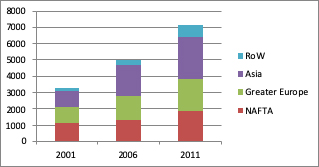

In terms of geography, the study reports that in 2013, Asia was the global leader, with a market share of 40.8% and consumption of 3.2 million tons- up from 2.0 million tons in 2008. Asia continue to grow both tonnage and market share between 2013 and 2018 with market share reaching 47.5% by 2018. Europe maintained its second rank in 2013, with a 25.2% market share and tonnage of 2.0 billion. Increase in non- wovens is expected to reach 2.5 million tons in Europe by 2018.

Chart 2: Non Wovens Production by region (In ‘000 tonnes)

For decades, the main producers of non woven products have been the United States, Western Europe. Now gradually, the Asian countries are increasing their non woven production share. As projected, Asia will account for over half of the global non woven fabric production by 2020 (as per latest issue of Technical textiles market from Textiles Intelligence).

Among Asian countries, China tops in the non woven production followed by japan and India.

-

Non Woven Markets In India:

As compared to the global average of 24 per cent, India stands at only 12% of technical textiles which are being manufactured by non woven technology. At this continuous increasing rate, the expected size of non wovens market by 2019 will be around US$ 45 million, considering growth at a CAGR of 6.7 per cent.

The domestic production of non wovens in India is estimated to be around 2.52 lakh tons for 2012-13 worth approximately Rs 3200 crore. The production of non wovens in India has been steadily rising since last few years.

India has recorded the highest growth of non wovens production since 2008 with a rise of 11% in 2013. It has been growing at 13% over the last five years. The trend of non woven production in India is as follows:

-

Non Woven Production Trend In India:

More than 50% of non woven capacity in India is of Spunbond non woven followed by needle punched non woven.

Chart 3: % share of India’s nonwovens by technology used

Indian market for nonwovens production is mainly comprised by the segments like Mobiltech, Meditech and Geotech, and local market products for automobile carpets, surgical dressings, non woven interlinings, tea bags fabric and the absorbent fabrics, diapers and sanitary napkins.

Some of the applications of non woven are cigarette filters, headliners, airlines disposables, surgical disposables, non wovens abrasives, sports footwear components, crop covers, non woven grocery and storage bags etc. With the growing concern over plastic and polythene usage and the ban imposed by Indian government on single-use disposable plastics, it can be said that the non wovens industry in packaging materials will touch new limits.

Chart 4: Growth rates of technical textiles 2001-2011 by main segments

The total Indian nonwovens consumption in 2011 was 250,000 tons and 78% of all consumption went into industrial end uses- India’s consumer disposables consumption was just 53,000 tons in 2011. Growth is being pegged at over 20% in the years to 2020, and there are indicators that certain consumers markets will expand more rapidly than others.

Table 1: Consumption of nonwovens in India vs GDP per capita (assuming an increase of 13.27% in per capita every year)

| Year | GDP per capita (USD) | Consumption of NonWovens (kg) |

| 2005 | 733 | 0.08 |

| 2010 | 1375 | 0.21 |

| 2015 | 2564 | 0.4 |

| 2020 | 4780 | 0.75 |

| 2025 | 8913 | 1.4 |

| 2030 | 16618 | 2.59 |

| 2035 | 30985 | 4.79 |

| 2040 | 57773 | 8.9 |

| 2045 | 107720 | 16.57 |

| 2050 | 200850 | 36.14 |

| Per Capita GDP Source: World Bank | ||

-

SWOT Analysis of Non Wovens Market In India:

- Strengths:

- Availability of skilled labor at cheaper cost

- Abundantly available raw materials from natural fibres to synthetics.

- Capacity to cater to the value chain

- Own huge market base

- India had been a textile hub for many years- good exports to foreign countries.

- Rich culture, expertise and skill sets for textiles.

- Weaknesses:

- Scattered production structure with less organized and more unorganized sector

- Lack of skilled personnel and expertise

- Inconsistency in quality

- Non-Timely supply of goods

- Lack in providing after sales service to customers

- Insufficient understanding of customer needs

- Supplying products for niche markets

- Obsolete technology being used

- Compromising on supply chain management etc

- Opportunities:

- One of the largest economies

- Government initiatives to promote nonwovens

- Awareness of nonwovens in healthcare, agriculture and industrial sector is growing at faster pace.

- The healthcare sector stood at USD 40 billion in 2012 and is expected to reach a size of USD 142 billion by 2020 thus increasing the nonwovens and technical textile usage.

- Tremendous potential to become main producers of nonwovens and demand would be created for use by developed countries.

- Threats:

- Competition with USA, European producers

- Inadequate R&D services in India

- No proper government initiatives

- Unlike the textile industry, which is export intensive, the Indian technical industry is import sensitive

-

Non Wovens- A Better Proposition For India:

We all know that nonwovens production being a compact technology yields higher production and are emerging technologies to produce complex products as well. As the process is very short, utility consumption is lower and bulk production results in minimal operating costs. The involvement of manual labor is very less and thus the quality is determined by the technology implemented. As India’s nonwovens is only 12% as compared to 24% production of non wovens usage in world. India has still a long way to go to meet global requirements of non wovens.

-

Growth Drivers For Non Woven Market In India

The growing middle class population and rise in income levels of half of India’s population are the major drivers for growth of Indian non woven and technical textile industry. Additionally, now the government and public sectors are also showing substantial interest in the opportunities beyond the conventional textiles chain starting from fibres to fashion. This situation is quite a contrast to what is happening in the United States and other developed countries.

Changing lifestyles and more awareness about health and hygiene products are the major factors for increase in non wovens. Also, the gradual increase in real estate, infrastructure development, industrial growth, urbanization, strict laws on waste management, increase in geotextiles can’t be ignored for increase in non wovens market in India.

Both from the perspectives of private and public sector, it’s the best time to invest in technical textiles. Indian government is facing tremendous pressure to revive and develop the textile sector by launching new incentives schemes and give subsidies as the textile industry contributes to nearly one third of the foreign exchange income through exports, provides second highest employment next to agriculture and is one of the core industry of the nation.

1 M.S. – Wuhan Textile University, China; B Tech- TIT&S Bhiwani (Haryana); Asst Manager (Mktg and Technical Services), Colorant Limited, Ahemdabad 380009

2MBA (GJU Pursuing), IIFT (Export Mgmt), B Tech -TIT&S Bhiwani (Haryana); General Manager (Yarn Mktg), Trident Limited, Ludhiana, Punjab

a[email protected] , b[email protected]

This is Abdulrahman from ALD for non-woven fabrics located in Yemen. We are looking for non-woven fabrics rolles . Please provide us with the specifications and information of your non-woven fabrics so that we can move the following quantities

WE ARE MANUFACTURER OF THERMO BOND NON WOVEN AND VARIOUS GSM PRODUCT KINDLY PROVIDE US WITH THE NUMBER OF THE YOUR PURCHASE TEAM. SO WE CAN SEND THE SAMPLE TO YOUR OFFICE.

THANKS & REGARDS

PARNEET SURI